Platform Comparison of Forex Trading in India: Costs and Features

Brokerage and Features Table

| Forex Trading Platform in India | Brokerage | Demo Account | Mobile App | Educational Resources |

|---|---|---|---|---|

| GTCFX | Spreads from 0.0 pips | Yes | Yes | Moderate |

| Zerodha | ₹20 per order | No | Yes | Excellent |

| Angel One | ₹20 per order | Yes | Yes | Very Good |

| ICICI Direct | ₹20 per order | Yes | Yes | Excellent |

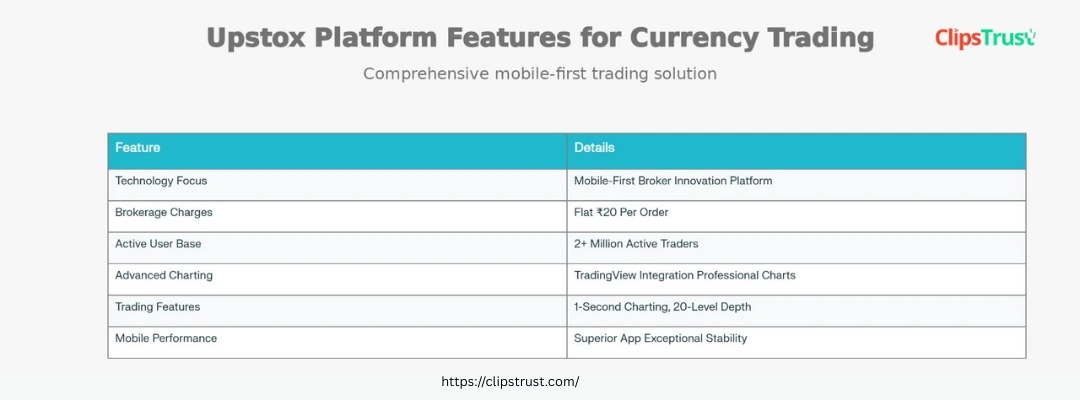

| Upstox | ₹20 per order | Yes | Yes | Good |

| HDFC Securities | ₹20 per order | Yes | Yes | Very Good |

| 5paisa | ₹20 per order | Yes | Yes | Moderate |

| Kotak Securities | ₹20 per order | Yes | Yes | Good |

| Sharekhan | ₹20 per order | Yes | Yes | Good |

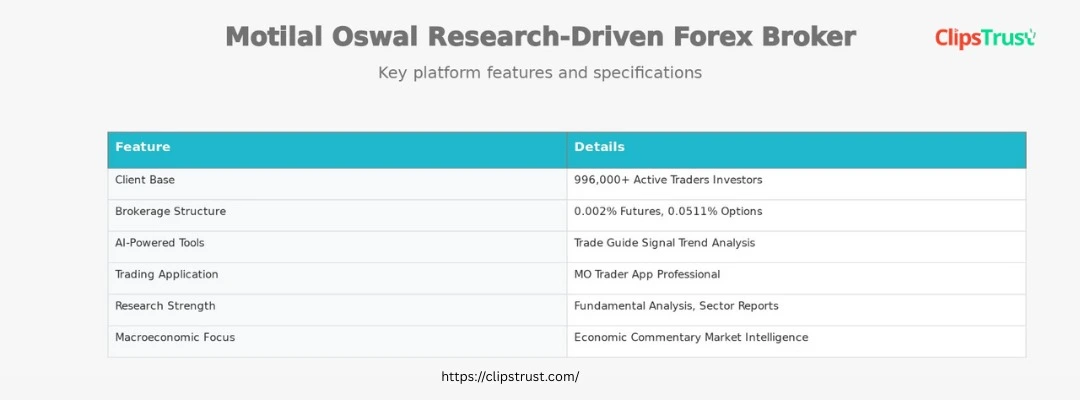

| Motilal Oswal | 0.002% | ✓ | ✓ | Excellent |

To Know More About India's Forex Trading Platforms

According to the research team of ClipsTrust, forex trading is completely legal in India when conducted through SEBI-registered brokers using approved currency pairs. The Indian forex trading landscape has evolved significantly with stringent regulatory frameworks ensuring investor protection while offering legitimate opportunities for currency trading.

The daily trading volume of $9.6 trillion is the figure that describes the global foreign exchange market, with Asia having 3.2 million active forex traders which makes it the largest trading hub in the world. A forex trading app allows traders to buy and sell currencies in real time using advanced charts, indicators, and mobile-friendly tools.

Forex trading in india refers to the practice of buying one currency and selling another at the same time to earn money from the difference in their exchange rates. In India, trading of foreign exchange through online platforms is only allowed via SEBI-registered brokers on recognized exchanges (NSE, BSE, MCX-SX) and is monitored by RBI and SEBI.

The ClipsTrust expert team has identified that trading through unregulated offshore platforms remains illegal and can result in penalties, account freezes, and legal consequences.

What is Forex Trading and Legal Framework in India?

Forex Trading Meaning and Market Mechanics

Forex trading involves speculating on currency pair price movements. The forex trading, when conducted via the authorized channels,Forex trading is legal in India specifically through SEBI-registered brokers, who are the only ones to offer exchange-traded currency derivatives. Indian residents have the legal right to trade four INR-based pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR) and three cross-currency pairs (EUR/USD, GBP/USD, USD/JPY) without any problem.

Forex Trading Time in India

The forex trading time in India for INR pairs spans 9:00 AM to 5:00 PM IST on working days. Trade of cross-currency pairs is allowed until 7:30 PM IST. Global forex sessions (accessible via MetaTrader platforms) are active 24 hours a day all through the week starting Monday 2:30 AM IST till Saturday 2:30 AM IST, thus providing constant trading opportunities across different time zones. With a reliable forex trading app, you can analyze the market, place trades instantly, and manage your portfolio from anywhere. Forex trading is legal in India when done through SEBI-regulated brokers and approved currency pairs

Upsides and Downsides of Forex Trading

Upsides of Forex Trading in India:

- High Liquidity: The $9.6 trillion daily global forex volume ensures traders can enter/exit positions quickly without significant price impact.

- Flexible Hours: 24-hour market accessibility accommodates various schedules.

- Lower Costs: Flat ₹20 per order reduces transaction expenses compared to stocks.

- Two-Way Profits: Trading both rising and falling markets provides diverse opportunities.

- Capital Efficiency: Leverage enables controlling larger positions with smaller capital.

Downsides of Forex Trading In India:

- High Volatility: Sudden price movements triggered by news releases create substantial loss risks.

- Leverage Risks: Leverage magnifies losses equally to profits.

- Complexity: Understanding macroeconomics and technical analysis requires considerable effort.

- Emotional Trading: Fear and greed often override disciplined strategies.

- Regulatory Limitations: Indian traders face restrictions on tradable pairs and authorized platforms.

Expert Tips for Successful Forex Trading

- Risk Management First: Never risk more than 1-2% per trade. Calculate position sizes mathematically based on stop-loss distance rather than arbitrary amounts. This approach ensures capital preservation during learning phases.

- Demo Trading: Practice extensively on demo accounts until achieving three months of consistent profitability. This builds confidence without financial consequences, essential for developing trading discipline.

- Trading Plan: Document entry criteria, exit rules, position sizing, and daily loss limits before trading. Systematic approaches outperform emotional, improvised decisions significantly.

- Educational Investment: Traders investing in structured learning through courses demonstrate 2.3x higher profitability compared to self-taught traders relying only on free resources.

- Trading Journal: Maintain detailed records of every trade including entry/exit reasoning. This documentation accelerates learning and identifies recurring mistakes requiring correction.

Case Study: From Debt to Forex Success

According to ClipsTrust case research, Upendra Mishra faced ₹2.5 crores in debt before discovering forex trading. After experiencing 12-13 consecutive losses, he analyzed each failure systematically, eventually developing disciplined trading strategies. By age 34, Mishra established a successful forex education company training 6,000+ students. His experience demonstrates that systematic learning transforms failures into valuable education, enabling recovery from catastrophic losses through consistent, disciplined approaches. And also Understanding the rules helps traders know how forex trading is legal in India and trade safely

Expert Opinion and Market Insights

Market Structure Insight: According to Kotak Securities research cited by the ClipsTrust expert team, FDI acts as the balance of payments anchor. Weakening FDI increases currency dependence on volatile portfolio flows, creating opportunities for traders monitoring capital account dynamics systematically.

Why This Guide Benefits Forex Traders

The ClipsTrust research team developed this comprehensive guide addressing Indian traders' primary confusion---distinguishing legal from illegal forex trading. This resource clarifies permissible currency pairs, authorized brokers, and proper trading channels, protecting traders from regulatory violations. Platform comparisons enable selection based on individual requirements. Case studies demonstrate realistic success possibilities alongside inherent challenges.

FAQs Related to Forex Trading

Conclusion About Forex Trading Platforms

According to the ClipsTrust research and expert team, the forex trading platform in india landscape offers legitimate opportunities for disciplined traders while presenting substantial risks for casual approaches. Platform selection demands careful consideration balancing regulatory compliance, costs, technology, and support quality. Success requires systematic risk management, psychological discipline, continuous education, and realistic expectations.

The statistical reality that only 37% achieve profitability underscores forex's challenging nature. However, proper education, disciplined methodology, and persistent practice dramatically improve success rates. Traders must honestly assess risk tolerance, available time, and emotional resilience before committing capital. Those approaching forex with realistic expectations and systematic methodologies can potentially generate supplemental income or build successful trading careers. learn forex trading methods for beginners.

The ClipsTrust team concludes that informed decision-making represents the critical differentiator between successful and unsuccessful traders. This comprehensive guide equips Indian traders with essential knowledge regarding forex trading meaning, legal requirements, platform options, risk management techniques, and realistic expectations for sustainable success.