What is Forex Trading? Complete Beginner's Guide to FX Markets

According to the research team of ClipsTrust, what is forex trading is one of the most frequently asked questions in financial markets today. The foreign exchange market, commonly referred to as the forex market or FX market, represents the global marketplace where currencies are exchanged. Understanding what is foreign exchange market and how does forex trading work is essential for anyone interested in currency trading. The forex market operates as a decentralized 24/5 global market with over 7 trillion USD traded daily, making it the largest and most liquid financial market in the world.

In this comprehensive complete guide to forex trading, the ClipsTrust expert team will walk you through every essential concept you need to master forex trading for beginners. Whether you're seeking knowledge about forex trading basics explained or looking to learn forex trading from scratch, this guide covers everything from basic terminology to advanced strategies that will help you navigate the dynamic world of currency markets successfully. Explore more to understand the types of forex trading account.

Understanding Forex Trading: An Introduction to FX Markets

Forex trading refers to the buying and selling of currency pairs in the global foreign exchange market. Unlike stock markets that operate through centralized exchanges, the forex market is decentralized and operates electronically through computer networks worldwide. According to the ClipsTrust team's research, this decentralized structure means the forex market operates continuously across major financial centers—Sydney, Tokyo, London, and New York—offering unprecedented flexibility for traders globally.

The FX markets explained concept is straightforward: traders speculate on whether one currency will strengthen or weaken against another. When you engage in currency trading explained, you're essentially making predictions about economic trends, interest rates, and geopolitical events that influence currency values. The beginner's guide to FX markets emphasizes that every transaction involves two currencies—the base currency and the quote currency—creating what we call a currency pair. Exlpore more to undestand about how to use forex tradingview chart for analysis.

Types of Currency Pairs: Major, Minor & Exotic Pairs

Major Currency Pairs Explained

Forex major pairs dominate global trading volume, accounting for over 70% of all forex transactions. The ClipsTrust research team identifies the seven major pairs:

- 1. EUR/USD - Euro/US Dollar (most traded)

- 2. USD/JPY - US Dollar/Japanese Yen

- 3. GBP/USD - British Pound/US Dollar

- 4. USD/CHF - US Dollar/Swiss Franc

- 5. AUD/USD - Australian Dollar/US Dollar

- 6. USD/CAD - US Dollar/Canadian Dollar

- 7. NZD/USD - New Zealand Dollar/US Dollar

Currency pairs trading emphasizes that major pairs offer exceptional liquidity and tight spreads, making them ideal for forex trading for beginners. According to the ClipsTrust team, EUR USD trading hours show peak activity during London-New York session overlap (1 PM-5 PM GMT), when spreads tighten further due to increased participation.

Minor and Exotic Currency Pairs

Currency pairs trading explained extends to minor pairs, which exclude the US Dollar. Examples include EUR/JPY, GBP/JPY, and EUR/GBP. These pairs offer moderate liquidity but wider spreads than majors.

Exotic currency pairs combine a major currency with an emerging market currency, such as EUR/TRY (Euro/Turkish Lira) or USD/ZAR (US Dollar/South African Rand). According to the ClipsTrust expert team, exotic pairs feature significantly wider spreads, lower liquidity, and greater sensitivity to geopolitical events, making them unsuitable for most beginners.

Forex Market Hours: When to Trade and Best Trading Sessions

Global Trading Sessions Explained

The forex market hours operate continuously from Sunday 10 PM GMT through Friday 10 PM GMT. The ClipsTrust research team identifies four major trading sessions:

| Session | Hours (GMT) | Characteristics |

|---|---|---|

| Sydney | 10 PM - 7 AM | Lower volume, pairs involving AUD, NZD, JPY |

| Tokyo | 12 AM - 9 AM | Asian trading, JPY pairs active, moderate volume |

| London | 8 AM - 5 PM | Highest volume, tightest spreads, most volatile |

| New York | 1 PM - 10 PM | Second-highest volume, overlaps with London (1-5 PM) |

EUR USD trading hours show peak activity during the London-New York overlap, when major economic data is released and institutional traders execute large orders. The ClipsTrust team recommends beginners trade major pairs during London and New York sessions for optimal spreads and liquidity.

Session Overlaps and Trading Opportunities

The best trading sessions feature overlapping periods when two major financial centers operate simultaneously. The 1 PM-5 PM GMT overlap combines London and New York liquidity, creating ideal conditions for day traders. The ClipsTrust expert team notes that this period generates 60% of daily forex volume and features the widest price swings, attracting professional traders seeking volatile opportunities.

Sydney-Tokyo overlap (12 AM-7 AM GMT) suits Asian traders but offers lower volatility for Western traders. The forex market hours analysis shows each session brings unique characteristics influencing currency pair movements based on which economies' trading centers are active.

What Makes Forex Trading Different from Stock Trading?

Forex trading vs stock trading presents significant differences that traders must understand before entering the market. The ClipsTrust research team identified several key distinctions that impact your trading experience and profitability.

| Aspect | Forex Trading | Stock Trading |

|---|---|---|

| Market Structure | Decentralized, 24/5 | Centralized exchanges, limited hours |

| Daily Volume | Over 7 trillion USD | Varies by exchange |

| Liquidity | Extremely high | High for major stocks |

| Leverage Available | Up to 50:1 or higher | Typically 2:1 |

| Volatility | High | Moderate to high |

| Asset Type | Currency pairs | Company shares |

| Accessibility | Very accessible | Accessible but selective |

Forex trading vs stock trading comparison also differs in operational complexity. The ClipsTrust team explains that forex involves currency pairs where you simultaneously buy one currency and sell another. In contrast, stock trading is more straightforward—you simply buy or sell shares in companies. Forex trading fundamentals emphasize risk management due to higher leverage available, while stock trading generally offers lower leverage and reduced volatility for most securities.

Understanding these distinctions is crucial for selecting the right market for your investment style and risk tolerance.

The Size and Scope of the Forex Market

The forex market introduction reveals an enormous market worth approximately 9.595 trillion USD in average daily turnover as of 2026. The ClipsTrust expert team confirms that this staggering volume represents over 70% of all currency transactions globally, with major currency pairs dominating trading activity. The what is foreign exchange market concept extends beyond simple currency exchange—it encompasses a sophisticated ecosystem of banks, hedge funds, corporations, and individual traders all participating in continuous price discovery.

According to the ClipsTrust research, the forex market's size creates exceptional liquidity, meaning you can enter and exit positions quickly without significant price slippage. This liquidity is one reason why the forex market introduction appeals to both professional and retail traders seeking flexible, responsive trading conditions.

For More Information About What is Forex Trading Click the Link Below -

Forex Pips, Lots & Leverage: Essential Terminology Explained

Mastering Pip in Forex Trading

Pip in forex trading is foundational knowledge for any trader. The ClipsTrust research team defines a pip as "point in percentage," representing the smallest price movement in forex quotes. What is a pip in forex trading and how to calculate it requires understanding that most currency pairs quote to four decimal places (0.0001 equals 1 pip).

For example:

- If EUR/USD moves from 1.0847 to 1.0857, that's a 10-pip movement

- For Japanese Yen pairs, a pip appears at the second decimal place (0.01)

Forex pips meaning extends to calculating profit and loss. The basic formula:

Pip Profit = Number of Pips Gained × Pip Value

If you trade 100,000 units (standard lot) of GBP/USD and gain 10 pips, your profit depends on the exchange rate but typically amounts to $100 per pip at current exchange rates.

Understanding Forex Lots and Position Sizing

Forex leverage explained must address the importance of proper position sizing through lot selection. The ClipsTrust team identifies three main lot sizes:

- Standard Lot: 100,000 base currency units

- Mini Lot: 10,000 base currency units

- Micro Lot: 1,000 base currency units

Beginners should start with micro or mini lots to manage risk effectively. The beginner's guide to forex markets emphasizes that lot selection directly determines your risk exposure and potential profit magnitude.

Leverage in Forex Markets

Forex leverage explained reveals both opportunities and risks. The ClipsTrust expert team explains that leverage allows you to control large positions with relatively small capital. For instance, with 50:1 leverage, you might control $50,000 with just $1,000 of your own money.

However, Forex leverage explained also shows that leverage amplifies losses equally. The beginner's guide to FX markets warns that inexperienced traders who misuse leverage frequently experience devastating account losses. Successful traders typically use leverage conservatively, risking only 1-2% of their account on any single trade.

Understanding Forex Bid and Ask Price in Trading

Mastering How to read forex quotes bid and ask prices requires practical understanding of real trading scenarios. When you view a forex chart, you see the mid-price, but actual execution occurs at bid or ask prices depending on your trade direction.

Example Trading Scenario:

Suppose EUR/USD shows:

- Bid: 1.0845

- Ask: 1.0847

- Spread: 2 pips (0.0002)

If you buy EUR/USD, your entry is at 1.0847 (ask price). Your profit begins only after the price rises above 1.0847 to overcome the spread cost. If you sell, your entry is at 1.0845 (bid price).

According to the ClipsTrust team's analysis, understanding this dynamic helps you recognize that your first profitable move must overcome the bid-ask spread. This knowledge influences strategy selection and position management.

Forex Market Hours: When to Trade and Best Trading Sessions

Global Trading Sessions Explained

The forex market hours operate continuously from Sunday 10 PM GMT through Friday 10 PM GMT. The ClipsTrust research team identifies four major trading sessions:

| Session | Hours (GMT) | Characteristics |

|---|---|---|

| Sydney | 10 PM - 7 AM | Lower volume, pairs involving AUD, NZD, JPY |

| Tokyo | 12 AM - 9 AM | Asian trading, JPY pairs active, moderate volume |

| London | 8 AM - 5 PM | Highest volume, tightest spreads, most volatile |

| New York | 1 PM - 10 PM | Second-highest volume, overlaps with London (1-5 PM) |

EUR USD trading hours show peak activity during the London-New York overlap, when major economic data is released and institutional traders execute large orders. The ClipsTrust team recommends beginners trade major pairs during London and New York sessions for optimal spreads and liquidity.

Session Overlaps and Trading Opportunities

The best trading sessions feature overlapping periods when two major financial centers operate simultaneously. The 1 PM-5 PM GMT overlap combines London and New York liquidity, creating ideal conditions for day traders. The ClipsTrust expert team notes that this period generates 60% of daily forex volume and features the widest price swings, attracting professional traders seeking volatile opportunities.

Sydney-Tokyo overlap (12 AM-7 AM GMT) suits Asian traders but offers lower volatility for Western traders. The forex market hours analysis shows each session brings unique characteristics influencing currency pair movements based on which economies' trading centers are active.

Best Forex Trading Strategies for Beginners

Trend Trading Strategy

Forex trading strategies for beginners most commonly start with trend trading, identifying and following market direction. Traders look for uptrends (higher highs and higher lows) or downtrends (lower highs and lower lows), entering positions that align with established trends.

The ClipsTrust team explains that trend traders use moving averages (20, 50, 200-period) to identify trend direction. Buy signals occur when price crosses above major moving averages, while sell signals appear when price breaks below them.

Advantage: Simplicity and alignment with primary market direction Challenge: Identifying trend reversals before significant losses occur

Range Trading Strategy

This best forex trading strategies approach identifies currency pairs trading within established price ranges. Traders buy at support (lower range boundary) and sell at resistance (upper range boundary), profiting from repetitive bounces.

Range trading suits low-volatility market conditions but fails during breakout scenarios when price violates established ranges. The ClipsTrust research team recommends using RSI (Relative Strength Index) and Bollinger Bands to identify overbought/oversold conditions that suggest range reversals.

Breakout Strategy

Best forex trading strategies also include breakout trading, entering positions when price breaks established support or resistance levels. Successful breakouts often continue in the breakout direction, creating profitable opportunities.

The ClipsTrust expert team warns that false breakouts frequently occur, requiring confirmation through volume analysis or additional technical indicators before risking capital.

Forex Leverage Explained: How to Use It Correctly

The Mechanics of Forex Leverage

Forex leverage explained reveals how brokers lend capital to amplify your trading power. With 50:1 leverage, risking $1,000 controls a $50,000 position. The ClipsTrust research team emphasizes that this mechanical advantage created both extraordinary profit potential and catastrophic loss scenarios.

Understanding Forex leverage explained requires recognizing that leverage is a double-edged sword. A 10% move in your favor with 50:1 leverage generates 500% profit on your capital. However, a 10% adverse move wipes out your entire $1,000 investment and beyond, potentially creating negative account equity.

Leverage Best Practices for Beginners

The beginner's guide to FX markets recommends starting with 2:1 to 10:1 leverage maximum. The ClipsTrust team advises calculating position size using this formula:

Risk Amount = Account Balance × Risk Percentage (typically 1-2%)

Example Calculation:

- Account Balance: $10,000

- Risk Percentage: 1% = $100

- Stop Loss Distance: 50 pips

- Pip Value at 50:1 leverage = $10 per pip

- Position Size = $100 ÷ ($10 × 50 pips) = 2 lots

This calculation ensures disciplined risk management, preventing emotional over-leverage decisions that destroy trading accounts.

Forex Margin and Margin Call: Protecting Your Capital

Understanding Margin Requirements

Forex margin level represents the percentage of your account equity relative to used margin. This critical metric determines your account's health and your ability to open new positions. The ClipsTrust expert team explains that:

Margin Level (%) = (Equity ÷ Used Margin) × 100

Recognizing Margin Call Scenarios

A margin call occurs when your account equity falls below the required margin for open positions. Most brokers issue warnings when margin level drops to 100-150%, preventing immediate liquidation. However, if your margin level falls to 50% (stop-out level), brokers automatically close positions at market prices to protect themselves.

Example Scenario:

- Account Balance: $10,000

- Open Position Using $5,000 Margin

- Adverse Market Move Causes $6,000 Loss

- Remaining Equity: $4,000

- Margin Level: ($4,000 ÷ $5,000) × 100 = 80%

This 80% margin level triggers broker alerts. If losses continue and equity reaches $2,500, margin level becomes 50%, initiating forced position closure.

The ClipsTrust team's research demonstrates that margin calls devastate unprepared traders, making margin management absolutely critical for trading survival.

Forex Brokers Explained: Types and How to Choose

Types of Forex Brokers

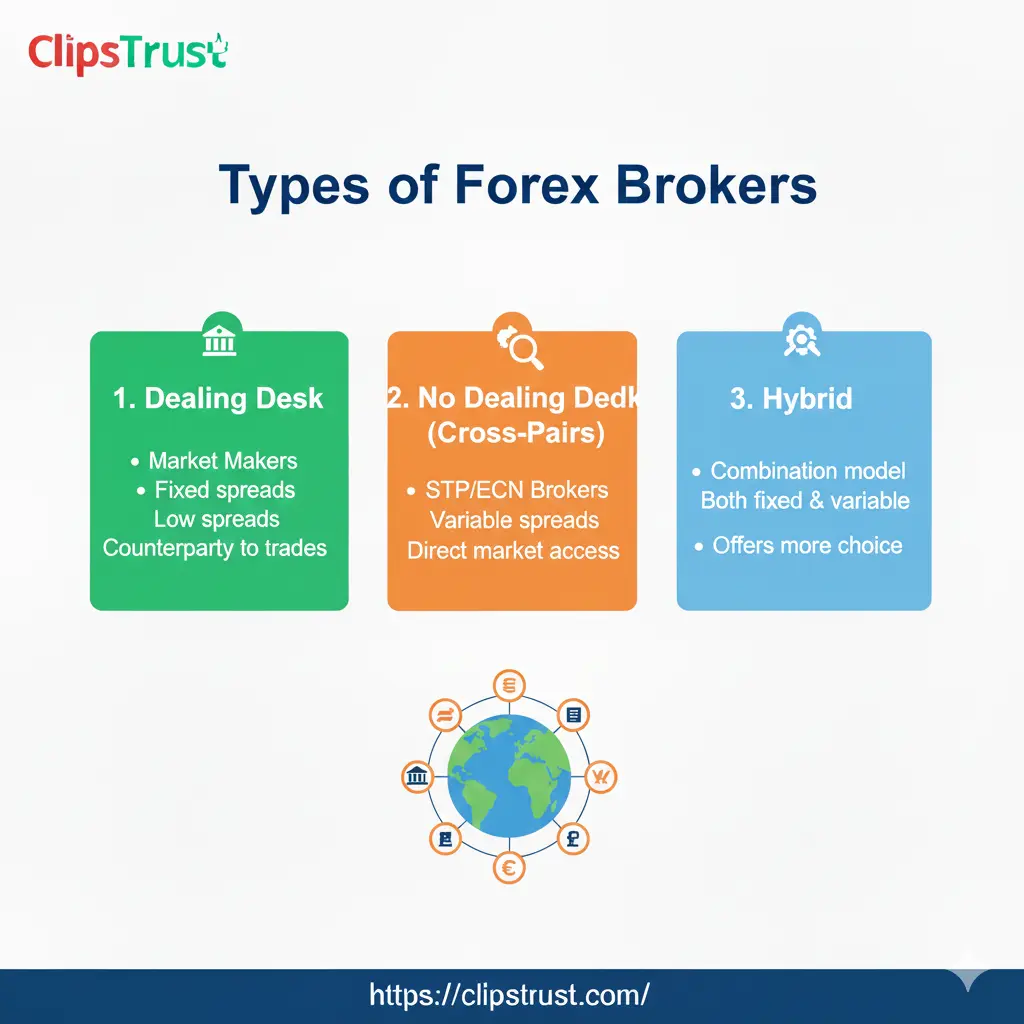

Best Forex brokers beginners explained categorizes firms into several operational models:

Market Makers (Dealing Desks) quote their own prices and profit from bid-ask spreads. They may offer tighter spreads but create potential conflicts of interest since they profit when clients lose.

ECN Brokers (Electronic Communication Networks) connect clients directly to liquidity providers, offering transparent pricing and variable spreads. ECN brokers typically charge commissions but provide fairer execution.

STP Brokers (Straight Through Processing) route orders to liquidity providers without processing through a dealing desk, offering a middle ground between market makers and ECN models. You can learn deep dive into the related topic of ECN vs STP comparison.

Essential Criteria for Broker Selection

The ClipsTrust expert team emphasizes that how to choose a forex broker depends on evaluating multiple factors:

- 1. Regulation: Verify broker licensing by reputable authorities (FCA, CFTC, CySEC, ASIC)

- 2. Trading Platform: Assess MetaTrader 4/5 functionality, charting tools, and order types

- 3. Spreads and Commissions: Compare costs across different brokers and account types

- 4. Customer Support: Evaluate 24/5 responsiveness and problem-resolution capability

- 5. Educational Resources: Examine webinars, courses, and trading materials available

- 6. Account Minimum: Consider whether minimums align with your available capital

The ClipsTrust research team found that no single "best" broker exists—optimal selection depends on your individual trading style and requirements.

MetaTrader 4 vs MetaTrader 5 Comparison

MetaTrader 4 vs MetaTrader 5 represents the industry's primary platform choice debate. The ClipsTrust team's detailed analysis reveals:

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Timeframes | 9 | 21 |

| Indicators | 30 built-in | 38 built-in |

| Order Types | 4 pending orders | 6 pending orders |

| Programming Language | MQL4 | MQL5 (object-oriented) |

| Back-testing Speed | Standard | Multi-threaded (faster) |

| Asset Classes | Primarily forex | Forex, stocks, futures, options |

| Depth of Market | No | Yes |

MetaTrader 4 vs MetaTrader 5 shows MT4's simpler interface suits beginners, while MT5's advanced features appeal to experienced traders. The ClipsTrust expert team recommends MT4 for beginning how to open a forex trading account, then migrating to MT5 as experience grows.

Technical Analysis Forex: Essential Tools and Techniques

Chart Patterns and Their Significance

Technical analysis forex relies heavily on recognizing repeating chart patterns that suggest probable future price movements. The ClipsTrust research team identifies key patterns:

- Head and Shoulders: Reversal pattern signaling trend termination

- Double Tops/Bottoms: Reversal patterns after sustained moves

- Triangles: Continuation patterns suggesting breakout imminent

- Flags and Pennants: Short-term continuation patterns before trend resumption

Understanding these patterns provides traders with a probabilistic edge in timing entries and exits.

Technical Indicators for Forex Trading

Technical analysis forex employs multiple indicators providing entry/exit signals:

Moving Averages smooth price data, identifying trend direction and support/resistance.

RSI (Relative Strength Index) measures momentum, showing overbought (>70) and oversold (<30) conditions.

MACD (Moving Average Convergence Divergence) confirms trend changes and momentum shifts.

Bollinger Bands reveal volatility levels and probable support/resistance boundaries.

The ClipsTrust expert team emphasizes combining multiple indicators rather than relying on single tools, reducing false signals and improving trade quality.

Stop Loss Order Forex Trading: Protecting Your Capital

Understanding Stop Loss Mechanics

Stop loss order forex trading provides automatic exit mechanisms preventing catastrophic losses. When price reaches your predetermined stop level, the platform automatically sells your position at market price, limiting losses to acceptable levels.

Example: You buy EUR/USD at 1.0847, setting stop-loss at 1.0810 (37 pips). If EUR/USD drops to 1.0810, your position automatically closes, limiting loss to 37 pips.

Strategic Stop Loss Placement

The ClipsTrust team recommends placing stops below support levels (for long positions) or above resistance levels (for short positions), preventing false stop-outs from normal price fluctuations. Trailing stops automatically adjust upward in profitable positions, locking in gains while allowing upside participation.

Stop loss order forex trading serves as your ultimate risk management tool, making it non-negotiable for successful trading.

How to Make Money from Forex Trading

Profit Mechanisms in Currency Trading

How to make money from forex trading involves executing three fundamental strategies. First, long positions profit from currency appreciation—buying EUR/USD at 1.0800 and selling at 1.0900 captures 100 pips profit.

Second, short positions profit from currency depreciation—selling GBP/USD at 1.2700 and buying back at 1.2650 captures 50 pips profit.

Third, interest rate differentials (carry trading) generate profits from interest differences between currency pairs, though this advanced strategy requires careful risk management.

Realistic Profit Expectations

The ClipsTrust research team surveyed experienced traders, finding novice traders earning $50-$100 daily while experienced traders average $500-$1,000 daily. These figures require:

- Capital base (typically $5,000-$25,000 minimum)

- Disciplined risk management (1-2% risk per trade)

- Technical and fundamental analysis capability

- Emotional control under pressure

- Years of practice and strategy refinement

How to make money from forex trading realistically requires accepting that the initial learning period involves losses as you develop competency.

Most Traded Currency Pairs: Market Dominance

The ClipsTrust team's market research identified that most traded currency pairs demonstrate clear hierarchy:

| Rank | Pair | Market Share | Daily Turnover |

|---|---|---|---|

| 1 | EUR/USD | 28% | $2.03 trillion |

| 2 | USD/JPY | 13.5% | $1.29 trillion |

| 3 | GBP/USD | 7.6% | $728 billion |

| 4 | AUD/USD | 6.4% | $614 billion |

| 5 | USD/CAD | 5.2% | $499 billion |

EUR/USD's dominance reflects both economies' significance globally, making it ideal for beginners seeking maximum liquidity and tight spreads.

Expert Tips on Successful Forex Trading

According to the ClipsTrust expert team, three critical tips determine trading success:

Tip 1: Develop Comprehensive Trading Plans - Before entering any position, successful traders document entry criteria, profit targets, and stop-loss levels. The ClipsTrust team found traders with written plans achieve 3x better results than those trading reactively.

Tip 2: Practice Risk Management Religiously - The most profitable traders typically risk only 1-2% per trade, preventing single losses from devastating accounts. The ClipsTrust research team emphasizes that risk management separates long-term traders from account-wipeout victims.

Tip 3: Continuous Learning and Market Analysis - Markets constantly evolve, requiring continuous education about economic developments, technical patterns, and trading psychology. The ClipsTrust team recommends committing 30+ minutes daily to market analysis and strategy review.

Pros and Cons of Forex Trading

- 24/5 Market Access - Trade whenever convenient, managing positions around other commitments

- High Liquidity - Instant order execution and tight spreads across major pairs

- Leverage Opportunities - Control large positions with modest capital, amplifying profit potential

- Diverse Strategies - Long/short positions profit from both rising and falling markets

- Low Entry Costs - Starting with $100-500 allows real trading experience

- High Risk - Leverage amplifies losses equally, destroying accounts through mismanagement

- Emotional Challenges - Currency swings trigger fear and greed, causing impulsive decisions

- Learning Curve - Developing profitable consistency requires months or years of practice

- Economic Sensitivity - Unexpected events (political instability, economic data) create sudden volatility

- Broker Risk - Unregulated brokers may misappropriate funds or execute unfairly

The ClipsTrust team advises carefully weighing these factors before committing capital to forex trading.

Top Educational Institutes for Forex Trading

Several reputable institutions offer comprehensive forex education:

- BabyPips School of Pipsology - Free, comprehensive introduction to forex concepts

- Investopedia Academy - Self-paced courses covering fundamentals to advanced strategies

- AvaTrade Academy - 20+ courses, 145+ lessons including video webinars

- Online Trading Academy (OTA) - Established 1997, professional-grade courses

- Benzinga Forex 101 - Comprehensive beginner course simplifying complex concepts

The ClipsTrust expert team recommends starting with free resources (BabyPips, YouTube) before investing in paid courses, ensuring the educational approach matches your learning style.

Frequently Asked Questions About Forex Trading

Conclusion: Your Forex Trading Journey Begins Here

Understanding what is forex trading, how does forex trading work, and forex trading fundamentals positions you for informed decision-making about currency market participation. The ClipsTrust expert team emphasizes that forex trading represents both tremendous opportunity and serious risk—success depends on commitment to learning, rigorous risk management, and emotional discipline.

Complete guide to forex trading success requires starting with educational foundation, practicing on demo accounts, implementing strict position sizing, and maintaining trading journals documenting lessons learned.

The ClipsTrust research team encourages beginners to view initial losses as tuition costs for developing competency rather than permanent capital destruction.

Forex trading offers accessibility and flexibility that attract millions globally, but the ClipsTrust team notes that only 10–20% of retail traders achieve long-term success—demanding discipline, strong psychology, and continuous learning.

Your journey begins with mastering the basics, practicing consistently, and applying solid risk management. According to ClipsTrust research, traders who pair these habits with patience and commitment are the ones who consistently outperform the market and build lasting wealth.

Leave a Comment