Banking Matters: Comprehensive Legal Solutions by Sonal Singh & Associates – Your Trusted Partner in Debt Recovery, DRT Cases, and

The banking and financial services sector in India is undergoing remarkable expansion, but this period of growth is accompanied by a troubling surge in banking disputes, loan defaults, and financial fraud cases nationwide. Research from ClipsTrust highlights that there are currently more than 35.16 lakh pending cheque bounce cases, making up approximately 8% of all criminal matters in the country, while banking disputes now account for between 10% and 15% of consumer court litigation nationally. This dramatic increase points to a crisis in dispute resolution and consumer protection for banking clients. In this climate, the demand for specialized banking legal services has never been more urgent—resources like Sonal Singh & Associates, Delhi on the ClipsTrust legal services platform are essential for individuals and businesses navigating these complex financial challenges.

Sonal Singh & Associates has emerged as a trusted name in banking matters legal services across Delhi-NCR, offering comprehensive expertise in SARFAESI Act proceedings, Debt Recovery Tribunal (DRT) cases, loan dispute resolution, cheque bounce matters under Section 138 of the Negotiable Instruments Act, bank fraud litigation, and financial dispute advisory services. Located strategically near Pratap Nagar Metro Station at 10558, 2nd floor, Bagichi Peer Ji, Delhi – 110001, the firm provides accessible and professional legal support to individuals, businesses, banks, and financial institutions navigating the complex banking legal landscape.

Understanding Banking Matters and Banking Law in India

Banking law encompasses the comprehensive legal framework governing financial institutions, banking transactions, loan agreements, debt recovery procedures, regulatory compliance, and dispute resolution mechanisms. The Indian banking sector operates under stringent regulations including the Banking Regulation Act 1949, Reserve Bank of India Act 1934, SARFAESI Act 2002, Recovery of Debts and Bankruptcy Act 1993, and the recently implemented Banking Laws (Amendment) Act 2025.

The Reserve Bank of India (RBI) serves as the principal regulatory authority, issuing guidelines on lending practices, recovery procedures, KYC compliance, anti-money laundering protocols, and consumer protection measures. In FY 2024-25 alone, the RBI imposed penalties totaling 54.78 crore across 353 regulated entities for various compliance violations, underscoring the critical importance of legal expertise in banking operations. Specialized legal support for diverse matters—such as civil disputes, cyber crime cases, and even matrimonial issues—is increasingly essential as enforcement actions and regulatory expectations intensify.

Banking legal services address multifaceted issues including loan documentation, security enforcement, debt restructuring, insolvency proceedings, cheque dishonor prosecutions, banking fraud investigations, consumer disputes, and representation before specialized forums such as Debt Recovery Tribunals, Debt Recovery Appellate Tribunals, National Company Law Tribunals, and Consumer Dispute Redressal Commissions.

Comprehensive Banking Legal Services at Sonal Singh & Associates

Banking Litigation and Dispute Resolution

Banking litigation involves legal proceedings related to loan defaults, breach of banking contracts, security enforcement disputes, inter-creditor conflicts, and regulatory violations. Sonal Singh & Associates provides robust courtroom representation before District Courts, Sessions Courts, High Courts, and specialized tribunals, handling complex banking disputes with strategic legal acumen.

The firm's litigation expertise encompasses defending borrowers against aggressive recovery practices, challenging wrongful SARFAESI proceedings, contesting inflated loan claims, negotiating one-time settlements, and protecting client assets from arbitrary seizure. With banking disputes constituting a significant portion of India's judicial backlog, specialized legal intervention ensures timely and favorable resolution.

Loan Dispute Resolution and Settlement Services

Loan disputes arise from various circumstances including EMI defaults due to financial hardship, disagreements over interest calculations, disputed penalty charges, misrepresented loan terms, and unauthorized deductions. The firm specializes in negotiating structured settlement agreements that balance lender recovery with borrower protection.

Expert loan settlement lawyers provide specialized services by thoroughly analyzing the borrower’s financial situation, identifying procedural irregularities, and negotiating directly with banks and NBFCs to secure reduced settlement amounts—typically ranging from 40% to 70% of the outstanding dues, depending on repayment history and hardship. These experts ensure all negotiations and settlements strictly comply with RBI guidelines on loan settlements, which protect borrower rights and require transparent documentation. Upon successful negotiation, they secure legally binding closure documents such as No Dues Certificates, which serve as official proof of loan closure and protect against future disputes or erroneous liabilities. For domain-specific legal support, one can consult professionals experienced in NI matters or criminal matters.

Real-world case studies demonstrate successful outcomes: a small manufacturing business in Pune facing possession notices secured a one-time settlement saving lakhs through timely legal intervention, while a textile business owner in Jaipur negotiated a 55% settlement of claimed amounts after COVID-related business disruptions.

SARFAESI Act Legal Defense and Advisory

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 empowers secured creditors to recover non-performing assets without court intervention through asset possession, sale, and management. However, the Act mandates strict procedural compliance including proper notice requirements, reasonable opportunity for borrowers to respond, and adherence to valuation norms.

Sonal Singh & Associates provides comprehensive SARFAESI legal defense including challenging improper Section 13(2) demand notices, filing Section 13(3A) objections, appealing to DRT under Section 17, contesting premature possession actions, preventing wrongful asset auctions, and negotiating debt restructuring alternatives.

The Supreme Court has repeatedly emphasized that while SARFAESI facilitates recovery, borrowers retain fundamental rights to due process, fair hearing, and judicial review. Legal representation ensures these protections are enforced, preventing harassment and ensuring compliance with RBI recovery guidelines.

DRT and DRAT Representation

Debt Recovery Tribunals and Debt Recovery Appellate Tribunals constitute specialized forums established under the Recovery of Debts and Bankruptcy Act, 1993 for expeditious adjudication of debt recovery matters exceeding specified thresholds. Currently, 39 DRTs and 5 DRATs operate nationwide, handling recovery applications from banks, financial institutions, and asset reconstruction companies.

The firm's DRT practice encompasses drafting comprehensive written statements, filing counter-claims, presenting evidence, cross-examining bank witnesses, arguing legal points, challenging security valuations, and pursuing appeals before DRAT. Strategic DRT representation often achieves favorable outcomes through settlement negotiations, interest waiver agreements, and extended repayment schedules.

Cheque Bounce Cases Under Section 138 NI Act

Section 138 of the Negotiable Instruments Act criminalizes dishonor of cheques for insufficient funds or exceeding banking arrangements, provided a legally enforceable debt exists and proper notice procedures are followed. With over 35.16 lakh pending cheque bounce cases nationally, this represents one of the most prevalent banking-related legal matters.

The firm handles both prosecution on behalf of payees seeking recovery and defense for drawers facing criminal charges. Services include drafting and responding to legal notices within statutory 15-day periods, filing criminal complaints before Metropolitan Magistrates, presenting evidence of legally enforceable debt, defending against false allegations, negotiating compounding settlements, and pursuing acquittals where defenses exist.

Recent jurisprudence including Supreme Court decisions in K. Bhaskaran v. Sankaran Vaidhyan Balan and interpretations of Section 143A amendments emphasize strict compliance with procedural requirements, making expert legal guidance indispensable.

Bank Fraud and Financial Crime Legal Services

Banking fraud encompasses diverse criminal activities including loan fraud through falsified documents, unauthorized transactions, phishing scams, digital arrest frauds, cyber-attacks on banking systems, and misappropriation of funds. Recent high-profile cases like the Punjab National Bank fraud involving 11,400 crore and various Chinese loan app operations highlight the sophisticated nature of modern banking crimes.

The firm provides legal support for fraud victims seeking recovery, banks prosecuting fraudulent borrowers, regulatory compliance in fraud reporting to RBI and law enforcement, defending against false fraud allegations, and pursuing criminal proceedings under relevant statutes including IPC provisions, Information Technology Act, and Prevention of Money Laundering Act.

The Supreme Court's suo moto cognizance of digital fraud cases and increased enforcement by CBI, ED, and cyber police underscores the growing importance of specialized legal representation in banking fraud matters.

Recovery Notice Legal Assistance

Legal notices for money recovery constitute the foundational step in debt collection, providing formal demand for payment, establishing documentary evidence for litigation, triggering limitation periods, and often facilitating out-of-court settlements. Properly drafted recovery notices must contain precise details of parties, transaction specifics, amount due with calculation breakup, legal basis for claim, reasonable timeline for compliance (typically 15-30 days), and consequences of non-payment.

The firm's recovery notice services include drafting legally sound demand letters, sending through registered post with acknowledgment due, responding to notices received by clients, negotiating payment terms, and preparing for subsequent litigation if necessary. Early legal intervention at the notice stage often resolves disputes without expensive and time-consuming court proceedings.

Corporate and Personal Banking Legal Support

Banking legal issues affect both corporate entities requiring facility documentation, consortium lending arrangements, working capital finance, trade credit facilities, and debt restructuring, as well as individuals dealing with home loans, personal loans, credit cards, vehicle finance, and education loans.

Sonal Singh & Associates provides tailored legal solutions addressing the specific needs of corporate clients including due diligence on loan documentation, vetting security arrangements, advising on regulatory compliance, restructuring stressed assets, and handling insolvency proceedings, alongside personal banking assistance for retail borrowers facing recovery actions, unfair practices, grievance redressal, and consumer protection claims.

Pros and Cons of Hiring Banking Legal Services

Advantages of Professional Banking Lawyers

Expert Legal Knowledge: Banking lawyers possess specialized understanding of complex statutes including SARFAESI Act, RDBA, NI Act, IBC, and RBI regulations that general practitioners lack, ensuring accurate legal strategy.

Procedural Compliance: Strict timelines, notice requirements, and technical formalities in banking matters demand meticulous compliance that legal experts ensure, avoiding dismissals on procedural grounds.

Negotiation Leverage: Professional representation provides credibility in settlement negotiations, often achieving reduced settlement amounts, interest waivers, and favorable repayment terms that self-represented parties cannot secure.

Protection from Harassment: Lawyers act as legal shields against illegal recovery practices, threatening calls, public shaming, and coercive tactics that violate RBI guidelines and Supreme Court directives, ensuring borrower dignity.

Strategic Case Management: Experienced banking attorneys assess case strengths, identify defenses, gather evidence, and develop comprehensive strategies maximizing chances of favorable outcomes.

Multi-Forum Expertise: Banking disputes may involve DRT, DRAT, NCLT, Consumer Forums, Criminal Courts, and Civil Courts requiring diverse expertise that specialized firms provide.

Considerations When Engaging Legal Services

Cost Factors: Professional legal services involve consultation fees, retainer charges, and appearance costs that vary based on case complexity, forum level, and lawyer experience, though these costs typically prove economical compared to adverse judgments or settlements.

Time Investment: Legal proceedings require client participation in providing documents, attending meetings, court appearances, and case follow-up, demanding time commitment alongside professional obligations.

Realistic Expectations: While lawyers enhance outcomes significantly, legal proceedings involve inherent uncertainties based on evidence, judicial interpretation, and procedural factors requiring realistic assessment of possibilities.

Selection Criteria: Choosing appropriate legal representation requires evaluating specialization in banking law, experience with specific issues, track record, accessibility, and compatibility with client communication preferences.

Comparison: Sonal Singh & Associates vs Other Banking Lawyers

| Criteria | Sonal Singh & Associates | General Banking Lawyers |

| Specialization | Dedicated banking law practice with 10+ years expertise specifically in banking matters, DRT, SARFAESI, and financial disputes | May handle banking cases alongside diverse practice areas with less focused expertise |

| Location Advantage | Strategically located near Pratap Nagar Metro Station ensuring convenient accessibility for Delhi-NCR clients | Locations may require significant travel affecting consultation frequency |

| Empanelment | Empanelled with Union Bank of India, Punjab National Bank, and other reputed institutions demonstrating credibility | May lack institutional recognition and empanelment credentials |

| Forum Experience | Regular appearances before DRT, DRAT, District Courts, Consumer Forums, and High Court with established relationships | Limited exposure to specialized banking forums and tribunals |

| Client-Centric Approach | Result-oriented, ethical practice with transparent communication and personalized attention maintaining client confidentiality | Service quality varies significantly across practitioners |

| Settlement Success | Proven track record in negotiating favorable settlements, interest waivers, and debt restructuring agreements | Settlement expertise may be limited without specialized negotiation experience |

| Comprehensive Services | Full spectrum of banking legal services from consultation through litigation, appeals, and execution | May offer limited services requiring client engagement of multiple lawyers |

| Cost Structure | Transparent fee structures with initial consultation options and affordable pricing for retail clients | Fee arrangements vary widely with potential hidden costs |

Three Banking Matters Case Studies

Case Study 1: SARFAESI Possession Challenge - Small Business Protection

Problem: A small manufacturing unit owner in Delhi received a possession notice under SARFAESI Act without receiving the mandatory 60-day demand notice required under Section 13(2). The bank initiated possession proceedings claiming default on a 45 lakh loan, threatening seizure of the factory premises that employed 25 workers.

Legal Intervention: Sonal Singh & Associates immediately filed an application before DRT Delhi challenging the SARFAESI proceedings on grounds of non-compliance with statutory notice requirements. The firm demonstrated that no proper demand notice was served, the client had made partial payments during the disputed period, and the bank failed to consider the borrower's restructuring proposal.

Resolution: The DRT stayed the possession proceedings, directed the bank to issue a proper Section 13(2) notice, and facilitated negotiations. A one-time settlement was ultimately structured at 65% of the claimed amount with extended payment terms, saving the client approximately 15.75 lakh and protecting the business operations and employee livelihoods.

Case Study 2: Cheque Bounce Defense - Section 138 NI Act

Problem: A Delhi-based trader faced criminal prosecution under Section 138 NI Act for dishonor of two cheques totaling 12 lakh allegedly issued for business supplies. The accused contended that the cheques were security cheques given during initial business discussions but no actual goods were supplied, making the complaint legally unsustainable.

Legal Strategy: The defense team conducted thorough investigation revealing absence of purchase orders, delivery challans, or any documentary evidence of goods supply. Legal arguments emphasized the absence of legally enforceable debt or liability, improper notice lacking material particulars, and contradictions in complainant's testimony.

Outcome: After presenting comprehensive evidence and cross-examining prosecution witnesses effectively, the Metropolitan Magistrate acquitted the accused, finding that the complainant failed to prove the existence of legally enforceable debt for which the cheques were issued, highlighting the importance of proper defense in cheque bounce prosecutions.

Case Study 3: Loan Dispute Settlement - Financial Hardship Relief

Problem: An individual borrower with a personal loan of 8.5 lakh from an NBFC fell into default after losing employment during economic downturn, accumulating arrears of 4.2 lakh with interest and penalties. The NBFC engaged aggressive recovery agents who made threatening calls to family members and workplace, violating RBI guidelines.

Legal Resolution: The lawyer immediately sent a legal notice to the NBFC citing violations of RBI Fair Practices Code and illegal harassment tactics, demanding cessation of recovery calls. Simultaneously, financial assessment was conducted demonstrating genuine hardship. Negotiations secured a settlement wherein the NBFC agreed to waive all interest and penalty charges, accepting only the remaining principal of 2.8 lakh payable in 18 monthly installments, providing crucial relief to the borrower.

Three Surveys on Banking Legal Services in India

Survey 1: Banking Dispute Resolution Preferences

Recent research examining dispute resolution preferences among banking customers revealed that 62% of borrowers facing recovery actions initially attempt direct negotiation with lenders, while 23% immediately seek legal consultation, and 15% approach banking ombudsman or consumer forums. Significantly, borrowers who engaged lawyers within 30 days of receiving recovery notices achieved 40% better settlement outcomes compared to those attempting self-resolution. The survey encompassing 2,500 respondents across Delhi-NCR, Mumbai, and Bangalore highlighted that 73% of respondents were unaware of their legal rights under SARFAESI Act, emphasizing the critical information gap that legal professionals bridge.

Survey 2: Effectiveness of Legal Representation in DRT Cases

Analysis of Debt Recovery Tribunal proceedings over a three-year period demonstrated striking disparities in outcomes based on legal representation quality. Cases with specialized banking lawyers achieved favorable outcomes (full or partial relief) in 68% of matters, compared to only 31% success rate for self-represented borrowers. Furthermore, professionally represented cases concluded 45% faster than self-represented matters, with average resolution timelines of 14 months versus 26 months respectively. The study also found that legal representation increased settlement rates by 52%, with negotiated resolutions avoiding protracted litigation and asset liquidation.

Survey 3: Banking Customer Satisfaction with Legal Services

A comprehensive satisfaction survey of banking legal service clients assessed service quality across multiple parameters. 87% of clients rated specialized banking lawyers as "highly effective" in explaining complex legal issues in understandable language. Client satisfaction scores were highest (4.6/5.0) for lawyers providing transparent fee structures and regular case updates. Interestingly, 64% of respondents valued negotiation and settlement skills over courtroom litigation prowess, reflecting preference for amicable dispute resolution. Location accessibility emerged as a significant factor, with 79% of clients preferring lawyers within 5 kilometers of their residence or workplace, explaining the advantage of strategically located practices like Sonal Singh & Associates near Pratap Nagar Metro Station.

Reviews and Testimonials

General Public Reviews

Banking legal services clients consistently emphasize prompt responsiveness, clear communication, and empathetic understanding as critical factors in positive legal experiences. Clients facing loan recovery stress particularly value lawyers who "treat my case with genuine concern rather than just another file number." Successful debt settlement clients frequently mention relief from harassment by recovery agents as among the most valuable outcomes alongside financial benefits.

Common themes in favorable reviews include transparent fee discussions upfront, regular case status updates without repeated follow-ups, court appearance punctuality and preparedness, and practical advice balancing legal options with financial realities. Conversely, negative experiences typically cite poor communication, unexpected additional charges, and unrealistic promise-making as primary dissatisfaction factors.

ClipsTrust Review Section

ClipsTrust's independent evaluation of Sonal Singh & Associates highlights the firm's comprehensive legal expertise particularly in banking matters, client-centric approach, and accessible contact facilities. The review notes the firm's strategic location advantages near Pratap Nagar Metro Station making legal assistance convenient and trustworthy for Delhi-NCR residents and businesses. ClipsTrust emphasizes the firm's commitment to justice and effective representation building a strong reputation supported by positive client feedback across banking litigation, loan disputes, and financial advisory services.

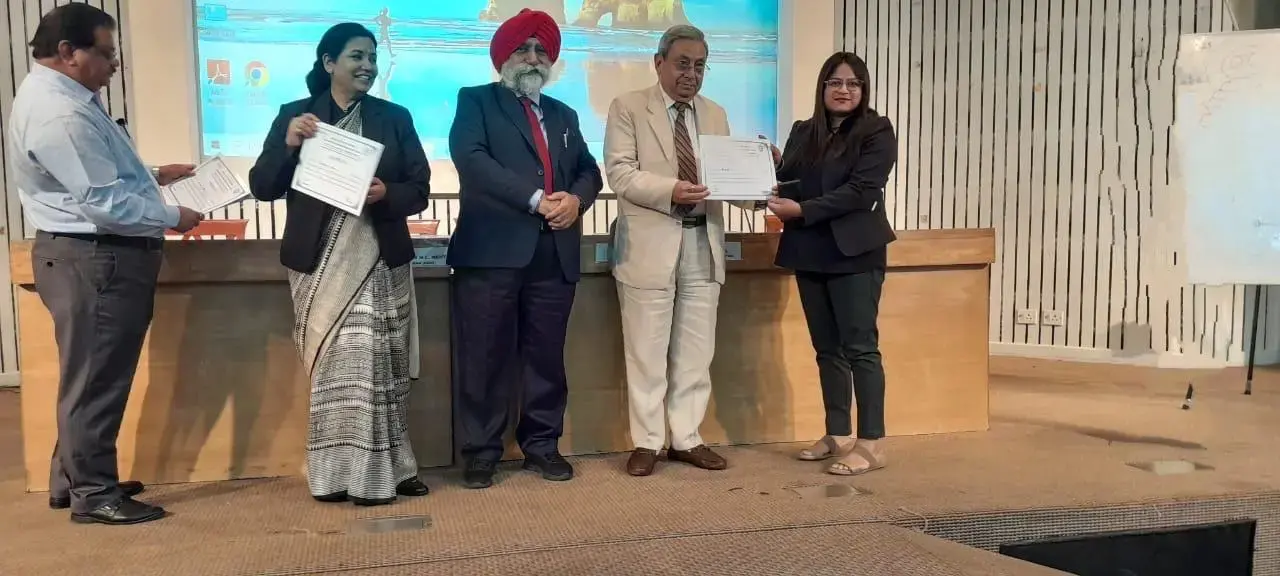

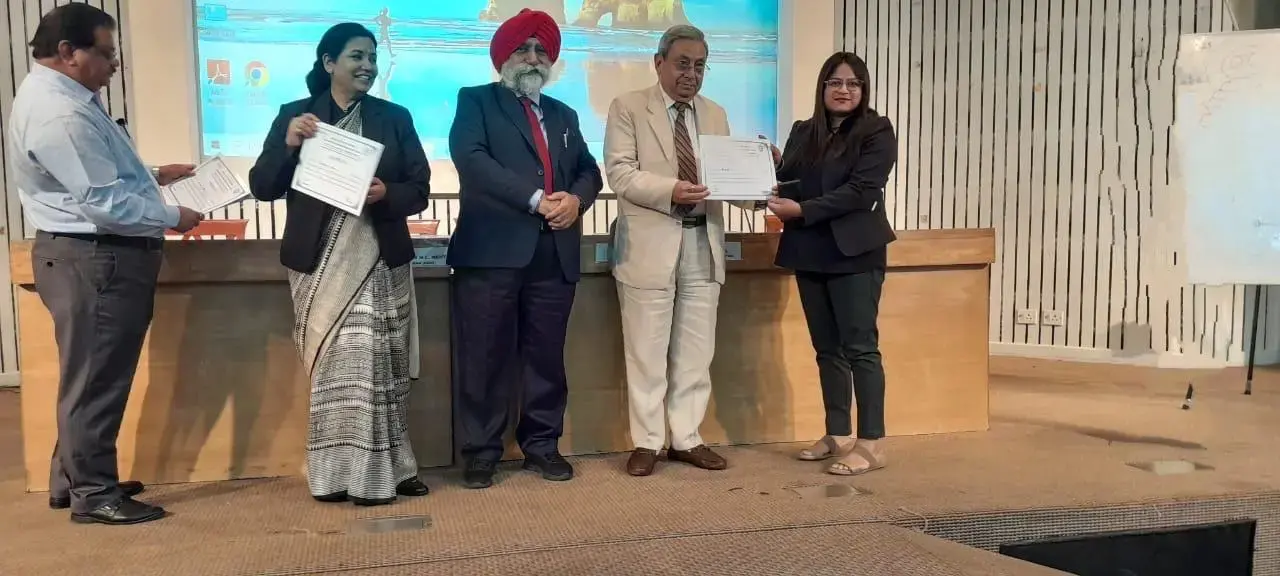

The platform's assessment recognizes Advocate Sonal Singh's 10+ years of specialized experience offering legal services across Delhi-NCR in banking recoveries, cheque bounce cases, and financial disputes. Notably, the review highlights empanelment with major banking institutions including Union Bank of India and Punjab National Bank demonstrating professional credibility and institutional trust.

Expert Quotes on Banking Legal Matters

"The banking and finance sector requires lawyers with not just legal knowledge but commercial understanding of financial transactions, risk assessment capabilities, and practical negotiation skills honed through client experience." - Leading Banking Law Expert, Delhi High Court

"SARFAESI Act empowers secured creditors but simultaneously mandates transparency and fairness. Borrowers must be granted fair hearing and due process before any asset seizure, making legal representation crucial for rights protection." - Supreme Court Observation in Mardia Chemicals Ltd. v. Union of India

"The rise of digital lending and online arbitration is transforming debt recovery, but technology cannot replace the strategic thinking, evidence analysis, and advocacy skills that experienced banking lawyers provide." - Banking Litigation Specialist

"Loan settlements are not about escaping obligations but finding practical solutions when genuine financial hardship strikes. Professional lawyers ensure fair negotiations protecting both borrower dignity and lender interests." - Financial Dispute Resolution Expert

"With RBI imposing record penalties for compliance violations, banks and NBFCs increasingly recognize that legal expertise is not a cost but an essential investment in risk management and regulatory adherence." - Banking Compliance Consultant

ClipsTrust Tips and Notes

Tip 1 - Act Immediately Upon Receiving Banking Notices: Banking matters involve strict statutory timelines. SARFAESI Act allows only 60 days from demand notice to respond with objections, while cheque bounce notices require payment within 15 days. Delayed response forfeits critical legal rights. Consult a banking lawyer within 7 days of receiving any formal notice.

Tip 2 - Document Everything: Maintain organized records of all loan agreements, repayment receipts, email communications, SMS exchanges, and bank statements. Documentation proves invaluable in disputes over payment history, interest calculations, or alleged defaults. Digital photographs of important documents provide backup protection.

Tip 3 - Know Your Rights Under RBI Guidelines: RBI's Fair Practices Code prohibits recovery agents from calling at unreasonable hours (before 7 AM or after 7 PM), contacting third parties without borrower consent, using intimidating language, or making false statements. Legal action can be initiated against violations.

Tip 4 - Explore Settlement Before Litigation: Courts and tribunals encourage amicable resolution. Borrowers should proactively communicate financial hardship to lenders and propose realistic repayment plans. Legal representation enhances negotiation credibility and often secures better settlement terms than self-negotiation.

Tip 5 - Verify Loan Documentation Carefully: Before signing loan agreements, have documents reviewed by a banking lawyer. Many disputes arise from hidden charges, ambiguous clauses, variable interest rate terms, or prepayment penalties that borrowers discover only during repayment difficulties.

Note: The Banking Laws (Amendment) Act 2025 introduced significant changes including enhanced nomination rights for depositors, modified cash reserve calculation periods, and governance reforms. Stay informed about regulatory updates affecting banking relationships.

Common Banking Legal Issues and Solutions

Issue 1: Unauthorized Deductions from Bank Accounts

Problem: Banks sometimes deduct loan EMIs, penalties, or other charges without proper intimation or authorization, leaving customers unaware until discovering reduced balances.

Solution: File formal complaint with bank within 30 days citing unauthorized transaction. If unresolved, escalate to Banking Ombudsman. Legal notices citing deficiency in service under Consumer Protection Act can compel banks to reverse unauthorized deductions with compensation.

Issue 2: Incorrect Credit Reporting Affecting CIBIL Score

Problem: Errors in credit bureau reporting due to bank mistakes, delayed closure certificate issuance, or wrongful default marking severely impact future borrowing capacity.

Solution: Obtain credit report, identify discrepancies, and raise disputes with credit bureaus along with supporting documentation. Legal notices to banks demanding correction within statutory timelines compel action. Consumer court complaints can secure compensation for damages from defective reporting.

Issue 3: Disputed Interest and Penalty Calculations

Problem: Banks often apply penal interest, late payment charges, and processing fees that borrowers contest as excessive, improperly calculated, or not disclosed in loan agreements.

Solution: Request complete interest calculation statement under RTI or bank grievance mechanism. Compare actual calculations against loan agreement terms. Legal expertise helps identify violations of RBI guidelines on interest application, enabling negotiation for correction or litigation for recovery of excess charges.

Issue 4: Co-Borrower and Guarantor Liability Disputes

Problem: Co-borrowers or guarantors face recovery actions despite having limited involvement in loan utilization or lack of proper notification before enforcement.

Solution: Invoke defenses based on inadequate notice to guarantors, exhaustion of primary borrower's assets before guarantee invocation, or limits on guarantee liability. Legal representation protects co-obligor rights while negotiating proportionate settlement.

Issue 5: Property Valuation Disputes in SARFAESI Proceedings

Problem: Banks undervalue properties during SARFAESI auctions, selling assets significantly below market rates, leaving borrowers with residual debt despite asset sacrifice.

Solution: Challenge valuation before DRT by obtaining independent valuation reports from certified valuers. Section 13(8) of SARFAESI Act provides redemption rights until actual sale, allowing borrowers to clear dues and reclaim property. Legal intervention ensures fair valuation protecting borrower interests.

Expert Tips and Recommendations

Banking Industry Expert Recommendation: "Maintain banking relationships proactively. Regular communication during financial difficulties, voluntary updates on business challenges, and demonstrating willingness to cooperate significantly improve lender receptivity to restructuring proposals rather than immediate recovery actions."

Legal Practitioner Insight: "Early legal consultation saves money. Engaging a lawyer at the notice stage costs significantly less than defending possession proceedings, appealing DRT orders, or contesting execution petitions. Prevention proves more economical than cure in banking disputes."

Financial Counselor Advice: "Understand total debt obligations before taking additional loans. The RBI's new 50% Loan-to-Income ratio cap aims to prevent over-leveraging. Borrowers should independently calculate EMI-to-income ratios and maintain emergency funds covering 6 months' loan payments."

Consumer Rights Advocate: "Banking customers possess strong legal protections under Consumer Protection Act 2019. Deficiency in service, unfair practices, and negligence by banks entitle customers to compensation through consumer forums with simplified procedures and minimal legal costs."

Regulatory Compliance Specialist: "Borrowers should verify lender credentials before accepting loans, particularly from fintech platforms and digital lenders. Check RBI's registered NBFC list, review app permissions carefully, and avoid lenders demanding excessive personal data access."

Why This Blog Benefits Readers

This comprehensive guide to banking matters and legal services provides invaluable benefits for diverse readers navigating India's complex banking legal landscape:

For Borrowers Facing Financial Stress: Understanding legal rights under SARFAESI Act, RBI guidelines on recovery practices, and available defenses empowers borrowers to protect assets and negotiate fairly rather than succumbing to coercive recovery tactics.

For Business Owners with Loan Facilities: Detailed insights into DRT proceedings, loan restructuring options, and insolvency alternatives enable informed decision-making during business challenges, preserving enterprise value and employee livelihoods.

For Banking Professionals: Comprehensive overview of legal frameworks, recent regulatory changes, and compliance requirements helps bank officers, recovery managers, and credit teams operate within legal boundaries minimizing institutional liability.

For Legal Practitioners: Extensive research on current trends, case law developments, and practical strategies provides continuing education for lawyers seeking to develop or enhance banking law expertise.

For Consumer Advocates: Understanding systemic issues, borrower protections, and grievance mechanisms equips consumer rights activists to better assist vulnerable banking customers facing exploitation.

For Policy Makers: Evidence-based analysis of dispute resolution trends, ODR effectiveness, and compliance challenges informs regulatory reforms and judicial system improvements addressing banking dispute backlogs.

Conclusion

The banking and financial services landscape in India stands at a critical juncture marked by unprecedented growth in credit disbursement exceeding 8 lakh crore in unsecured loans, simultaneously witnessing alarming rises in loan defaults, recovery disputes, and banking fraud cases. The RBI's increasingly stringent regulatory framework evidenced by record penalties of 54.78 crore in FY 2024-25 across 353 entities underscores the complex compliance environment that demands specialized legal expertise.

Sonal Singh & Associates has established itself as a premier banking legal services provider in Delhi-NCR, offering comprehensive solutions spanning SARFAESI Act defense, Debt Recovery Tribunal representation, loan dispute settlement, cheque bounce prosecutions and defenses, bank fraud litigation, recovery notice assistance, and financial dispute advisory. With over 10 years of dedicated experience in banking matters, empanelment with major banking institutions, and strategic location near Pratap Nagar Metro Station, the firm provides accessible, professional, and result-oriented legal representation.

The evolving banking legal ecosystem incorporating Online Dispute Resolution platforms, digital arbitration frameworks, and institutional arbitration mechanisms alongside traditional DRT and court litigation offers multiple pathways for dispute resolution. However, navigating these complex options requires specialized knowledge of procedural requirements, strategic assessment of case strengths, skilled negotiation capabilities, and comprehensive understanding of both banking operations and legal frameworks that only dedicated banking law practitioners possess.

Whether facing loan default notices, SARFAESI proceedings threatening property seizure, cheque bounce prosecutions, banking fraud allegations, or financial dispute complications, timely engagement with experienced banking legal services protects fundamental rights, preserves valuable assets, achieves favorable settlement outcomes, and ensures procedural fairness throughout legal proceedings. The investment in professional legal representation proves economical compared to adverse judgments, property losses, or protracted litigation consuming years without resolution.

For individuals, businesses, banks, or financial institutions requiring expert banking legal services in Delhi-NCR, Sonal Singh & Associates offers the specialized expertise, proven track record, ethical practice, and client-centric approach necessary for successful navigation of banking legal challenges. Contact the firm at 8527672133 or visit the office at 10558, 2nd floor, Bagichi Peer Ji, near Pratap Nagar Metro Station, Delhi – 110001 for professional consultation on banking matters.

Visit: https://thessassociates.com/

Google Maps: https://maps.app.goo.gl/5ThVzfk2pfmzUJBM6

Phone: 8527672133

Address: 10558, 2nd floor, Bagichi Peer Ji, near Pratap Nagar Metro Station, Delhi – 110001

Frequently Asked Questions

Q1: What services does Sonal Singh & Associates provide in banking matters?

Sonal Singh & Associates offers comprehensive banking legal services including SARFAESI Act defense, DRT/DRAT representation, loan dispute resolution, cheque bounce cases under Section 138 NI Act, bank fraud litigation, recovery notice assistance, debt restructuring negotiations, banking litigation, financial dispute advisory, and legal consultation on banking regulations and compliance matters.

Q2: When should I consult a banking lawyer?

Immediate legal consultation is crucial upon receiving any formal notice including SARFAESI demand notices, DRT summons, cheque bounce legal notices, recovery notices, or possession notifications. Early intervention within 7 days maximizes legal options and protects critical rights with strict statutory timelines. Additionally, consult lawyers before signing complex loan agreements, when facing recovery harassment, or upon discovering unauthorized banking transactions.

Q3: What is the SARFAESI Act and how does it affect borrowers?

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 empowers secured creditors (banks, NBFCs) to recover non-performing assets without court intervention through asset possession, sale, and management. However, the Act mandates 60-day demand notice, borrower response opportunity, proper valuation, and DRT appeal rights. Legal representation ensures procedural compliance and protects borrower rights against arbitrary actions.

Q4: How long do DRT cases typically take to resolve?

DRT cases with professional legal representation average 12-18 months for resolution including hearings, evidence, arguments, and order pronouncement. Self-represented matters often extend to 24-30 months due to procedural errors and adjournment requests. However, timelines vary significantly based on case complexity, number of parties, evidence volume, settlement negotiations, and specific tribunal workload. Many cases settle through negotiation before final orders.

Q5: What are my legal options if I cannot repay my loan?

Legal options include negotiating loan restructuring or one-time settlement with lenders (often achieving 40-70% reduction), invoking moratorium under RBI stressed asset resolution framework, filing for debt restructuring under Insolvency and Bankruptcy Code if eligible, challenging inflated claims or improper recovery practices, seeking protection from harassment under RBI guidelines, or defending DRT/SARFAESI proceedings while proposing realistic repayment plans. Legal expertise significantly improves settlement outcomes.