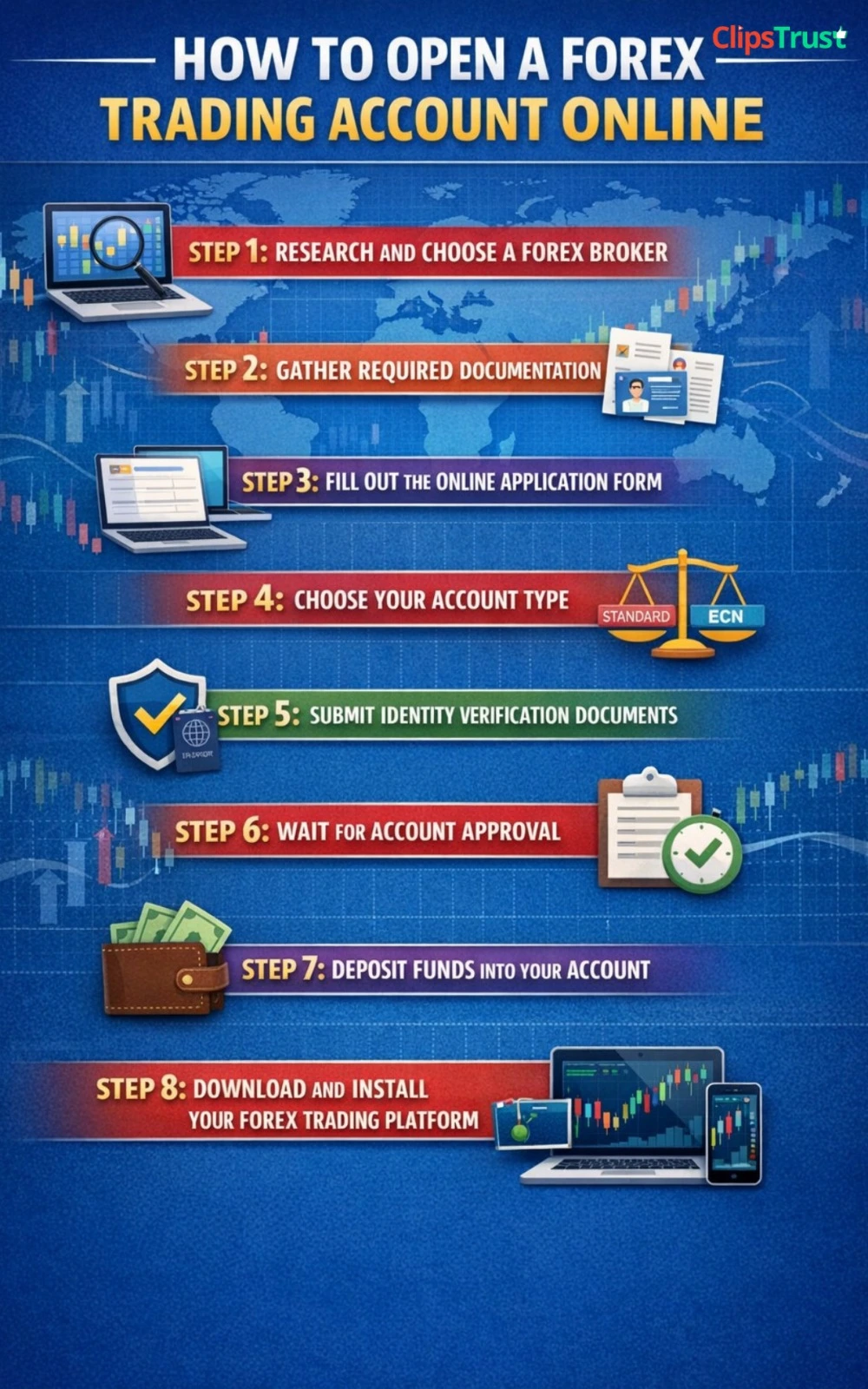

Step-by-Step Guide for Opening a Forex Trading Account Online

STEP 1: Research and Choose a Forex Broker

The first critical decision is selecting a regulated, trustworthy forex broker.

This choice directly impacts your trading costs, execution quality, and overall safety of funds.

What to Look For:

Regulatory Status: The most important factor is verifying that your broker holds legitimate regulatory licenses. Look for authorisations from FCA (Financial Conduct Authority, UK), ASIC (Australian Securities and Investments Commission), CySEC (Cyprus Securities and Exchange Commission), or SEBI/RBI for operations in India. A regulated broker must comply with strict capital requirements, client fund protection, and anti-money laundering regulations.

Trading Platforms: Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer advanced charting, indicators, and automated trading capabilities. Many brokers also provide proprietary web-based platforms designed for user-friendliness. Choose a broker whose platform matches your technical comfort level.

Spreads and Fees: Compare the bid-ask spreads (the difference between buy and sell prices). Standard spreads for major currency pairs like EUR/USD typically range from 1-2 pips. Some brokers offer fixed spreads; others offer variable spreads that adjust with market volatility.

Customer Support: Since forex markets operate 24/5 (Sunday evening to Friday evening), you need access to 24/5 live customer support. Test their support responsiveness before opening an account. Readers also searched for how to Install MT4 and MT5.

Minimum Deposit Requirements: These vary significantly by broker, ranging from as low as $5-$10 for micro accounts to $1,000+ for standard accounts. Your choice should align with your initial capital.

Recommended Brokers:

- OANDA: 25+ years in operation, US-regulated, comprehensive trading tools

- IC Markets: ECN broker with competitive spreads and fast execution

- Exness: Micro account options as low as $1, global reach

- XM Group: Low minimum deposits, good customer support

- Pepperstone: Australian-regulated, excellent platform options

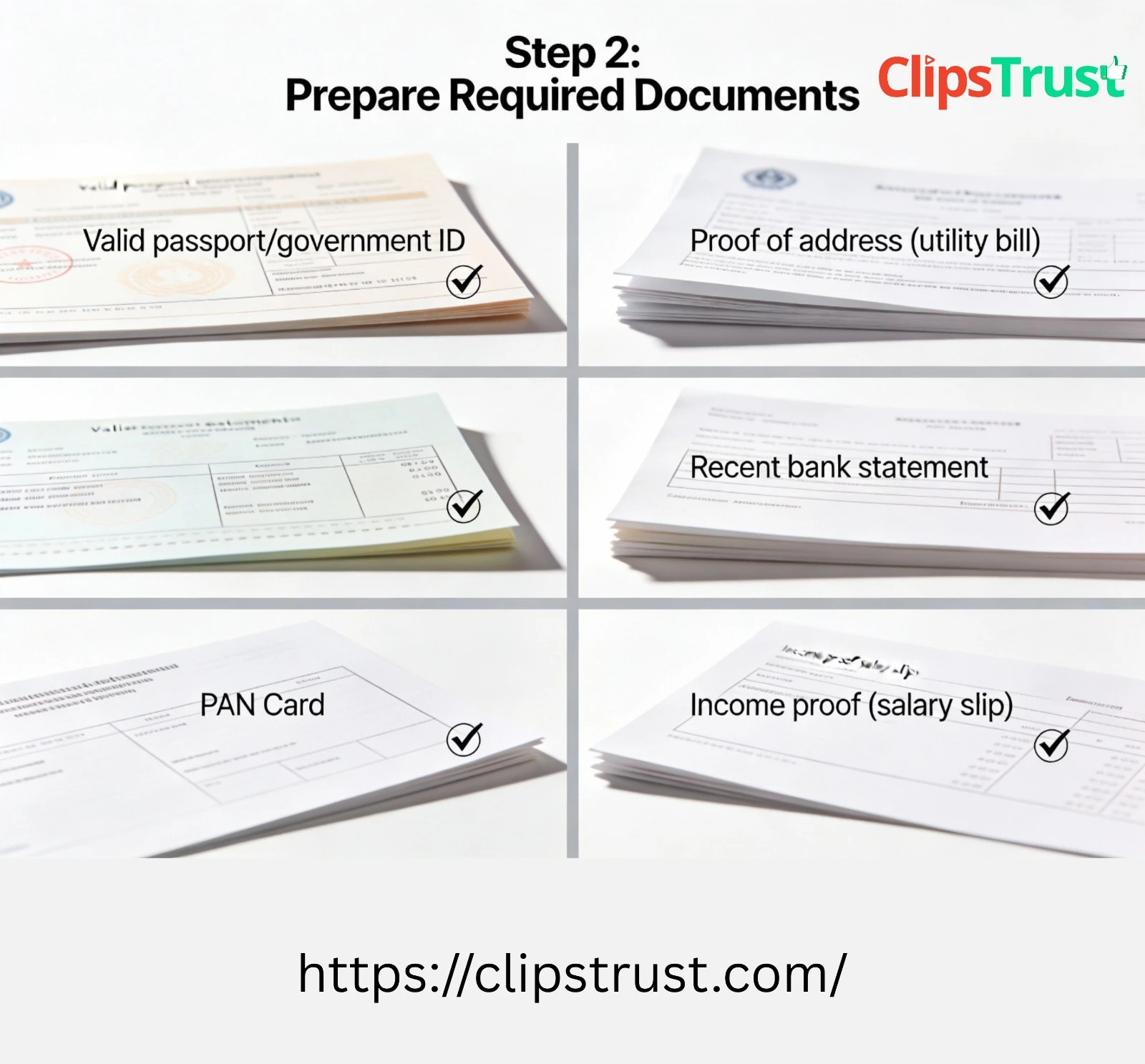

STEP 2: Gather Required Documentation to Open a Forex Trading Account

Before starting the application, prepare all necessary documents.

This speeds up the verification process and prevents delays. Understand how to use TradingView Forex Chart better with our forex technical analysis guide.

Identity Proof (Select One):

- Valid passport

- Government-issued ID card

- Driving license

- National identity card (Aadhaar for India residents)

Address Proof (Required - dated within 3 months):

- Utility bill (electricity, water, gas, internet, or telephone)

- Recent bank statement

- Government-issued document with your address

- Rental agreement with official stamp

Financial Documentation:

- PAN Card (for Indian residents)

- Tax ID or Social Security Number

- Recent bank statement (last 3 months)

- Proof of income (salary slips, ITR, or business documents)

Additional Requirements:

- Clear, colored passport-sized photograph (recent)

- Active email address

- Contact phone number

- Residential address details

Document Quality Standards:

- All documents must be dated within the last 6 months

- All four corners must be visible if documents are scanned

- High-resolution scans (minimum 2MB) or clear photographs

- Information must match exactly across all documents - the slightest discrepancy can cause delays

- No blurry, faded, or poorly lit images

- Ensure text is clearly legible

Preparation Tips:

Before you scan or photograph documents, lay them flat on a white background, ensure proper lighting, and verify all text is clearly visible. Keep digital copies organized in a dedicated folder for easy access during the application process. Explore the most effective Best Forex Trading Strategies That Work.

STEP 3: Fill Out the Online Application Form to Open a Forex Trading Account

Once you've selected your broker, visit their website and locate the account opening section.

The online form typically asks for personal, financial, and trading-related information. Discover Forex Trading Methods for Beginners used by professional traders.

Personal Information Section:

- Full legal name (exactly as it appears on your ID)

- Email address (ensure it's active and you have regular access)

- Phone number (mobile numbers are preferred)

- Date of birth

- Nationality and country of residence

- Complete residential address

Financial Information Section:

- Annual income range

- Estimated net worth

- Employment status (employed, self-employed, student, retired, other)

- Tax identification number or Social Security Number

- Source of funds information

- Banking details (optional at this stage, required for deposits)

Trading-Specific Information:

- Years of forex trading experience (0 years for beginners)

- Trading experience level (beginner, intermediate, advanced)

- Previous trading platforms used

- Trading objectives (speculation for profit, hedging, income generation, learning)

- Preferred account currency (USD, EUR, GBP, INR, etc.)

Password and Security:

- Create a strong password with a minimum of 8 characters: must include uppercase letters, lowercase letters, numbers, and special symbols (@, !, #, etc.)

- Confirm password (retype to verify)

- Review and check the "I Agree to Terms and Conditions" box

- Check the privacy policy agreement

Form Submission Best Practices:

- Double-check all information for accuracy before submitting

- Your email and phone number must be correct - you'll receive account verification emails

- Avoid typos in your name and address

- Use a secure, unique password you haven't used for other accounts

- Save your login credentials in a password manager

- Keep the confirmation email for your records

Most brokers will send a confirmation email immediately after submission. Check this email for the next steps in the process. Read our detailed article on What is Islamic Forex Trading Accounts?

STEP 4: Choose Your Account Type to Open a Forex Trading Account

Brokers typically offer multiple account types designed for different trader profiles.

Your choice affects your trading costs, risk level, and profit potential. Learn the difference between ECN vs STP vs Market Maker brokers.

MICRO ACCOUNT - For Beginners

| Feature | Details |

|---|---|

| Lot Size | 1,000 currency units (0.01 lots) |

| Pip Value | $0.10 per pip movement |

| Minimum Deposit | $10-$100 |

| Leverage | Typically 1:10 to 1:50 |

| Best For | Beginners, strategy testing, minimal capital investment |

| Risk Level | Lowest - 100 times less risky than standard accounts |

| Profit Per Trade | Small ($10-$50 typical per 100-pip move) |

Advantages: Risk management is easier, perfect for learning the platform, helps develop discipline without significant financial consequences.

Disadvantages: Profits are correspondingly small, may feel tedious to experienced traders.

MINI ACCOUNT - For Intermediate Traders

| Feature | Details |

|---|---|

| Lot Size | 10,000 currency units (0.1 lots) |

| Pip Value | $1 per pip movement |

| Minimum Deposit | $100-$500 |

| Leverage | Typically 1:50 to 1:100 |

| Best For | Intermediate traders with moderate capital |

| Risk Level | Moderate |

| Profit Per Trade | Medium ($100-$500 typical per 100-pip move) |

Advantages: Good balance between risk and reward, allows meaningful profit while maintaining control, bridge between micro and standard accounts.

Disadvantages: Requires more capital than micro accounts, higher per-trade loss potential.

STANDARD ACCOUNT - For Professionals

| Feature | Details |

|---|---|

| Lot Size | 100,000 currency units (1 lot) |

| Pip Value | $10 per pip movement |

| Minimum Deposit | $1,000-$5,000+ |

| Leverage | Typically 1:100 to 1:500 |

| Best For | Experienced traders with significant capital |

| Risk Level | Higher |

| Profit Per Trade | Higher ($1,000+ typical per 100-pip move) |

Advantages: Tighter spreads, more trading tools, better execution quality, higher profit potential.

Disadvantages: Substantial capital requirement, higher risk of significant losses, not suitable for beginners.

DEMO ACCOUNT - Highly Recommended for Everyone

| Feature | Details |

|---|---|

| Funds | Virtual/simulated money ($10,000-$100,000 typical) |

| Real Data | Live or near-real-time pricing |

| Risk | Zero - no real money at stake |

| Duration | Usually 30-90 days, often extendable |

| Best For | Learning, strategy testing, platform familiarization |

| Cost | Completely free |

Key Advantage: Demo accounts use real market data while eliminating emotional pressure and financial risk. Many brokers allow demo account creation with minimal information (just name and email), making it accessible immediately. Learn how to fund a forex trading account in forex.

How Demo Differs from Live Trading:

- Spreads: Demo often features artificially low or zero spreads; live accounts have realistic variable spreads

- Slippage: Not experienced in demo (prices change between order placement and execution in live accounts)

- Market Execution: Demo provides instant execution; live accounts may experience partial fills or requotes during volatility

- Emotional Component: Demo has no emotional pressure; live accounts involve real financial consequences affecting trading psychology

- Trading Costs: Demo typically has no commissions or fees; live accounts incur spreads, commissions, and swap fees

Expert Recommendation: Start with a demo account for at least 4 weeks. Practice your strategy, understand the platform, and achieve consistent demo profits before risking real money. This approach prevents costly beginner mistakes and builds genuine competence. For a deep explanation, read our detailed post of Comparison MetaTrader 4 vs MetaTrader 5.

STEP 5: Submit Identity Verification Documents to Open a Forex Trading Account

After your initial application receives preliminary approval, brokers require Know Your Customer (KYC) verification for regulatory compliance.

This is legally mandated to prevent money laundering and fraud. You may also find our article on what is Pips in Forex Trading?

What is KYC?

KYC (Know Your Customer) is a three-step process required by financial regulators:

- Customer Identification: Verify your true identity through government-issued documents

- Customer Due Diligence: Assess your background, financial status, and risk profile

- Ongoing Monitoring: Continuously monitor for suspicious activity

The KYC Process for Forex:

Step 1: Access Your Account's Verification Section

- Log in to your broker account

- Navigate to "Account Settings," "My Account," or "Verification."

- Look for the "Upload Documents" or "Identity Verification" button

Step 2: Upload Required Documents

- Select document type from the dropdown (Passport, ID, Address Proof)

- Upload high-quality scan or photo (PDF or JPG, minimum 2MB)

- Ensure all four corners are visible

- Text must be clearly legible

- If passport, upload front page with all information visible

Step 3: Proof of Address

- Recent utility bill (electricity, water, gas, internet, or telephone)

- Or recent bank statement

- Or a government-issued document with your address

- Must be dated within 3 months of application

- Full name and address must be clearly visible

Step 4: Selfie or Video Verification (Some Brokers)

- Some brokers require a selfie holding your ID next to your face

- Or a short video call to confirm identity

- Or liveness verification using facial recognition

- This prevents identity fraud and deepfakes

Step 5: Submit and Monitor

- Confirm all documents are submitted

- Track verification status in your dashboard

- Most brokers show "Pending," "In Progress," or "Verified" status

Document Upload Best Practices:

- High-resolution images - blurry documents are rejected

- Proper lighting - avoid shadows or glare

- All corners visible - no cropped documents

- Recent documents - generally within 3-6 months

- Matching information - name and address must match across all documents

- Correct format - PDF or JPG, not JPEG or PNG, sometimes required

Verification Timeline:

- Instant Approval: Some brokers use automated eID verification - can approve within minutes

- Standard Process: 24-48 hours for manual compliance team review

- Extended Review: 5-7 business days (only if documents need clarification or if requested)

- Complex Cases: Up to 2 weeks (rare, typically for high-deposit accounts)

Common Rejection Reasons and Solutions

| Issue | Solution |

|---|---|

| Blurry/unclear documents | Retake with better lighting and focus |

| Documents older than 6 months | Provide recently dated documents |

| Information mismatch (name spelling differs) | Resubmit with exactly matching names |

| Cropped document corners | Ensure all four corners are visible |

| Wrong document type | Upload the correct document type as requested |

| Signature issues | Ensure signature is clear if required |

What to Do If Verification is Delayed:

- Contact the broker's support team - they can tell you exactly what's needed

- Provide additional documentation if requested

- Be prompt in responding to any broker communications

- Avoid opening multiple verification requests

STEP 6: Wait for Account Approval to Open a Forex Trading Account

The approval process is typically automated after you submit documents.

Timeline of Events:

Hours 0-2: Initial Automated Checks

- System verifies document format and quality

- Initial identity verification checks run

- Account shows "Under Review" status

Hours 2-24: Manual Compliance Review

- Human compliance officer reviews documents

- Cross-checks information against global databases

- Assesses risk profile based on information provided

- Verifies the funds source's legitimacy

Hours 24-48: Final Approval

- Account status changes to "Approved" or "Verified."

- You receive an email confirmation

- Full trading features unlock

- Deposit functionality becomes available

How You'll Know Your Account is Approved:

- Confirmation email with subject line "Account Verification Complete" or "Welcome to [Broker Name]"

- Dashboard status changes from "Pending" to "Approve.d"

- Ability to view account balance and trading platform details

- Access to the deposit page (typically restricted until approval)

- Notification in your broker's notification center

Important Considerations:

- Do Not Attempt Multiple Deposits Before Approval: This can trigger additional verification requirements or account holds

- Limited Access Before Full Verification: Some brokers allow demo trading or limited live trading before full KYC completion

- $9,000 Threshold: Under certain regulations (European MiFID rules), some brokers require full verification only if gross deposits exceed $9,000

- Withdrawal Requirements: You typically need full verification to withdraw funds from your account, even if trading is permitted earlier

If Your Account is Rejected:

- Broker will provide a specific rejection reason (usually via email)

- Most rejections can be resolved by resubmitting corrected documents

- Contact support immediately if unclear why the account was rejected

- Common fixes: Update document, provide alternative proof, clarify income source

STEP 7: Deposit Funds into Your Account to Open a Forex Trading Account

Once approved, you can now fund your trading account.

Brokers offer multiple deposit methods, each with different minimums, processing times, and fees. Learn about the Types of Currency Pairs in Forex Market.

Payment Methods Comparison

| Method | Min Deposit | Max Deposit | Processing Time | Fees | Best For |

|---|---|---|---|---|---|

| Credit/Debit Card (Visa/Mastercard) | $50 | $30,000 | Instant to 2 hours | Usually free from broker | Quick funding |

| Bank Transfer | $100-$500 | Unlimited | 2-5 business days | May have bank fees | Large deposits |

| E-Wallets (PayPal, Skrill, Neteller) | $50 | $30,000 | Instant to 1 hour | 0-2% from wallet | Speed & convenience |

| Cryptocurrencies | Varies | Unlimited | 10 minutes - 1 hour | Varies | Tech-savvy traders |

| UPI/Local (India specific) | $5-10 | Variable | Instant | Usually free | Indian traders |

Step-by-Step Deposit Process:

Step 1: Navigate to the Deposit Section

- Log in to your broker account

- Click "Deposit" or "Cashier" (usually in the main menu or top-right)

- Ensure the account is approved before attempting a deposit

Step 2: Choose Payment Method

- Review available methods for your country

- Note the minimum and maximum deposit amounts

- Check if any fees apply

Step 3: Enter Deposit Amount

- Type the amount you wish to deposit

- The system typically shows the fee breakdown and the amount received

- Review the information carefully

Step 4: Proceed to Payment Gateway

- Click "Continue" or "Proceed"

- Enter payment details (card number, bank account, etc.)

- Complete any security steps (OTP, 3D Secure, etc.)

Step 5: Confirm Transaction

- Verify all transaction details

- Confirm the transaction

- Wait for payment processing confirmation

Step 6: Verify Deposit Received

- Most deposits (cards, e-wallets) appear instantly to within 2 hours

- Bank transfers may take 2-5 business days

- You'll receive a confirmation email and SMS

- Check your account balance in the trading platform

Deposit Tips for Beginners:

- Start Small: Recommend depositing $100-$500 initially

- Use Trusted Methods: Credit cards or PayPal offer buyer protection

- Avoid Large First Deposits: Once comfortable, increase gradually

- Check Withdrawal Policies: Ensure you can withdraw using the same method

- Keep Documentation: Save deposit receipts and confirmation emails

- Ask About Bonuses: Some brokers offer welcome bonuses (100% deposit match up to $500, etc.)

Common Deposit Issues

| Issue | Resolution |

|---|---|

| The deposit is not appearing in the account | Wait 2-24 hours, depending on the method; contact support with the transaction ID |

| Insufficient funds error | Ensure card/account has sufficient balance; check daily limits |

| Declined transaction | Contact your bank - forex may be flagged; use a different card if available |

| Higher than expected fees | Check with your bank - fees may be from your bank, not the broker |

STEP 8: Download and Install Your Forex Trading Platform

With funds now in your account, download the trading platform to execute trades.

Popular Platforms:

MetaTrader 4 (MT4)

- Most widely used forex platform globally

- Supported by nearly all brokers

- Advanced charting with 21+ technical indicators

- Expert Advisors (EAs) for automated trading

- Available on Windows, Mac, web, and mobile

- Large community with thousands of indicators and scripts

MetaTrader 5 (MT5)

- Newer version with improved performance

- Includes stocks and futures (not just forex)

- Better charting than MT4

- More built-in technical indicators

- 25+ timeframes (vs 9 in MT4)

Proprietary Platforms

- OANDA's fxTrade

- IC Markets' cTrader

- Broker-specific web platforms

- Often more user-friendly for beginners

- Limited customization compared to MT4/MT5

Installation Process:

Step 1: Visit Broker's Platform Page

- Log in to the broker account

- Locate "Download," "Platforms," or "Trading Tools"

- Select your operating system (Windows, Mac, iOS, Android)

Step 2: Download Platform

- Click the download link

- Files typically 30-100MB in size

- Wait for the complete download

Step 3: Install Application

- Run installer (setup.exe for Windows)

- Follow the installation wizard

- Accept terms and conditions

- Choose installation location (Program Files typically)

- Complete installation

Step 4: Launch and Log In

- Open the platform from your desktop/applications

- Enter broker credentials (email/username and password)

- Select "Live" account (you previously only had demo access)

- Connect to live market data

Step 5: Familiarize Yourself

- Review the platform layout

- Locate key sections: Market Watch, Terminal, Charts

- Open a currency pair chart

- Practice navigating menus (don't trade yet)

What is Forex Trading?

What is Forex Trading? It is the simultaneous buying of one currency and selling of another. Traders speculate on the fluctuating exchange rates between currency pairs, such as the Euro and the US Dollar (EUR/USD). Unlike the stock market, the forex market operates 24 hours a day, five days a week, allowing for continuous trading opportunities.

Opening a forex trading account is a streamlined process that typically takes 24-48 hours from application to approval. This guide covers every essential step, from broker selection through your first trade, with accompanying visual illustrations. Whether you're a complete beginner or transitioning to forex trading, this comprehensive roadmap will help you navigate the entire process efficiently and securely. Learn how the forex market works.

Pros and Cons of a Forex Trading Account

Advantages

- High Liquidity: You can enter and exit positions instantly.

- 24/5 Market: Trade whenever it suits your schedule.

- Leverage: Control large positions with small capital.

- Low Barriers to Entry: Start with minimal funds.

Disadvantages

- High Risk: Leverage can work against you, wiping out accounts.

- Complexity: Requires understanding of macroeconomics.

- Scams: The industry is rife with unregulated, fraudulent brokers.

- Emotional Stress: Rapid market moves can induce panic.

(FAQs) About Open a Forex Trading Account

Conclusion

According to the Clipstrust blog team, learning how to open a forex trading account online is a straightforward process when broken down into manageable steps. From the initial forex broker account selection criteria to the final forex account funding methods, precision is key.

By adhering to the complete forex opening process outlined here, you ensure your trading journey starts on a secure footing. Remember that the market rewards discipline and knowledge. Ensure you have met all forex trading account requirements and verified your identity before risking capital.

The forex account setup guide provided here is your blueprint for safety. Take your time to choose the best forex broker options that align with your goals. Trading is a marathon, not a sprint.

Leave a Comment