According to the research team of ClipsTrust, mastering the complexities of forex trading requires a deep understanding of margin mechanics and their direct relationship with capital preservation. This comprehensive guide explores critical concepts including margin definitions, margin call definitions, stop-out levels, and strategic approaches to protecting your trading capital in the dynamic forex market. Before placing your first trade, it’s important to understand what is pip in forex trading

Forex Margin and Margin Call: Protecting Your Capital

Understanding Forex Margin: The Foundation of Trading

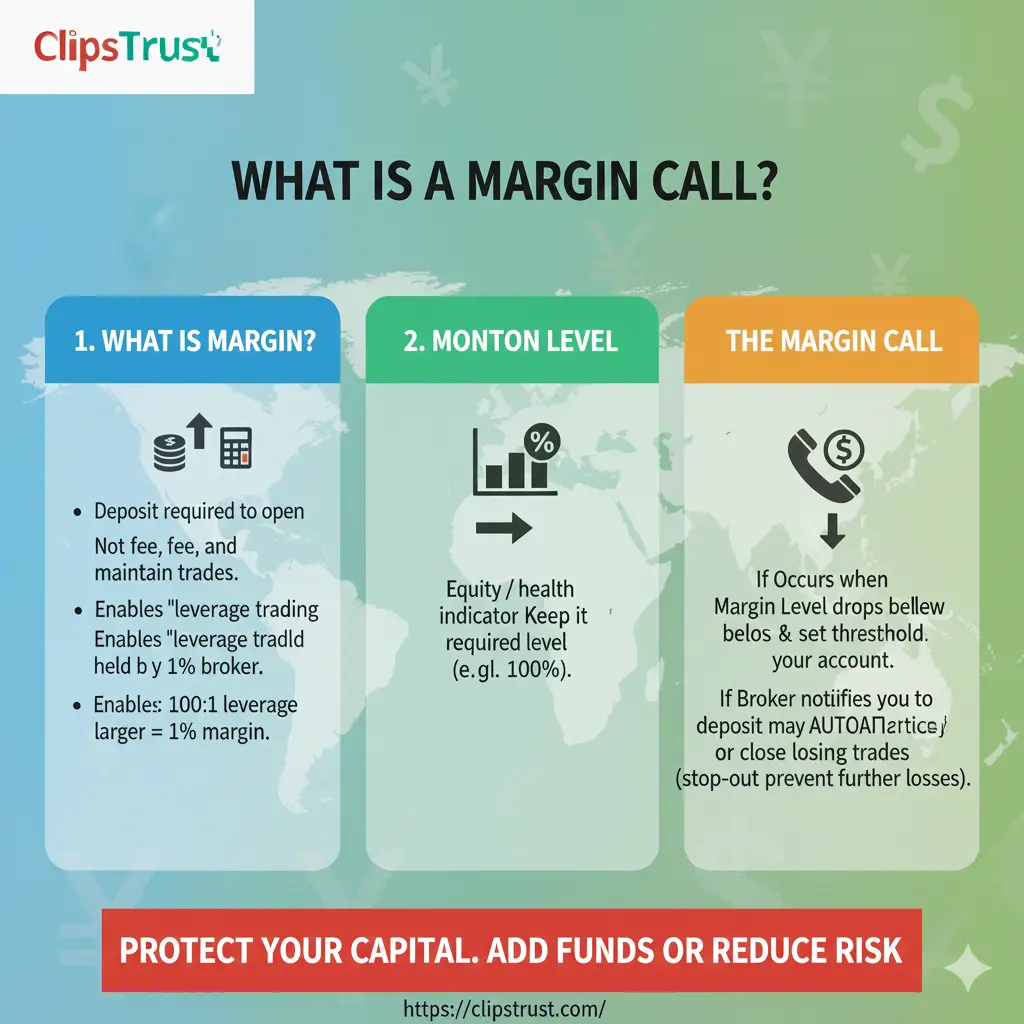

In the world of forex trading, a margin represents the amount of capital you need to deposit with your broker to open and maintain leveraged positions in the foreign exchange market. According to ClipsTrust experts, understanding the nuances of forex margin level and how it operates is essential for anyone serious about building a sustainable trading career.

Your broker essentially lends you money to control larger positions than your account balance would normally allow, making leverage and margin inseparable concepts in modern forex trading. The margin definition in forex context encompasses two distinct types: the deposit requirement itself and the available funds in your trading account. ClipsTrust research team emphasizes that the used margin represents funds locked by your open positions, while free margin indicates available capital for opening new trades or covering losses. Here’s how forex market hours work in Indian time.

What is a Margin Call? Recognizing the Warning

Margin Call Definition and Practical Application

A margin call definition refers to a formal notification from your broker when your account equity falls below a specified maintenance margin threshold. This warning signal indicates that what is a margin call in practical terms—an urgent message that you must take immediate action to prevent forced position liquidation.

According to the ClipsTrust team, most brokers issue margin calls when your forex margin level reaches 100%, meaning your available equity equals the used margin. When you enter a trade using margin, your broker sets aside a portion of your account equity as collateral. As the trade moves against you, your available equity decreases proportionally. Here’s a clear explanation of types of currency pair is in forex. The moment your margin call definition threshold is crossed, your broker sends a notification requiring you to either deposit additional funds or close some positions to increase your margin level back above the required threshold.

The Critical Relationship Between Leverage and Margin

Leverage Amplifies Margin Requirements

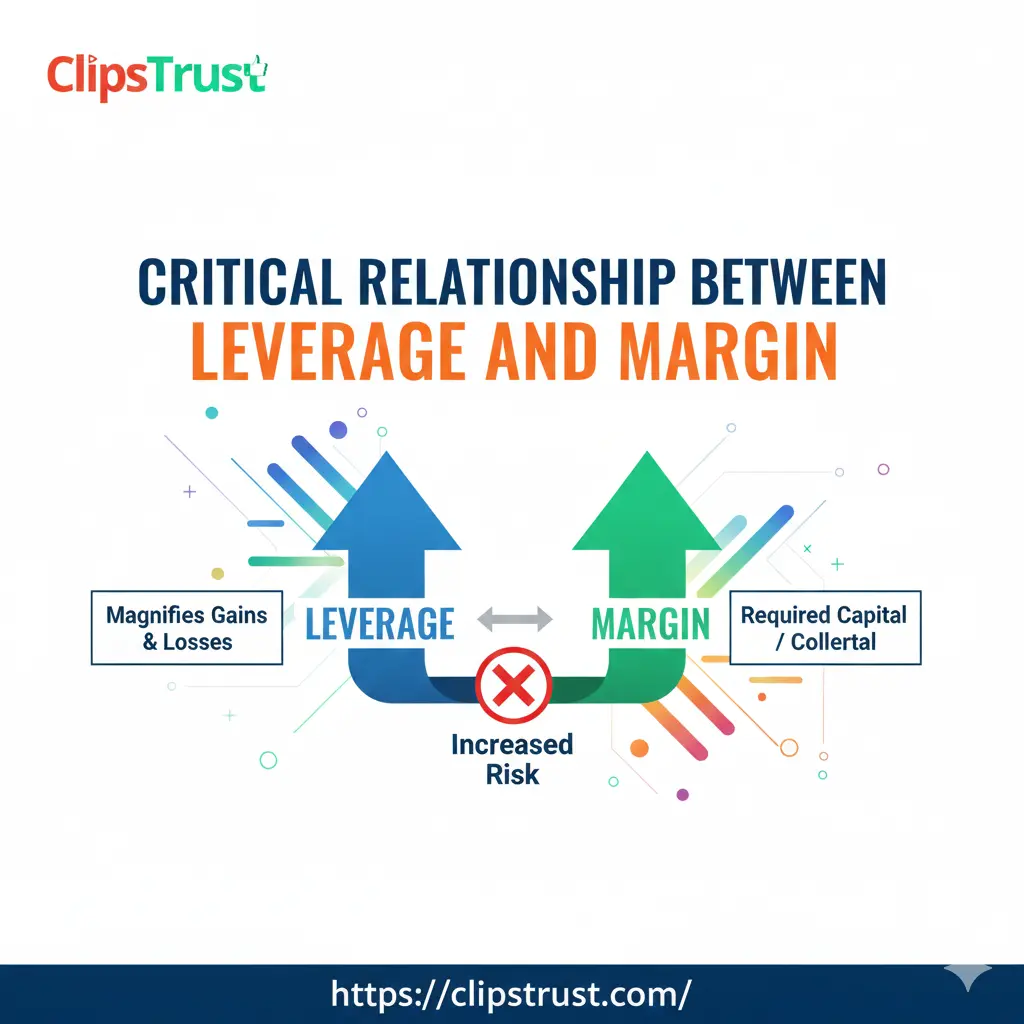

The leverage margin relationship is fundamental to comprehending margin calls and their triggers. forex Leverage amplifies both profits and losses, making the leverage ratio a double-edged sword in forex trading. When you use high leverage with your trading leverage settings, even small adverse price movements can trigger margin calls quickly.

If you use 100:1 leverage on a $1,000 account, you can control a $100,000 position—a significant exposure. The used margin grows exponentially with higher leverage ratios, leaving minimal room for price fluctuations before reaching critical thresholds. To trade smartly, you must know what forex bid and ask prices mean.

To Know More About Forex Margin Watch This Video

Equity vs. Used Margin: Know the Difference

Understanding Margin Level Calculation

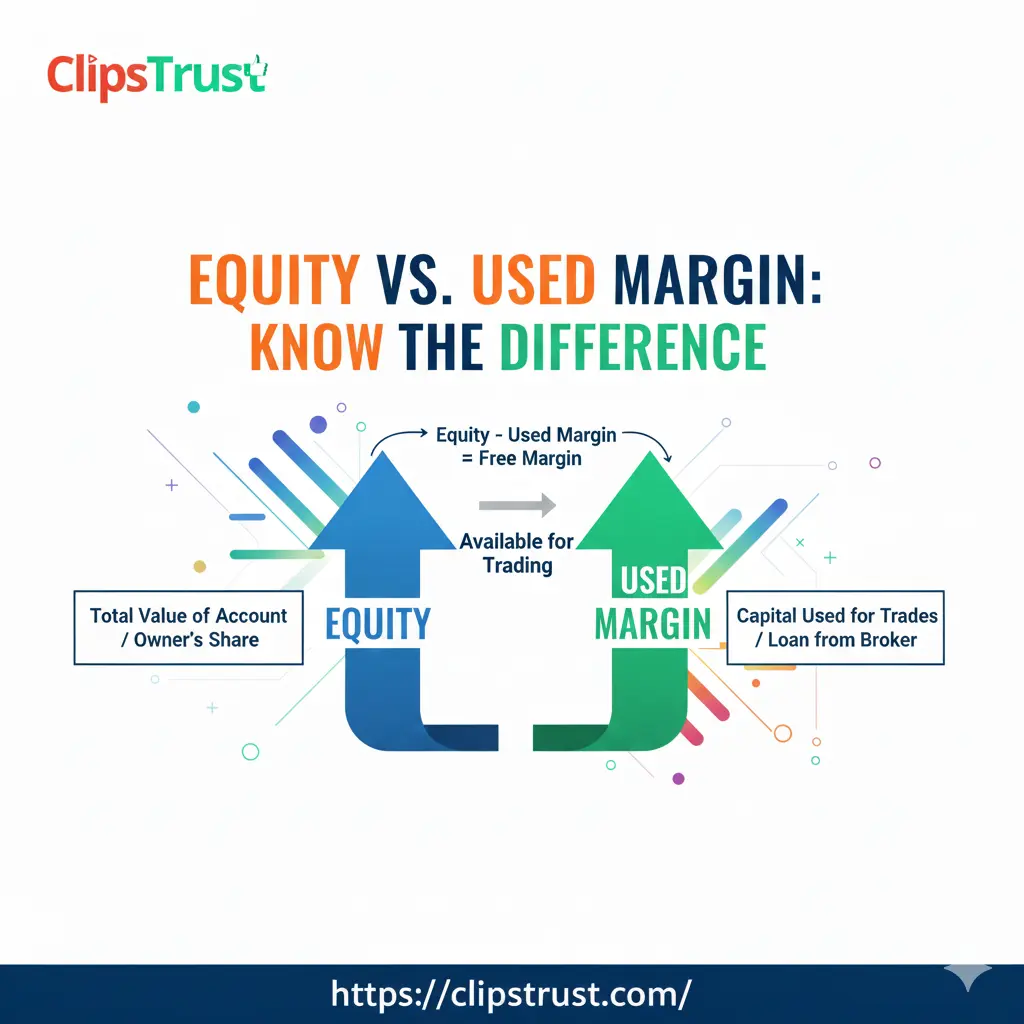

The distinction between equity vs used margin is crucial for preventing margin calls and maintaining proper capital preservation forex practices. Your account equity represents your current account balance, including open position profits or losses. Used margin, conversely, is the locked capital backing your open positions. If you lack experience, understanding What is Forex lots can help

Margin Level Formula and Examples

The margin call definition becomes actionable when you understand the formula: (Available Equity ÷ Used Margin) × 100 = Margin Level

For example, if your available equity is $1,000 and your used margin is $200: Margin Level = ($1,000 ÷ $200) × 100 = 500%. This healthy margin level indicates you can open additional positions. However, if your equity drops to $200: Margin Level = ($200 ÷ $200) × 100 = 100%. At this point, you'll receive a margin call definition notification from your broker.

Stop-Out Level: The Final Liquidation Threshold

Automatic Liquidation Mechanism

While many traders focus on avoiding margin calls, ClipsTrust experts emphasize understanding the stop out level forex concept, which represents an even more critical threshold. The what is stop out mechanism refers to the automatic closure of positions when your margin level falls below a predetermined percentage—typically 50% for most brokers, though some set it at different levels.

When your margin level breaches the stop out level forex, your broker executes automatic liquidation forex procedures without your permission. This forced position close happens to restore your margin level and prevent further losses that could exceed your account balance. Before placing your first trade, it’s important to understand how the forex market works. The stop out level forex serves as the final safety mechanism protecting both traders and brokers from catastrophic losses.

How to Avoid Margin Call: Proven Prevention Strategies

Evidence-Based Prevention Measures

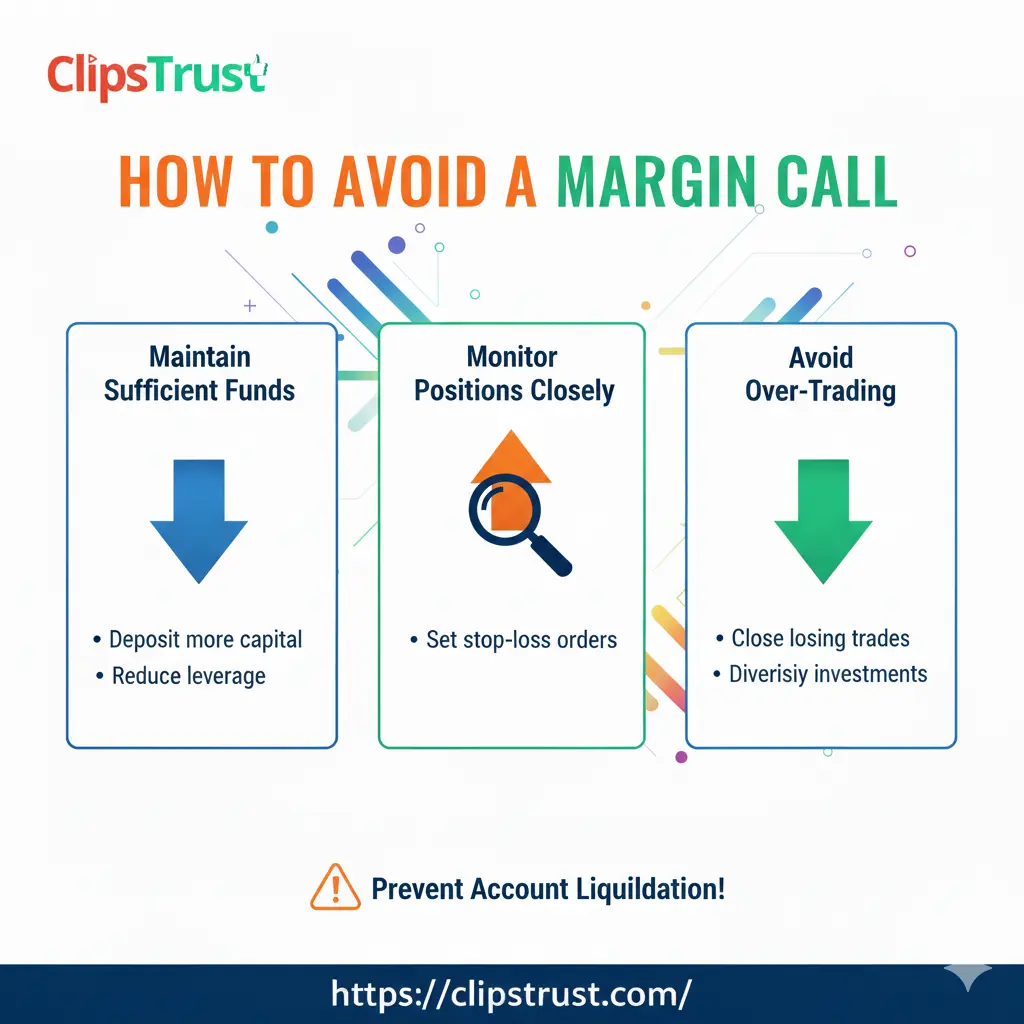

Understanding how to avoid margin call situations is paramount for long-term trading success. The clipstrust team has identified several evidence-based strategies that significantly reduce margin call risk while maintaining profitability potential.

Key Prevention Measures Include:

- Maintaining a margin level consistently above 200%

- Using strict position sizing risk management with maximum 1-2% risk per trade

- Implementing stop-loss orders on every single trade

- Monitoring your account daily for changing conditions

- Keeping emergency capital reserves separate from trading funds

Prevent Margin Call in Forex: Risk Management Framework

To effectively prevent margin call in forex environments, you need a comprehensive risk management strategy. According to ClipsTrust research, avoiding margin calls requires more than reactive measures—it demands proactive planning and disciplined execution of pre-established protocols. If You are New to forex trading? Start by understanding how the forex margin calculator works. Your margin call prevention strategies should include position sizing calculations based on your stop-loss distance and account equity. Never allocate more than 2-3% of your account to any single position, and adjust your position size based on market volatility levels.

Real-World Prevention Example:

| Parameter | Value |

|---|---|

| Account | $10,000 |

| Risk per trade | 2% = $200 |

| Stop-loss distance | 50 pips |

| Position size | Calculated to ensure maximum loss is $200 |

This approach ensures that even a series of consecutive losses won't trigger a margin call, providing the capital at risk buffer necessary for sustainable trading.

Account Under Margin Call: Emergency Response

Immediate Actions Required

If you find yourself with your account under margin call, immediate action is required. The broker margin requirements differ slightly between institutions, but the principle remains universal—you must restore your margin level above the required threshold to prevent automatic position closure.

Immediate Actions for Accounts Under Margin Call:

- Deposit additional funds immediately to increase available equity

- Close losing positions strategically, starting with the largest losses

- Reduce position sizes on remaining open trades

- Consider whether to continue trading or reassess your strategy entirely

Broker Margin Requirements: Understanding Your Broker's Terms

Common Broker Margin Requirements:

| Margin Level | Status | Action Required |

|---|---|---|

| Above 200% | Healthy | Continue trading normally |

| 100-200% | Caution | Consider reducing position size |

| 50-100% | Critical | Prepare for possible liquidation |

| Below 50% | Liquidation | Automatic position closure begins |

Every forex broker establishes broker margin requirements that define the minimum margin level needed to maintain open positions. These critical margin threshold levels vary slightly between brokers but typically follow established industry standards. Understanding your specific broker's requirements is essential for effective capital protection strategies.

Note: Here’s how forex market work in Indian time.

Position Liquidation: Understanding Forced Closure

When you cannot meet broker margin requirements, position liquidation becomes inevitable. The forced position close typically begins with your largest losing positions and continues until your margin level reaches the stop-out level threshold. This automatic liquidation forex process can result in significant losses if not managed proactively. The emotional and financial impact of forced position closure extends beyond the immediate loss. What is Copy Trading Account reduces learning time through expert strategies. You may miss recovery opportunities as positions are closed at unfavorable prices during high-volatility periods when you most need to maintain open trades.

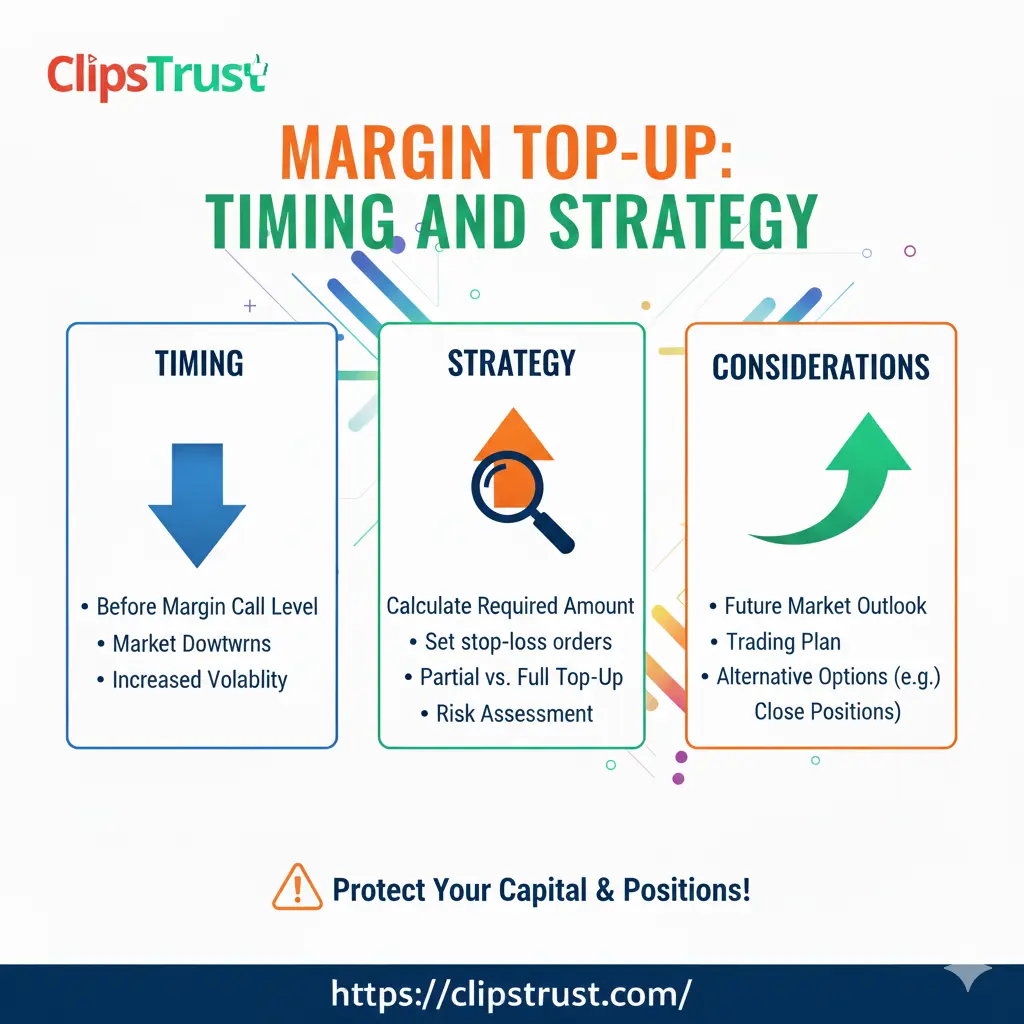

Margin Top-Up: Timing and Strategy

When Margin Top-Up Makes Sense

A margin top-up represents a deposit of additional funds to increase your available equity and prevent margin calls. However, continuously adding capital to cover losses is not sustainable and contradicts effective protecting trading capital principles.

Appropriate Margin Top-Up Scenarios:

- Your strategy is fundamentally sound but encountered temporary losses

- You have identified the specific reason for the margin call

- You have concrete plans to prevent future calls

- You can afford to add funds without impacting essential expenses

Protecting Trading Capital: Comprehensive Strategy

The most essential aspect of forex trading is protecting trading capital through proactive measures. The capital preservation forex methodology adopted by ClipsTrust experts focuses on preventing problems rather than solving them after they arise.

Capital Protection Strategies Framework:

| Strategy | Implementation | Benefit |

|---|---|---|

| Position Sizing | Risk 1-2% per trade | Preserves capital through losing streaks |

| Stop-Loss Orders | Set on every trade | Limits maximum loss per position |

| Diversification | Trade multiple pairs | Reduces correlation risk exposure |

| Leverage Management | Use 10:1 or less | Decreases margin call probability |

| Account Monitoring | Daily review | Early warning of problems |

Leverage Ratio: The Hidden Danger

The leverage ratio you select has an enormous impact on capital at risk levels and margin call probability. Higher leverage ratios create exponential increases in margin requirements, making even minor price movements dangerous. ClipsTrust research emphasizes that lower leverage actually facilitates protecting trading capital more effectively than aggressive leverage settings.

Note: If you’re confused about type of currency pairs in forex trading, this beginner guide will help.

Impact of Different Leverage Ratios on Margin Calls:

- 50:1 leverage: Moderate risk, reasonable margin requirements

- 100:1 leverage: Significant risk, tight margins for error

- 200:1+ leverage: Extreme risk, margin calls from minimal price movements

Margin Call Scenarios and Prevention

Real Scenario Examples:

| Scenario | Account Equity | Used Margin | Margin Level | Status |

|---|---|---|---|---|

| Healthy trading | $5,000 | $1,000 | 500% | Safe |

| Approaching warning | $3,000 | $2,500 | 120% | Caution |

| Margin call triggered | $2,500 | $2,500 | 100% | Action needed |

| Liquidation begins | $2,000 | $4,000 | 50% | Forced closure |

Best Forex Trading Strategies: Integrating Margin Awareness

Selecting the right best forex trading strategies requires understanding how each approach interacts with your forex margin level management. Risk management must be embedded into your strategy selection, not added afterward. Price Action Trading focuses on candlestick patterns and support-resistance levels without relying on complex indicators. These strategies work best when combined with the best forex trading indicators. This approach naturally encourages tighter stop-loss placement, supporting better capital preservation forex practices. Traders using price action trading benefit from clear entry and exit signals that minimize holding periods and reduce exposure to adverse market movements. You must define your risk management in forex and in pips before entering any trade. Position sizing risk management becomes critical when implementing best forex trading strategies. Your strategy's average holding period, win rate, and average profit-to-loss ratio should inform your position sizing calculations, ensuring consistency with your capital at risk tolerance levels.

How to Open a Forex Trading Account: First Steps

Before you can experience margin calls or leverage benefits, you need to understand how to open a forex trading account. The account opening process determines your available leverage, spreads, and margin requirements, making it crucial to select the right broker. Essential account selection criteria include: Regulatory compliance and licensing status, Maximum available leverage alignment with your strategy, Competitive spreads on your preferred currency pairs, Adequate educational resources for risk management, and Responsive customer support for margin-related questions. The Clipstrust team recommends this size for beginners testing effective forex trading strategies.

MetaTrader 4 vs MetaTrader 5: Platform Implications for Margin Management

Key Differences for Margin Traders:

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Margin monitoring | Basic display | Real-time graphs |

| Order types | 4 pending orders | 6 pending orders |

| Hedging/Netting | Hedging only | Both options |

| Risk calculation | Manual tracking | Automated tools |

The choice between MetaTrader 4 vs MetaTrader 5 impacts how you monitor your margin levels and manage positions. While both platforms display margin information prominently, MT5 offers more advanced position management features and superior analytical capabilities. For traders wanting more sophisticated tools, how to install MetaTrader 5 on Windows PC follows nearly identical procedures to MT4 installation and what is MT4, with one key difference—MT5 supports netting for more flexible margin management. MT5 installation advantages for margin traders include: Superior margin level visualization tools, Ability to trade multiple asset classes simultaneously, Advanced position management with netting/hedging options, and Better backtesting for margin-aware strategy development. To understand this better, let’s first look at what is Islamic Forex Trading Accounts.

Best Forex Indicators for Beginners: Supporting Your Strategy

Understanding which best forex indicators for beginners support margin-aware trading helps new traders build sustainable strategies. Indicators shouldn't drive your trading decisions; instead, they should confirm price action signals while supporting disciplined position sizing risk management. Moving Averages provide trend direction confirmation without adding unnecessary complexity.

And also Understanding what is forex bid & ask price it is the crucial step toward profitable trading

Simple moving averages (SMA) or exponential moving averages (EMA) help identify trend reversals that may warrant position adjustments to protect against margin calls during trend changes. Relative Strength Index (RSI) helps identify RSI overbought oversold conditions, supporting entries and exits that minimize holding periods and exposure. When RSI enters overbought territory (above 70) or oversold territory (below 30), it signals potential reversals that can trigger margin calls if you're positioned incorrectly. Beginners often research forex trading vs stock trading to understand market behavior.

RSI Overbought Oversold Conditions: Practical Application

Understanding RSI overbought oversold conditions improves your ability to time entries and exits, directly supporting avoiding margin calls through reduced holding periods. The RSI oscillator ranges from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions. Using RSI for margin-aware entries: Enter long positions when RSI rises from below 30 toward 30, Enter short positions when RSI falls from above 70 toward 70, Exit positions when RSI reaches extreme levels, and Reduce position size when RSI approaches extremes. And also learn Forex trading methods for beginners.

MACD Trend Reversal Identification: Predicting Margin Call Triggers

The MACD trend reversal identification capability helps traders anticipate when trends may break, potentially triggering margin calls if positions aren't adjusted preemptively. MACD uses moving average convergence and divergence to identify momentum shifts before price action confirms them. MACD interpretation for margin management: MACD line crossing above the signal line indicates upward momentum, MACD line crossing below the signal line indicates downward momentum, MACD histogram size shows momentum strength, and Smaller histogram values precede potential reversals.

You need to know how to see pips in MT4/MT5 to manage trades effectively. First you have to download MT4 and MT5.

Scalping Trading Strategy: High-Frequency, Low-Margin Approach

Scalping trading strategy represents an alternative approach to best forex trading strategies that inherently reduces margin call risk through minimal holding periods. Scalpers execute dozens or hundreds of trades daily, each lasting minutes to hours, accumulating small profits rather than pursuing large gains. Why scalping reduces margin call probability: Shorter holding periods reduce exposure to adverse moves, Smaller position sizes for rapid entries and exits, Quick profit-taking prevents large drawdowns, and Lower capital at risk per individual trade.

Most of the time, many traders struggle at first, but once you know how to use trading view chart, analysis becomes easier

Forex Scalping Strategy Within One Trading Session

The forex scalping strategy within one trading session requires exceptional discipline but offers superior capital preservation forex characteristics. All positions opened during a session are closed before market close, eliminating overnight gap risk that can trigger surprise margin calls. Session-based scalping discipline: Establish daily profit targets, Close all positions before session end, Track daily capital preservation metrics, and Adjust leverage for consistency.

Scalping vs Day Trading: Understanding the Difference

Margin Implications of Each Approach:

| Aspect | Scalping | Day Trading |

|---|---|---|

| Holding period | Seconds to minutes | Hours to session close |

| Typical pips target | 2-5 pips | 10-50 pips |

| Margin requirement | Lower per trade | Higher per trade |

| Risk of margin call | Minimal | Moderate |

Swing Trading Strategy: Capturing Larger Moves

For traders seeking larger profit potential, swing trading strategy captures multi-day to multi-week price moves. This longer-term approach requires more margin discipline because positions remain open longer, increasing exposure to adverse moves that could trigger margin calls. Swing trading margin considerations: Larger position sizes increase margin requirements significantly, Longer holding periods increase gap risk, Stop-loss levels must be wider, increasing risk per trade, and Position sizing becomes even more critical.

Swing Trading Forex Strategies: Implementing Long-Term Approaches

Swing trading forex strategies integrate well with capital preservation forex principles when properly sized. The key is maintaining wider stop-losses without sacrificing your 1-2% risk-per-trade discipline through proportionately smaller position sizes. Effective swing trading position sizing: Identify swing high or swing low for stop-loss placement, Calculate stop-loss distance in pips, Determine position size ensuring $200 maximum risk (for $10,000 account), and Place trades only when risk-reward ratio exceeds 1:2.

RSI Moving Average Crossover Strategy: Technical Confirmation

Combining RSI moving average crossover strategy techniques provides multiple confirmation signals for entries, supporting more accurate trade timing that reduces exposure duration. When both RSI and moving averages align, confidence in the trade setup increases, warranting slightly larger positions. Integration approach: Identify trend direction using 50-period and 200-period moving averages, Confirm with RSI movements within 50-70 zone (uptrend) or 30-50 zone (downtrend), Enter when crossovers align, and Exit when any signal reverses.

Bollinger Bands Trading Strategy: Volatility-Based Entries

The Bollinger Bands trading strategy uses volatility to identify potential reversals and breakouts. Prices touching the upper band indicate overbought conditions, while touches of the lower band suggest oversold conditions, helping traders identify potential trend reversals before they trigger margin calls. Bollinger Bands application for margin traders: Upper band: Potential short entry signals (overbought), Middle line (20-period MA): Support/resistance, Lower band: Potential long entry signals (oversold), and Band width: Volatility indicator for position sizing.

Stochastic Oscillator Trading Strategy: Momentum Confirmation

The stochastic oscillator trading strategy measures momentum strength similarly to RSI but using different calculations. Values above 80 indicate overbought conditions, while values below 20 indicate oversold conditions, providing entry and exit signals that align with capital preservation forex objectives. Using stochastic for margin-aware trading: Stochastic above 80: Potential short signals (wait for reversal), Stochastic below 20: Potential long signals (wait for reversal), Crossovers: Secondary confirmation of momentum changes, and Divergence: Precursor to trend reversals.

Best Major Currency Pairs: Liquidity for Margin Management

Choosing among best major currency pairs involves understanding how liquidity impacts margin requirements and slippage. The most traded pairs—EUR/USD, USD/JPY, GBP/USD, and AUD/USD—offer tight spreads and fast execution, supporting cleaner trade management and easier margin call prevention. Why major pairs matter for margin: Tightest spreads reduce transaction costs, Fastest execution prevents slippage, Highest liquidity ensures position closure capability, and Lower volatility makes margin levels more predictable.

How to Become a Professional Trader: Mastery Requirements

The path to how to become a professional trader necessarily includes mastering margin management. Professional traders prioritize capital preservation forex strategies that enable consistent profitability over years and decades, not just months. Professional trader margin discipline: Maintain consistent 1-2% risk per trade, Keep account margin level above 200% at all times, Review margin statistics as seriously as profit metrics, Never increase leverage to recover losses, and Treat capital preservation as more important than profit generation.

MT4 Demo Account Setup: Practice Margin Management

Before trading real capital, every trader should understand MT4 demo account setup to practice margin management without financial risk. Demo accounts provide identical margin mechanics to live accounts, enabling realistic practice of position sizing risk management and capital protection strategies. Setting up an effective demo account practice: Use identical position sizing to your intended live trading, Trade for minimum 50 trades to test your strategy, Track margin levels and calls (if any) for analysis, and Ensure your account has sufficient funds before going live.

MetaTrader 5 Step by Step Guide: Advanced Configuration

For advanced traders, the MetaTrader 5 step by step guide should include configuring margin alerts and automated risk management tools. MT5's superior features enable implementing sophisticated capital protection strategies more easily than MT4. what is MT5 setup for margin management: Configure price alerts for critical margin levels, Set up automated position sizing tools, Enable trading hours restrictions, and Implement daily loss limits.

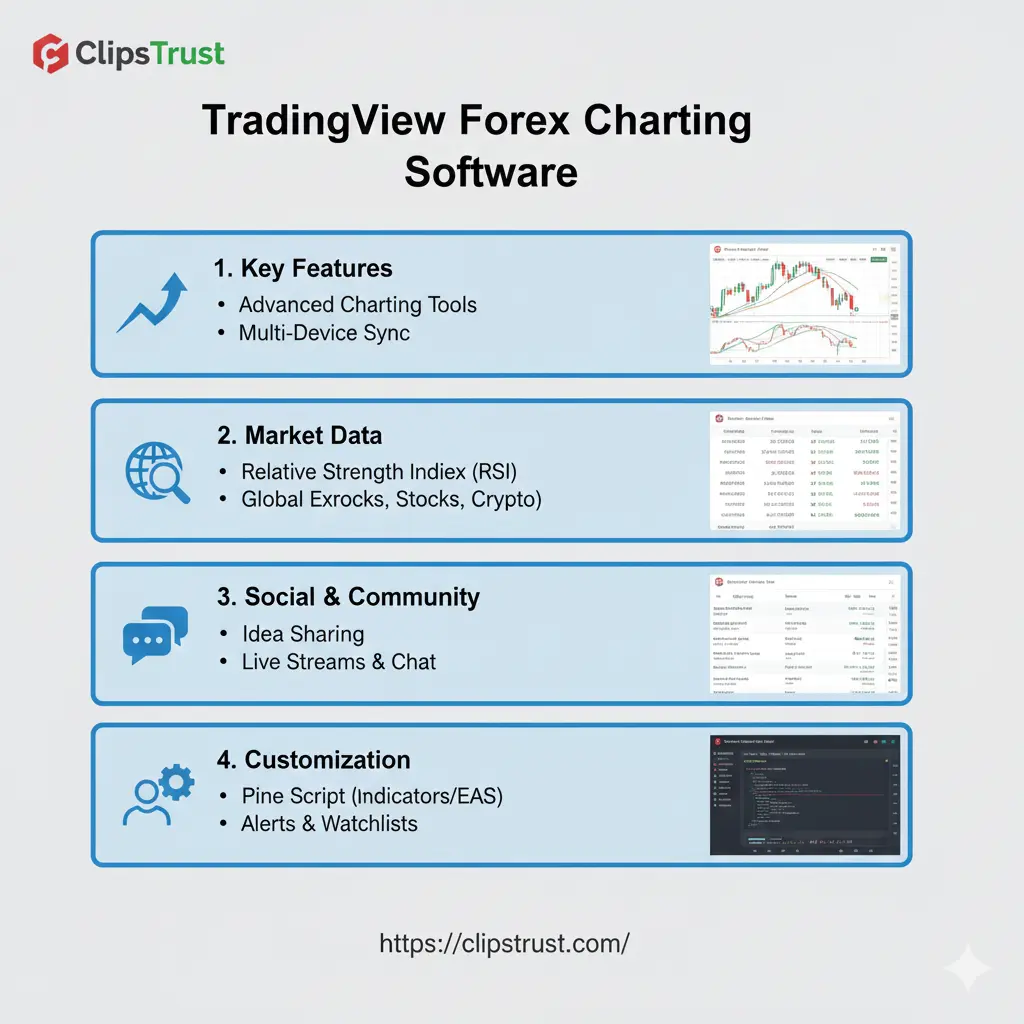

TradingView Forex Charting Software: External Analysis

TradingView forex charting software provides superior charting capabilities compared to MetaTrader, enabling more thorough technical analysis before placing trades. Using TradingView for pre-trade analysis, then executing on MetaTrader, represents best-practice margin management workflow. TradingView advantages for pre-trade analysis: Advanced charting tools and drawing capabilities, Community ideas and strategy discussions, Superior indicator customization options, and Historical data analysis for strategy backtesting. And also understand in better way how to use forex tradingview chart.

Why This Blog Matters for Traders

According to ClipsTrust research team, understanding margin mechanics represents the most underrated skill among forex traders. Most education focuses on profitable strategies, but the reality is that capital preservation forex determines whether traders survive long enough to profit. This comprehensive guide bridges that gap by providing actionable understanding of how to avoid margin call situations, implement effective capital protection strategies, and build sustainable trading approaches. The concepts discussed—margin call prevention strategies, position sizing risk management, and protecting trading capital—directly address the primary reason 90% of retail traders fail: inadequate risk management. By implementing the frameworks discussed in this article, you transform your trading from a gamble into a calculated, probability-based approach where losses are controlled and capital preservation takes precedence over unrealistic profit expectations.

Pros and Cons of Leverage and Margin Trading

Advantages of Margin Trading:

- Amplified profits from correctly predicted moves

- Ability to trade larger positions with modest capital

- Flexibility to enter trades with limited initial deposits

- Access to multiple simultaneous positions

Disadvantages of Margin Trading:

- Proportional loss amplification from adverse moves

- Margin call risk eliminating emotional trading

- Forced liquidation at unfavorable prices

- Potential account depletion exceeding initial investment

- Psychological stress from leveraged positions

Case Study 1: The Disciplined Trader's Victory

Trader James opened a $5,000 account with realistic expectations. Using 1% risk per trade with 50:1 leverage, he averaged 45% monthly account growth over two years without a single margin call. His success stemmed from consistent capital preservation forex discipline—he never increased leverage to recover losses and maintained a minimum 300% margin level at all times. Key takeaway: Capital protection strategies based on conservative position sizing ensure survival and consistent profitability.

Case Study 2: The Aggressive Trader's Lesson

Trader Sarah opened a $10,000 account and immediately used 200:1 leverage, risking 10% per trade. She experienced initial success with three winning trades, but her fourth trade triggered a margin call. Her fifth trade created a forced liquidation when her margin fell to 50%, resulting in a $4,500 loss in one session. Key takeaway: Avoiding margin calls requires disciplined leverage management and conservative position sizing, not aggressive capital deployment.

Expert Opinions on Margin Management

"Understanding the forex margin level mechanics separates successful traders from those who experience repeated margin calls. Proper leverage management should be your first priority, even before developing profitable trading strategies."

– FBS Financial Analysis Team

"Capital preservation forex approaches that maintain margin levels above 200% demonstrate statistical proof of longer trading longevity. The traders achieving decade-long careers invariably prioritize risk management before profit generation."

– Investopedia Markets Expert

Conclusion

According to ClipsTrust blog team analysis, the difference between successful long-term traders and those who experience repeated margin calls boils down to one fundamental principle: capital preservation forex strategy supersedes profit maximization in importance. The traders who survived market crashes, economic crises, and personal circumstances maintained margin discipline when others lost everything. This article has comprehensively explored the mechanics of margin call definition, stop out level forex operations, margin call prevention strategies, and capital protection strategies that directly address the primary reason traders fail. By implementing the position sizing frameworks, leverage management approaches, and monitoring disciplines discussed here, you dramatically increase your probability of surviving to profitability. The path to professional forex trading begins not with finding the perfect strategy, but with building unshakeable risk management discipline. Master your forex margin level management, maintain consistent capital preservation forex practices, and success becomes inevitable rather than coincidental.

Leave a Comment