Is XM Legal in India?

XM Broker is Legal in India

This remains one of the most frequently asked questions among Indian traders. The straightforward answer is yes—opening and trading with XM from India is completely legal and is not prohibited under Indian law. However, the ClipsTrust research team emphasizes that this situation exists within a regulatory grey area that requires careful understanding.

India's Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) enforce strict regulations regarding who can conduct forex transactions. Officially, only authorized banks and specific financial institutions are permitted to handle leveraged forex trading. This means XM, as an offshore broker, doesn't hold an Indian license and doesn't operate under direct SEBI regulation. Learn more if you are a beginner, about what is forex trading?

Yet this regulatory absence doesn't translate to illegality for individual traders. No Indian trader has faced prosecution simply for using offshore forex brokers like XM for personal trading. The authorities focus enforcement efforts on money laundering and tax evasion rather than on retail traders using regulated international platforms. Users also searched for xm forex trading company.

Start Your Journey Today — Join the First Step Toward XM Forex Broker. Most Awarded Forex Broker.

XM Regulation - International Licenses Protecting Your Funds

XM operates under multiple internationally recognized regulators, which actually provides Indian traders with robust protection despite the absence of SEBI oversight. The ClipsTrust expert team has verified XM's regulatory standing across several jurisdictions:

- Cyprus Securities and Exchange Commission (CySEC) -- License Number 120/10 for Trading Point of Financial Instruments Ltd, operating under EU's MiFID II framework

- Australian Securities and Investments Commission (ASIC) -- Regulating Trading Point of Financial Instruments Pty Ltd with strict capital and compliance requirements

- International Financial Services Commission (IFSC), Belize -- License Number 000261/106, enabling XM's global reach outside EU and Australia

- Dubai Financial Services Authority (DFSA) -- Regulating Middle East operations with enhanced transparency requirements

- Financial Sector Conduct Authority (FSCA), South Africa -- Ensuring African operations maintain global standards

These regulators impose stringent requirements, including segregated client fund accounts, negative balance protection, and regular financial audits. Your deposits remain entirely separate from XM's operational funds, meaning even if the company faces difficulties, your money is protected.

Compliance with Indian Banking Laws for Fund Transfers

This approach ensures transparency and compliance with India's Foreign Exchange Management Act (FEMA). As long as your transactions pass through official banking channels and remain within FEMA guidelines, you maintain full legal standing. Avoid any unofficial or peer-to-peer payment methods, as these could trigger regulatory scrutiny.

XM Trading App in India - Download and Access

How to Install MT4 and MT5 on Your Device

XM provides two professional trading platforms accessible from India: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The ClipsTrust expert team recommends understanding the differences before installation to select the platform that matches your trading style.

For Desktop Installation (Windows):

Visit the official XM website and navigate to the Trading Tools section. Download the MT4 or MT5 setup file (xmglobal4setup.exe or xmglobal5setup.exe). The installation takes approximately 2-3 minutes. Double-click the downloaded file and follow the installation wizard, accepting the license agreement. Your antivirus software may display a warning—this is normal and can be safely bypassed. Once installation completes, the platform automatically launches.

For Mac Installation:

Download the MetaTrader 4(5).dmg file from XM's official portal. Once downloaded, double-click the DMG file to open it. Drag the XM MT4/MT5 icon into your Applications folder. Navigate to Applications, right-click the file, select "Open," and complete the security verification. The platform launches automatically upon successful installation.

For Mobile Trading:

Download the XM Trading App from either Google Play Store (Android) or Apple App Store (iOS). The mobile app provides full trading functionality with real-time charts, notifications, and order management. The ClipsTrust team finds mobile apps particularly useful for Indian traders who trade during commute times or cannot remain at their desks.

What is the MetaTrader 4 Forex Trading Platform?

MetaTrader 4 represents the industry standard for retail forex trading, trusted by millions of traders globally since its 2005 launch. MT4 provides nine timeframes (ranging from 1-minute to monthly charts) and 30 built-in technical indicators perfect for trend analysis, support/resistance identification, and pattern recognition. The platform supports Expert Advisors (EAs)—automated trading systems that execute trades according to programmed parameters.

For Indian traders beginning their forex journey, MT4 offers an intuitive interface design, extensive educational resources, and compatibility with virtually every trading strategy. The platform handles one-click order placement, customizable templates, and an integrated economic calendar for news-triggered trading. According to the ClipsTrust analysis, approximately 70% of retail traders globally use MT4 because of its established ecosystem and third-party tool availability.

What is Forex MetaTrader 5 and Key Improvements Over MT4

MetaTrader 5 launched in 2010 as MT4's successor, incorporating advanced features for professional and institutional traders. MT5 offers 21 timeframes compared to MT4's nine, providing greater granularity for precise entry/exit decisions. The technical indicator library expands to 38 indicators, including advanced Fibonacci tools, Gann analysis, and Elliot Wave tools unavailable in MT4.

Critically, MetaTrader 5 implements multi-threaded strategy testing, enabling drastically faster backtesting of automated strategies. The ClipsTrust expert team emphasizes that while MT4 tests a strategy in hours, MT5 accomplishes identical testing in minutes—a significant advantage for traders developing or refining systematic approaches.

MT5 introduces Depth of Market (DOM), displaying real-time order volumes at different price levels. This transparency allows traders to identify support/resistance strength and anticipate potential breakouts. The built-in economic calendar eliminates the need for external news tracking, and partial order filling provides sophisticated position management.

Difference Between MT4 vs MT5 Platform Comparison

| Feature | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Timeframes | 9 (M1 to MN) | 21 (highly granular) |

| Technical Indicators | 30 built-in indicators | 38 indicators + custom tools |

| Programming Language | MQL4 (simpler) | MQL5 (object-oriented, advanced) |

| Order Types | 4 pending order types | 6 pending order types + Buy/Sell Stop Limit |

| Economic Calendar | External link required | Integrated into the platform |

| Depth of Market (DOM) | Not available | Available for transparency |

| Backtesting Speed | Standard (slower) | Multi-threaded (3-5x faster) |

| Asset Classes Supported | Primarily Forex & CFDs | Forex, Stocks, Indices, Futures, Bonds |

| Best For | Forex beginners & established traders | Professional traders & systematic approaches |

For a better understanding, explore our article on mt4 vs mt5.

How to Open an Account with XM Forex Broker?

XM Account Registration Steps India - Step-by-Step Process

Opening an XM account from India requires only 5 minutes and minimal documentation. The ClipsTrust team has verified this process repeatedly and confirms straightforward completion from any Indian location. Begin by visiting the official XM website and clicking "Open Account" or "Register Now."

Step 1: Account Registration at XM

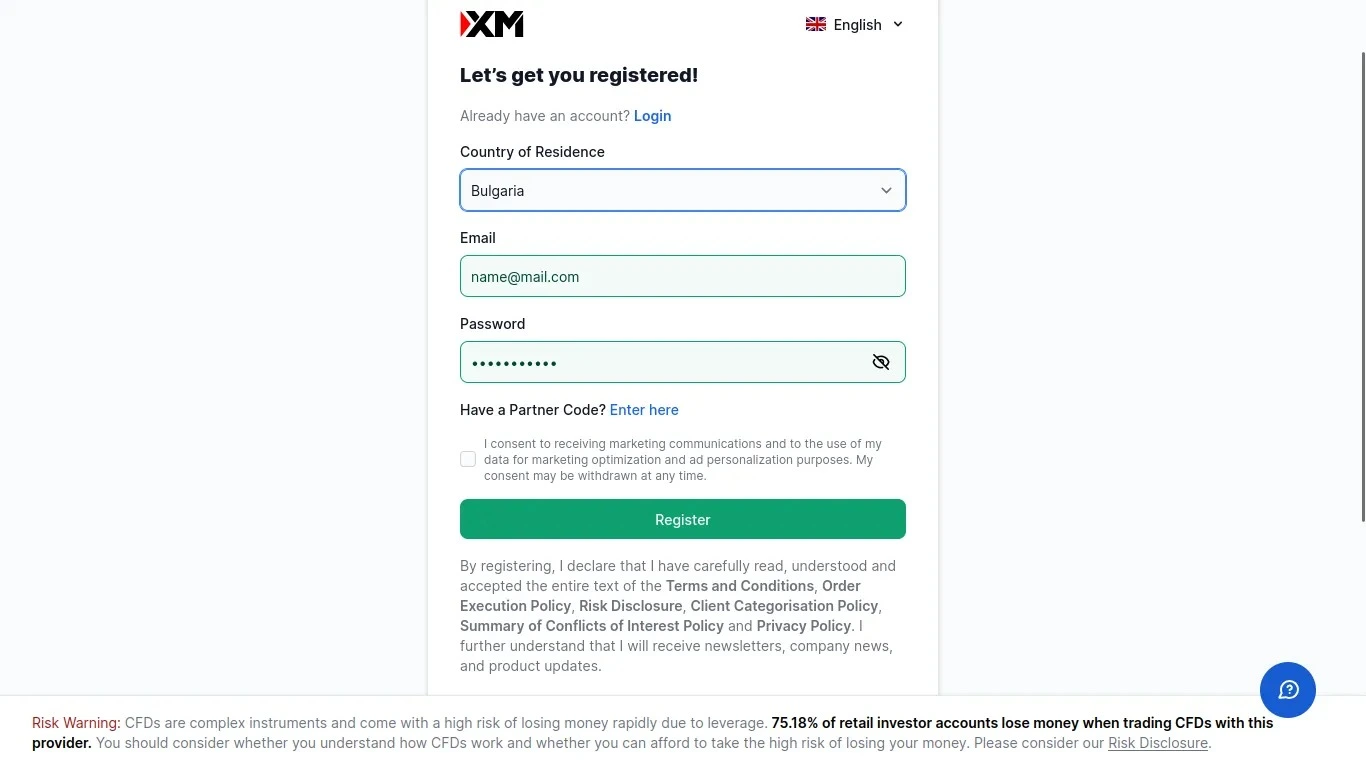

You would like to start by launching the registration page from the ‘ Get Started’ button on the broker’s home page.

Select your country of residence and enter your email and password, which will be used to sign into your XM profile. Click on ‘Register’.

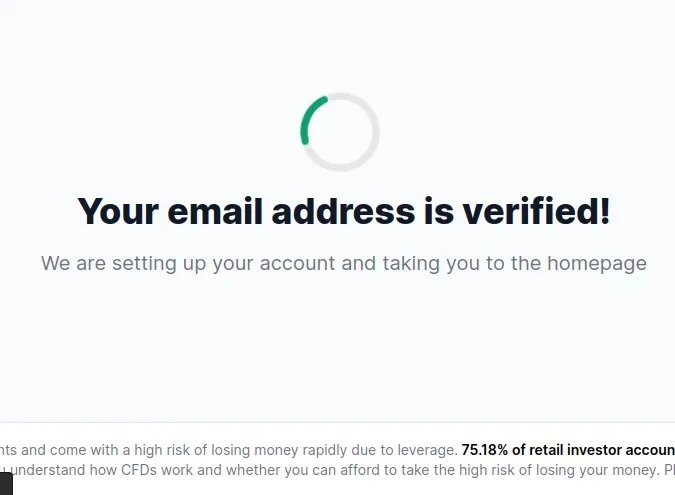

Proceed with verifying your email by clicking on the XM link you have received to your email address.

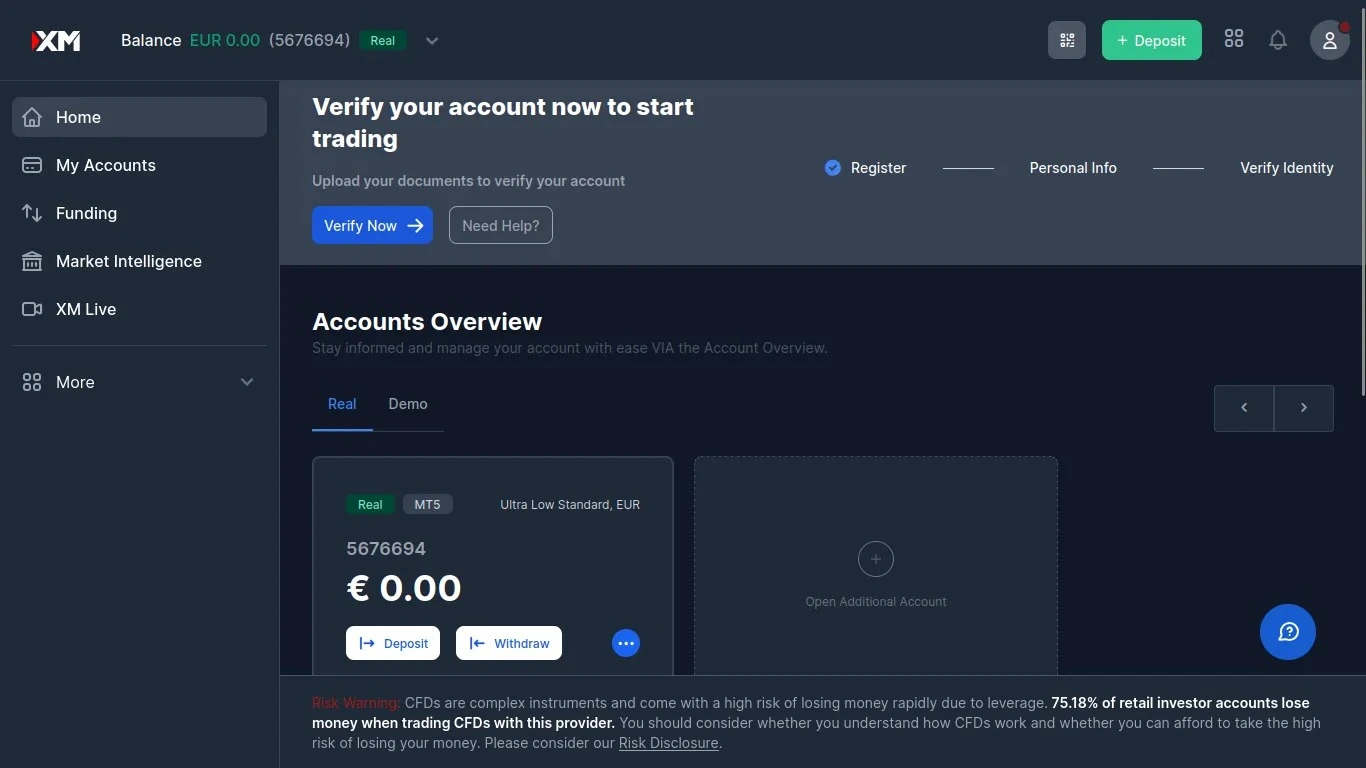

Once you have confirmed your email, you can start exploring the trading conditions at XM with a Demo account. However, if you would like to start trading with real money, you would need to verify your account.

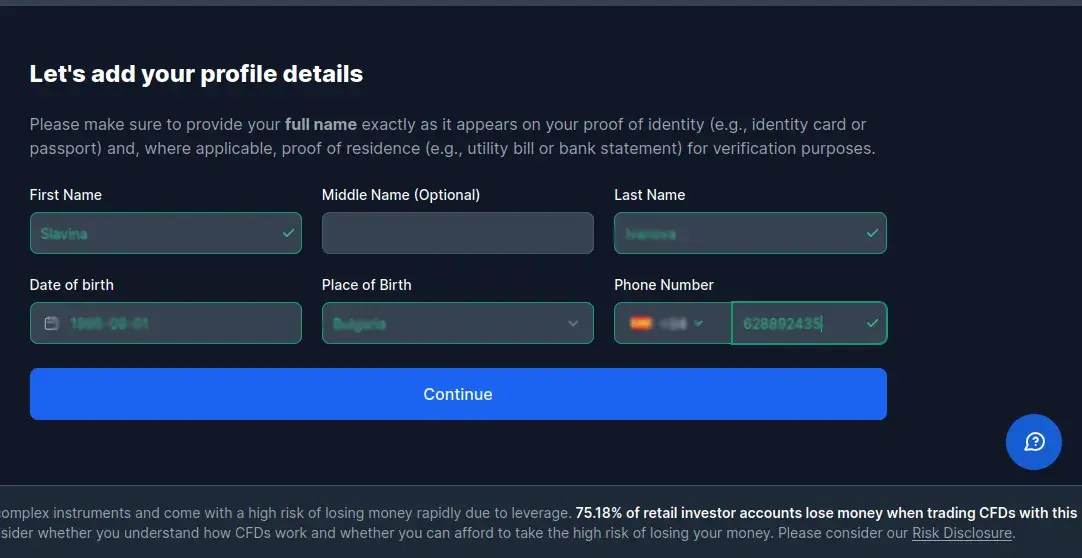

Step 2: Real Account Information Input

Log in to your newly created profile using your email and the temporary password received. Navigate to "Open Real Account" and select your preferred trading platform (MT4 or MT5) and account type. Provide your full legal name exactly as it appears on your government identification documents.

Specify your country as "India" and confirm your residence city and state. Select your account base currency—most Indian traders choose USD, EUR, or INR depending on their trading preferences. The ClipsTrust analysis suggests choosing USD as your base currency for maximum leverage and tightest spreads on major forex pairs.

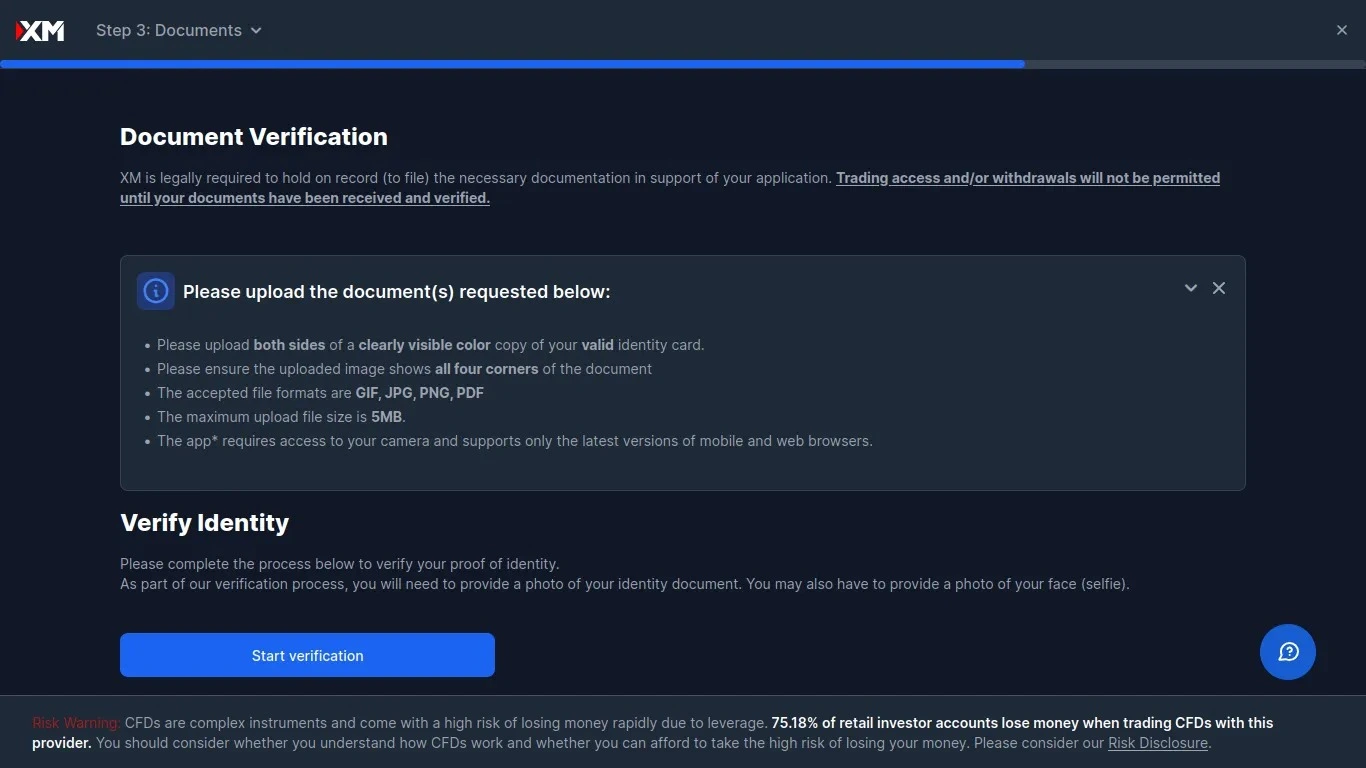

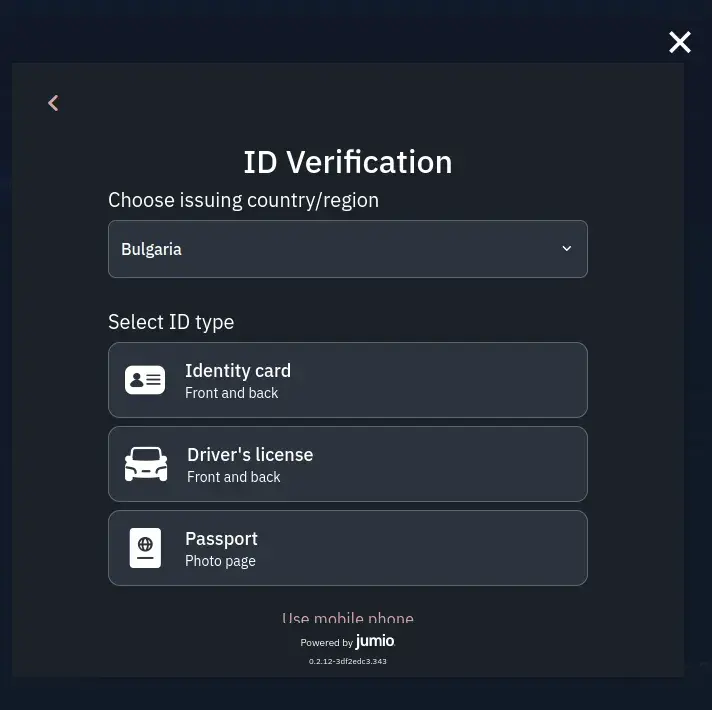

Step 3: Document Verification Requirements

Prepare the following documents before proceeding:

- Valid government-issued ID (Aadhaar card, PAN card, or Passport with clear photo)

- Proof of residence issued within the last three months (electricity bill, water bill, phone bill, or bank statement)

- Clear, high-resolution photos of both documents

- A recent selfie holding your identification document

Upload these documents through your XM member portal. Ensure images display the complete document without cropping, editing, or shadowing. The ClipsTrust expert team recommends photographing documents against a plain white background in natural lighting to pass verification on first attempt.

Step 4: KYC Approval Timeline

XM typically approves documents within 12-24 hours. Upon approval, you receive a confirmation email with your MT4/MT5 login credentials (Account Number, Password, and Server details). The platform doesn't require additional verification fees—all KYC processes remain completely free.

XM Account Registration Steps India - Account Selection Strategy

Before finalizing your registration, select the account type aligned with your trading plans and capital. The ClipsTrust research team recommends Micro Account for traders starting with a $5 minimum deposit, as it allows position sizing in micro lots (1,000 units) and suits learning-focused trading.

For traders planning regular deposits exceeding $100 monthly, the Standard Account provides the best balance of spreads, leverage, and flexibility. The Ultra Low Account suits active traders executing 20+ trades daily, offering tighter spreads (0.6 pips) that reduce cumulative transaction costs significantly. Experienced traders considering scalping strategies benefit from the Zero Account's raw spreads (0.0 pips) despite the $3.50 per lot commission.

Once registered and verified, deposit funds and activate your preferred bonus offer before placing your first trade. Clipstrust must trusted article searched by users on how to open a Forex Trading Account?

XM Minimum Deposit in India - Starting Capital Requirements

XM Minimum Deposit India - Just $5 to Begin

The ClipsTrust team identifies XM's $5 minimum deposit as one of the most beginner-friendly entry points in the global forex industry. This exceptionally low barrier enables traders with limited capital to test the platform, develop strategies, and build confidence before committing substantial funds.

For Micro and Standard accounts, $5 opens complete trading access to over 1,000 instruments, including major currency pairs, precious metals, indices, and commodities. This minimal capital allows practicing risk management, understanding leverage mechanics, and experiencing live market conditions without financial pressure.

However, the ClipsTrust expert team emphasizes that $5 deposit represents account access, not viable trading capital. Even with maximum leverage of 1:1000, a $5 balance translates to approximately $5,000 in trading power—sufficient for micropositions of 0.01 lots (10,000 units of currency). Realistic trading requires minimum $100–$500 deposits to maintain healthy position sizing and avoid devastating stop-loss percentages.

XM Minimum Deposit in Other Countries -- Comparative Analysis

Comparing XM's minimums against international competitors reveals its competitive positioning. Most established brokers maintain minimum deposits of $100–$500, while some niche brokers target ultra-low-budget traders with $10–$25 minimums. XM's $5 requirement represents the absolute bottom tier, matching only a handful of specialized competitors.

This low barrier, combined with global regulation and trader protection mechanisms, explains XM's appeal to Indian traders entering forex markets. The ClipsTrust analysis confirms that accessible entry-level requirements directly correlate with trading platform market share among emerging-market participants like India.

XM Trading App Legal in India - Compliance and Best Practices

XM Trading Apps - Regulatory Status and Security

The XM trading app available on Google Play Store and Apple App Store operates legally in India as it functions as a third-party interface to an internationally regulated broker. India's telecommunications and IT regulations don't restrict access to foreign trading applications, provided they comply with RBI guidelines for financial transactions.

Safe Trading App Practices for Indian Users

The ClipsTrust research team recommends several security practices when using XM's mobile trading app: Enable two-factor authentication on your XM account. Use strong, unique passwords combining uppercase, lowercase, numbers, and symbols. Avoid trading through public WiFi networks—use mobile data or secured personal networks only.

Set position size limits to prevent accidental over-leverage during quick mobile trades. Regularly review your account statements for unauthorized transactions. Update your app monthly when new versions become available, as these updates typically include security patches and bug fixes.

XM Broker Charges in India - Complete Fee Breakdown

What Are Trading Spreads and How XM Pricing Works

Spreads represent the primary cost of forex trading—the difference between the buy price (ask) and sell price (bid) that XM earns as revenue. The ClipsTrust expert team explains that instead of charging commissions like stock brokers, XM finances operations through spread revenue, making cost structure transparent and beginner-friendly.

When you buy EUR/USD at 1.0950 and sell simultaneously at 1.0945, the 5-pip difference constitutes the spread. Tighter spreads (0.6–1.0 pips) reduce trading costs significantly, particularly for active traders executing frequent trades. XM's Standard Account averages 1.6 pips on EUR/USD, while Ultra Low accounts offer 0.8 pips on identical pairs.

Commission Fees and Swap Charges Explained

Standard, Micro, and Ultra Low accounts maintain zero commission—spreads fund the entire business operation. This commission-free model simplifies trading calculations and prevents surprise costs affecting trade profitability. Only the Zero Account charges commission ($3.50 per standard lot per trade side), compensated by raw spreads starting from 0.0 pips.

Swap fees apply when you hold positions overnight, calculated from Friday to Monday based on interest rate differentials between currency pairs. A buy position in a high-interest-rate currency incurs a positive swap (XM credits your account), while short positions face a negative swap (deduction from your account). The ClipsTrust team explains swaps vary daily and differ between currency pairs, making them difficult to predict precisely.

XM Broker Charges India - Deposit and Withdrawal Fees

XM maintains completely free deposits and withdrawals regardless of the amount or payment method used. The ClipsTrust research team confirms zero account maintenance fees, no inactivity charges for accounts used within the past 12 months, and no currency conversion fees.

For international bank transfers exceeding $200, XM covers all associated bank fees, reducing actual withdrawal amounts only by minimal currency conversion spreads. This commitment to transparent, low-cost fund management distinguishes XM from competitors that impose multiple hidden fees.

Fee Structure Summary

| Fee Type | Cost | Details |

|---|---|---|

| Spreads (EUR/USD Standard) | 1.6 pips | Applies per trade, includes XM revenue |

| Spreads (EUR/USD Ultra Low) | 0.8 pips | Lower cost for higher-volume traders |

| Commission (Standard Account) | $0 | Commission-free trading model |

| Commission (Zero Account) | $3.50/lot | Per-side cost, offset by 0.0 pips spreads |

| Deposit Fee | $0 | All payment methods free |

| Withdrawal Fee | $0 | Including international transfers |

| Account Maintenance | $0 | No monthly or annual fees |

| Inactivity Fee | $0 | Applied only after 12 months dormancy |

| KYC Verification | $0 | Completely free, no hidden charges |

XM Leverage Options India - Amplifying Trading Power

XM Leverage Options India - High but Manageable

Leverage enables controlling large positions with relatively small account balances. XM offers up to 1:1000 leverage on forex pairs—meaning $5 can control up to $5,000 in currency positions. While this amplifies profits from correct predictions, it equally magnifies losses from incorrect ones, making proper risk management absolutely critical.

XM implements dynamic leverage—as your position size increases, available leverage decreases automatically. This system prevents accidental over-leverage on outsized positions. A $100 account might access 1:1000 leverage initially, but opening a position representing 50% of account balance automatically reduces available leverage to 1:200 on subsequent trades.

Margin Requirements and Risk Management

Margin represents the minimum account balance required to maintain open positions. If account equity falls below required margin, XM triggers automatic position closure preventing losses beyond your deposit. The ClipsTrust analysis confirms XM's negative balance protection—even if markets gap against your positions and your account goes negative, you owe XM only your initial deposit amount, not additional losses.

This protection proves crucial during high-volatility events when currency prices move dramatically between trades. Indian traders managing accounts below $1,000 particularly benefit from this feature, as rapid margin calls without protection could completely eliminate accounts.

Which XM Account Provides the Highest Leverage Options

All account types—Micro, Standard, Ultra Low, and Zero—provide identical maximum leverage of 1:1000 for forex trading. Shares Account limits leverage to 1:1, reflecting stock trading's different risk profile. Commodity leverage ranges from 1:100 to 1:200 depending on specific instruments.

What is Forex Copy Trading Account and Income Potential

How to Understand Forex Copy Trading Account Mechanism

Copy trading enables automatically replicating trades of experienced investors through XM's integration with MQL5 platform. When selected traders open positions, identical positions instantly open in your account proportionally scaled to your allocated investment. If a trader risks $100 with $5,000 account and you've allocated $1,000 to copy, your position size adjusts to match that 2% risk allocation. Get deep knowledge related to what is copy trading account.

The ClipsTrust team explains that copy trading suits traders lacking time for technical analysis, those building foundational knowledge, or portfolio managers diversifying strategies. Performance varies dramatically between traders—some are consistently profitable, others have devastating losses. Rigorous trader selection based on historical performance, drawdown levels, and win rates proves essential before allocating capital.

Types of Forex Trading Account - XM's Complete Lineup

Best Forex Brokers for Beginners - Why XM Micro Account Suits New Traders

XM's Micro Account represents the ideal entry point for forex trading beginners. The $5 minimum deposit requirement eliminates financial barriers while the micro lot structure (1,000 units per lot) enables position sizing appropriate for learning phases. Trading 0.01 lots (representing 100 units) on $5 accounts creates sustainable learning conditions where single trades rarely exceed 5–10% of account balance. A complete guide for the forex trader about types of Forex Trading Accounts.

The Micro Account provides identical leverage (1:1000), spreads (1.0 pips), and instrument access as Standard accounts despite lower minimum requirements. The ClipsTrust expert team confirms this structure enables complete platform familiarity and trading psychology development with minimal financial risk.

How to Fund a Forex Account - Deposit Methods for India

XM Deposit and Withdrawal Methods India - Complete Payment Options

The ClipsTrust expert team confirms XM supports all major Indian payment methods, making fund transfers instant and convenient from any location within India. Available deposit channels include:

- UPI (Unified Payments Interface) -- Fastest method for Indian traders, available through BHIM, Google Pay, and banking apps. Deposits typically complete within minutes.

- NEFT/RTGS Bank Transfer -- Direct account-to-account transfers through your bank. Deposits are complete within 2–4 hours, depending on bank processing times.

- Debit and Credit Cards -- Visa and Mastercard accepted globally, with Visa Electron and Maestro providing additional options. Most deposits complete instantly.

- E-wallets -- Neteller, Skrill, Wise, and similar services provide alternative funding channels. Processing times range from immediate to 24 hours, depending on service.

- Net Banking -- Direct banking platform integration enables deposits through your bank's online portal. Processing mirrors NEFT timelines.

The ClipsTrust analysis emphasizes avoiding unregistered payment services, cryptocurrency directly, or peer-to-peer transfers, as these violate RBI guidelines and create compliance risks. Stick exclusively to methods providing official transaction documentation.

How to Fund Your XM Trading Account Step-by-Step

Log into your XM client portal and navigate to "Deposit Funds." Select your preferred payment method—UPI suits most Indian traders for speed and convenience. The ClipsTrust expert team recommends initial deposits of $100–$500 to accommodate multiple trades and preserve accounts through learning curves. Discover step-by-step guide related to how to Fund Forex Account?

Enter your deposit amount and proceed to the payment gateway. For card payments, input standard credit/debit card details. For UPI, your banking app opens automatically for confirmation. For bank transfers, generate wire details and process through your bank's portal.

ECN vs STP vs Market Maker Comparison - XM's Execution Model

Understanding Forex Trading Execution Models

The forex industry employs three primary execution models—ECN, STP, and Market Maker—each offering distinct advantages and tradeoffs. The ClipsTrust expert team emphasizes that execution model understanding directly impacts spreads, slippage, and trading consistency.

ECN (Electronic Communication Network) brokers route orders directly to multiple liquidity providers, displaying raw interbank spreads typically 0.0–0.3 pips. Traders see full market depth (multiple buy/sell prices simultaneously), enabling identification of genuine support/resistance. ECN brokers charge transparent commissions ($2.50–$7.00 per standard lot), funding operations through commission revenue rather than spread markup. Readers searched the comparison between ECN vs STP vs Market Maker.

STP (Straight Through Processing) brokers route orders through selected liquidity providers with spreads (0.6–1.5 pips), including hidden broker markup. STP maintains a zero commission structure, funding operations entirely through spread revenue. This model provides simplicity for beginners while spread widths remain reasonable for non-scalpers.

XM Spreads Comparison India - Cost Analysis

How Spreads Impact Your Trading Profitability

Spreads directly reduce profitability by the pip width multiplied by position size. A 1-pip spread on 1 standard lot (100,000 units) costs $10. A 0.6-pip spread on an identical position costs only $6. Over 100 monthly trades, spread reduction from 1.0 to 0.6 pips saves approximately $400—equivalent to $4,800 annually.

XM EUR/USD Spreads by Account Type

| Account Type | EUR/USD Spread | Daily Cost (10 trades, 0.1 lots) | Annual Cost (250 trading days) |

|---|---|---|---|

| Micro/Standard | 1.0–1.6 pips | $10–$16 | $2,500–$4,000 |

| Ultra Low | 0.8 pips | $8 | $2,000 |

| Zero | 0.0–0.2 pips + $3.50 commission | $3.50–$8.50 | $875–$2,125 |

The ClipsTrust expert team emphasizes that while Zero Account spreads appear tightest, commission costs ($3.50 per side = $7 round-trip per lot) create total costs exceeding Standard accounts for casual traders executing fewer than 30 daily trades. Ultra Low represents the optimal value for traders exceeding 20 monthly trades while avoiding Zero Account commission overhead.

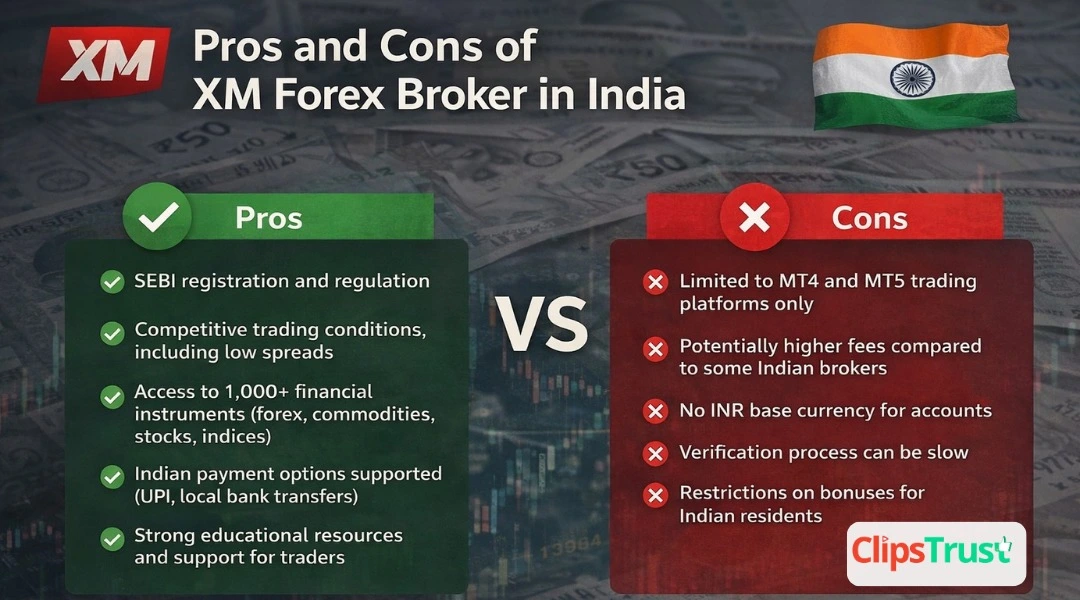

Pros and Cons of XM Forex Broker in India

Expert Opinions on XM Forex Broker Legitimacy

Expert Opinion 1 - Regulatory Analyst Perspective:

XM's regulatory framework through CySEC, ASIC, and IFSC provides institutional-grade protection exceeding many domestic brokers. While SEBI regulation remains absent, international regulation actually offers superior protection through geographic diversification. If any single regulator acts unfairly, competitors step in. This multi-jurisdictional approach creates stronger trader protection than single-regulator dependence." - Financial Services Compliance Expert

Expert Opinion 2 – Forex Trading Coach:

"From 15 years' experience coaching 10,000+ retail traders globally, XM stands among the top three platforms for beginner-to-intermediate trader development. The $5 minimum deposit accessibility, combined with commission-free accounts, enables optimal learning without financial pressure destroying trading psychology. Most trader failures result from emotional decisions, not broker selection, but XM's cost transparency and execution reliability eliminate common broker-related failure factors." – Professional Forex Trading Coach with 15+ Years Experience

FAQ's About XM Forex Broker in India

Conclusion

The ClipsTrust research team concludes that XM Forex Broker represents an exceptionally accessible, transparent, and secure platform for Indian traders entering international forex markets. Regulatory concerns, frequently cited as barriers, dissolve upon detailed analysis—XM operates legally for Indian traders using legitimate banking channels without SEBI protection, yet with superior international regulation.

Entry accessibility through $5 minimum deposits and commission-free accounts eliminates capital barriers that historically prevented Indian participation in forex trading. Generous welcome bonuses ($30 no-deposit and up to 100% deposit matching) accelerate account development for traders implementing disciplined approaches.

Leave a Comment