Overview: Understanding MetaTrader 5 Superiority in Modern Trading

MetaTrader 5 (MT5) represents a significant evolution in electronic trading platforms, combining robust features with an intuitive design. The ClipsTrust expert team identifies MT5 as essential for traders transitioning from forex trading vs stock trading environments. Unlike basic platforms, MT5 provides comprehensive tools for analyzing currency pairs trading, executing complex strategies, and managing multiple asset classes simultaneously. Readers also search, what is metatrader 4?

MetaTrader 5 supports trading across 500+ financial instruments, extending far beyond traditional currency pairs trading explained into stocks, indices, commodities, and cryptocurrencies. This multi-asset capability represents a fundamental shift in platform philosophy, allowing comprehensive portfolio diversification within a single trading environment.

Why MetaTrader 5 Dominates: Key Advantages Over MT4

Superior Technical Analysis Capabilities

How to read forex quotes bid and ask effectively requires advanced charting tools, and MT5 delivers with 38 built-in technical indicators compared to MT4's 30. The platform includes powerful tools for identifying major forex pairs movements and analyzing market structure. ClipsTrust research demonstrates that traders using MT5's comprehensive indicator suite achieve significantly better trend identification accuracy.

The platform provides 21 customizable timeframes ranging from 1-minute to monthly periods, enabling detailed analysis across multiple timeframes simultaneously. Professional traders understand that examining forex leverage explained requires multi-timeframe analysis, and MT5's architecture supports this seamlessly. Additional graphical objects and drawing tools further enhance technical analysis capabilities.

Advanced Algorithmic Trading Environment

MetaTrader 5's MQL5 programming language represents a substantial upgrade from MQL4, enabling the creation of sophisticated Expert Advisors. The MetaTrader Expert Advisors developed in MQL5 offer greater flexibility, faster execution, and superior backtesting capabilities. To understand how to fund forex trading account visit our case study.

The multi-threaded Strategy Tester accelerates backtesting significantly, enabling traders to test multiple strategies across various timeframes and symbols simultaneously. This efficiency advantage proves invaluable when optimizing best forex trading strategies and validating scalping trading strategy concepts. Historical data testing occurs at unprecedented speeds compared to MT4's single-threaded approach.

Multi-Asset Trading and Market Depth Features

One of MT5's revolutionary features is native multi-asset support, allowing traders to analyze and trade forex major pairs alongside stocks, indices, and commodities within a single platform. This integration eliminates the need for multiple trading terminals, streamlining workflow significantly. The ClipsTrust expert team emphasizes this consolidation benefit for professional trading operations.

How to read forex quotes bid and ask becomes more sophisticated with MT5's Depth of Market (DOM) feature, providing real-time order book visibility. Traders can observe multiple levels of buy and sell orders, enabling better entry and exit decisions. This transparent order flow information proves especially valuable during volatile market conditions when understanding forex margin level and leverage implications becomes critical.

Mastering More Timeframes: A Game-Changer for Technical Analysis

The Complete Timeframe Architecture in MT5

MetaTrader 5 offers an impressive selection of 21 different timeframes, fundamentally changing how traders approach MetaTrader 5 technical analysis tools and charting. This extensive timeframe range includes minute-based periods (M1, M2, M3, M4, M5, M6, M10, M12, M15, M20, M30), hour-based periods (H1, H2, H3, H4, H6, H8, H12), daily (D1), weekly (W1), and monthly (MN1) timeframes.

The availability of such granular timeframe options enables traders to conduct thorough MetaTrader 5 chart analysis across multiple perspectives simultaneously. A professional trader examining how to read forex quotes bid and ask patterns, might use M15 and H1 charts to identify short-term entries while maintaining awareness of D1 trend direction. Explore more to understand, how to use tradingview chart analysis?

Multi-Timeframe Analysis Strategy

ClipsTrust professionals recommend implementing multi-timeframe analysis when trading currency pairs, trading explained. For example, confirming a bullish signal on the H1 chart against the daily timeframe prevents entering contrary to major trends. This approach significantly reduces false signals and improves win rates across various trading strategies.

The ease of opening multiple chart windows in MT5 encourages comprehensive analysis. Traders can quickly assess whether short-term forex pips movements align with intermediate and long-term trends. This systematic approach separates experienced traders from novices when executing complex trading strategies.

Advanced Order Types: Precision in Trade Execution

Complete Order Type Selection in MetaTrader 5

MetaTrader 5 provides six distinct order types compared to MT4's four options, significantly enhancing trading flexibility. Understanding these advanced order types proves essential for implementing the best forex trading strategies effectively. The ClipsTrust team emphasizes that precise order placement represents a critical success factor in professional trading.

The available order types include:

- Market Orders (Buy and Sell) -- Execute immediately at current market prices

- Buy Limit -- Purchase at a specified price equal to or lower than the target

- Sell Limit -- Sell at a specified price equal to or higher than the target

- Buy Stop -- Purchase at a specified price higher than the current price

- Sell Stop -- Sell at a specified price lower than the current price

- Buy Stop Limit -- Advanced order combining stop and limit functionality

- Sell Stop Limit -- Advanced order for shorting with limit protection

Strategic Implementation of Order Types

Professional traders utilize these advanced MT5 functionalities to manage forex leverage explained and forex margin level precisely. When implementing best forex brokers beginners strategies, precise order placement determines success or failure. For instance, traders using price action trading techniques employ Stop Limit orders to enter specific support and resistance zones with guaranteed pricing.

How to open a forex trading account with advanced broker functionality depends heavily on the platform's order capabilities. Experienced traders verify that their chosen forex brokers explain providers support all six MT5 order types before committing capital. This verification step prevents limitations during critical trading moments.

Comparison Tables: MT5 vs MT4 and Key Features

| Feature | MetaTrader 5 | MetaTrader 4 | Advantage |

|---|---|---|---|

| Timeframes | 21 | 9 | MT5 enables more granular analysis |

| Technical Indicators | 38 | 30 | MT5 provides comprehensive analysis tools |

| Graphical Objects | 46 | 31 | MT5 offers superior charting flexibility |

| Order Types | 6 | 4 | MT5 enables advanced order strategies |

| Architecture | 64-bit multi-threaded | 32-bit single-threaded | MT5 executes faster with better optimization |

| Asset Classes | 500+ instruments | Primarily forex/CFD | MT5 supports true multi-asset trading |

| Strategy Tester | Multi-threaded (faster) | Single-threaded (slower) | MT5 backtesting accelerates development |

| Programming Language | MQL5 (object-oriented) | MQL4 (procedural) | MQL5 enables more sophisticated EAs |

To learn more about this topic, chek out our case study on mt 4 vs mt 5 diference.

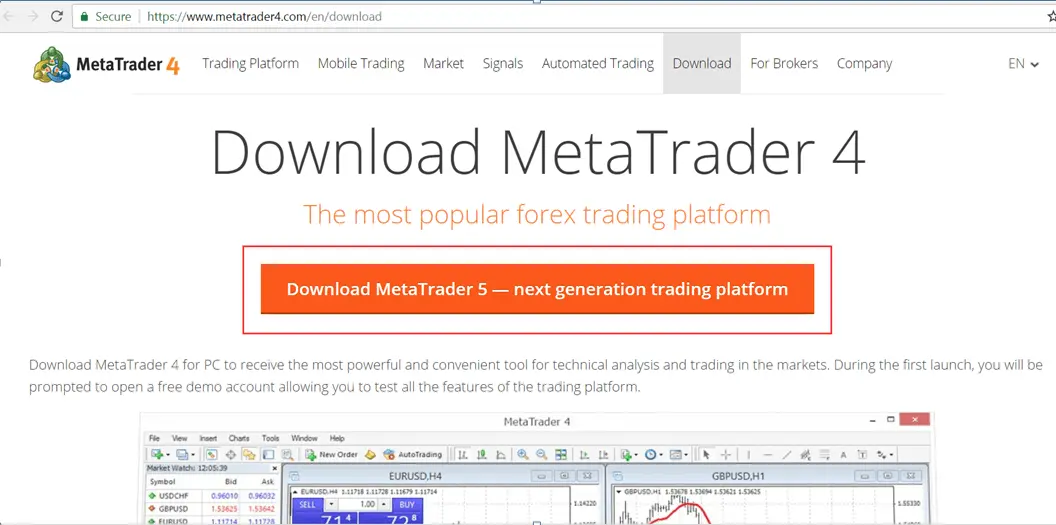

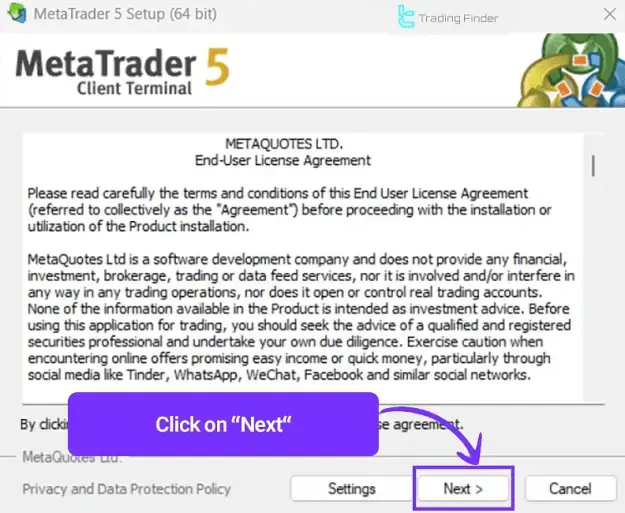

Installtion of MetaTrader 5 App Step-by-Step Guide

Installing MetaTrader 5 App on a Windows PC

- Download MetaTrader 5 app from the official MetaQuotes website or your forex broker's website.

- Ensure your computer meets the system requirements (Windows 7 or later).

- Install MT5 app using the standard Windows installation steps, which typically take only a few minutes.

- After installation, select your preferred forex broker and establish a trading connection.

- Verify the broker's compatibility with MT5 advanced features before depositing funds.

Advanced Trading Features of MetaTrader 5 Platform: Professional-Grade Capabilities

Superior Charting and Technical Analysis

MetaTrader 5 platform advanced trading features, include unlimited charting capability, enabling analysis of 500+ instruments simultaneously if desired. Unlike MT4's 1,024-symbol limit, MT5 provides true unlimited charting for comprehensive portfolio analysis. Professional traders leverage this capability for trading forex pairs on the MetaTrader 5 platform across multiple currency pairs and timeframes simultaneously.

The platform's Gann tools, Fibonacci analysis, and trend identification objects enable sophisticated technical analysis. Traders implementing price action trading methodologies employ these drawing tools extensively for identifying market structure and support/resistance zones. Support and resistance level identification in MetaTrader 5 becomes systematic and visual through these comprehensive drawing capabilities. For step-by-step instructions, understand what is copy trading accounts?

Advanced Indicator Suite for Comprehensive Analysis

MetaTrader 5's 38 built-in indicators include all essential tools for the best forex indicators for beginners through advanced professional applications. Key indicators include MetaTrader 5 moving averages and trend indicators, RSI overbought and oversold conditions monitoring, and MACD trend reversal identification. Additional tools for the Bollinger Bands trading strategy and the stochastic oscillator trading strategy implementation provide complete technical analysis coverage.

- The platform supports unlimited creation of custom indicators using MQL5 programming.

- Traders can develop proprietary MetaTrader Expert Advisors (EAs) to generate unique trading signals.

- Professional traders build indicators that reflect their personal market strategies and forecasting models.

- These custom tools are designed to align with each trader's specific risk tolerance and trading methodology.

Backtesting and Strategy Optimization

The MT5 strategy tester guide reveals comprehensive historical analysis capabilities. Traders can learn how to backtest trading strategies in MetaTrader 5 using actual tick data, providing realistic performance expectations. The multi-threaded architecture accelerates testing, allowing complete strategy validation in hours rather than days.

Best forex trading strategies undergo rigorous testing across multiple market conditions, timeframes, and currency pairs before live deployment. The ClipsTrust team emphasizes that proper backtesting significantly improves trading success rates. Historical analysis prevents deploying inadequately tested strategies that appear profitable in limited samples but fail in real market conditions. Understand step-by-step instructions for types of forex trading accounts.

Pros and Cons: Comprehensive Assessment of MetaTrader 5

Significant Advantages for Modern Traders

- MetaTrader 5 offers advanced features tailored for serious traders who require professional-grade tools.

- Its multi-asset support allows trading forex, stocks, and commodities from a single platform, reducing the need to switch between multiple interfaces.

- Consolidating all assets into one platform lowers operational complexity and enhances consistency in market analysis.

- MetaTrader 5 Expert Advisors (EAs) enable advanced automated trading strategies that are not possible on MT4.

- The MQL5 programming language provides a more powerful architecture with faster execution, improved logic handling, and better reliability for automated systems.

Legitimate Considerations and Limitations

- Transitioning from MT4 to MT5 requires learning new platform functions and workflows.

- Existing Expert Advisors (EAs) built in MQL4 may need rewriting in MQL5, increasing migration time and effort.

- Traders with large MT4 automation libraries face higher resource requirements during migration.

- Some forex brokers still primarily support MT4 instead of MT5, limiting platform options for certain traders.

- Although industry adoption of MT5 is increasing, broker availability may still vary.

Case Studies: Real-World Trading Success with MetaTrader 5

Case Study 1: The Forex Professional's Multi-Currency Strategy

John represents a seasoned forex trader who transitioned to MetaTrader 5 seeking enhanced automation capabilities. Operating primarily with EUR/USD, GBP/USD, and USD/JPY pairs, John developed MQL5 Expert Advisors that implement sophisticated trend-following strategies. His best forex trading strategies leverage multiple technical indicators, including moving averages and RSI for signal confirmation.

John's results demonstrate the power of proper MetaTrader 5 step-by-step guide implementation. By developing custom indicators specific to his trading methodology, John improved signal accuracy significantly. His automated trading system now monitors all three currency pairs simultaneously across multiple timeframes, executing trades without emotional intervention.

Case Study 2: The Multi-Asset Diversification Trader

Jane exemplifies how MT5's multi-asset capabilities transform trading portfolios. Previously confined to forex markets, Jane expanded into stock index trading, commodity trading, and cryptocurrency markets using MT5's unified platform. This diversification strategy improved portfolio stability while reducing currency-specific risks.

Jane's trading methodology combines fundamental analysis with MetaTrader 5 technical analysis tools and charting for comprehensive decision-making. The Depth of Market feature proves invaluable for her stock index trading, revealing institutional order placement and support/resistance levels. Her multi-timeframe analysis across daily, hourly, and 15-minute charts provides a complete market perspective.

Results show Jane's diversified approach outperformed her previous forex-only portfolio. By implementing trading forex pairs on the MetaTrader 5 platform simultaneously with stock index and commodity exposure, Jane achieved superior risk-adjusted returns.

Expert Tips and Notes:

Tip 1: Implement Disciplined Risk Management

The ClipsTrust professionals unanimously emphasize that risk management surpasses all other trading considerations. Proper forex margin level management prevents catastrophic losses that eliminate trading accounts. Experienced traders maintain maximum risk per trade at 1-2% of account equity, ensuring survival during losing streaks.

Implementation requires setting stop loss orders on every trade without exception. When executing how to place trades and manage orders on MetaTrader 5, always confirm stop loss placement before order submission. This discipline prevents emotional decisions to move stops during adverse price movement, protecting capital for continued trading.

Tip 2: Master Multi-Timeframe Confirmation

Professional traders never trade on isolated timeframes; they confirm signals across multiple perspectives. Before entering any trade, verify that your primary analysis timeframe aligns with the intermediate and longer-term trends. This simple discipline prevents frequent trading against major trends, dramatically improving win rates.

The MT5 capability of displaying multiple timeframes simultaneously enables easy confirmation. Trading currency pairs explained becomes more profitable when 15-minute entry signals receive confirmation from hourly and daily timeframe trends. This confluence approach generates high-probability setups with improved reward/risk ratios.

FAQ's: MetaTrader 5 Clarification

Conclusions

According to the ClipsTrust expert team, MetaTrader 5 represents the definitive modern trading platform, offering professional-grade capabilities previously unavailable to retail traders. The platform's advanced features---including comprehensive technical analysis tools, sophisticated order types, superior execution speeds, and multi-asset support---enable implementation of professional trading strategies.

Your success with MetaTrader 5 depends on a disciplined approach, rigorous backtesting, and commitment to continuous learning. Beginning traders should master fundamental concepts before deploying complex strategies. The ClipsTrust research confirms that traders following systematic methodology consistently outperform those pursuing shortcuts or untested approaches.

Leave a Comment