Tag Markets - Global Online Forex & CFD Trading Platform

ClipsTrust research identifies Tag Markets as a growing multi-asset brokerage platform offering forex, CFD, and cryptocurrency trading under the oversight of the Financial Services Commission of Mauritius. As the global e-brokerage industry expands—from $11.57B in 2026 to a projected $18.50B by 2034—Tag Markets meets rising demand for diversified assets, technology, and regulatory compliance. The CFD market alone is set to grow from $2.93B in 2024 to $4.93B by 2032, driven by retail participation and mobile trading. Tag Markets differentiates itself through platforms like MT5, cTrader, and DXTrade, competitive spreads from 1.0 pip, low minimum deposits of $10, and crypto-based funding for instant account access.

Tag Markets of Business Information

| # | Field | Details |

|---|

| 1 | Business Name | Tag Markets |

| 2 | Category | Online Forex & CFD Trading Broker |

| 3 | Industry Focus | Multi-Asset Trading, Brokerage, Market Access |

| 4 | Website | https://www.tagmarkets.com/ |

| 5 | Phone Number | (+44) 755 748 8836, +91 86677 93224 |

| 6 | Email | help@tagmarkets.com |

| 7 | Business Hours | 24/5 Trading Access |

| 8 | Operating Entity | T.M. Financials Ltd |

| 9 | Registration | Mauritius, Company Number C185265 |

| 10 | Regulation | Financial Services Commission (FSC) Mauritius, License GB21026474 |

| 11 | Registered Address | C/o Alexander Management Services Limited, 3 Emerald Park, Trianon, Quatres Bornes, 72257, Republic of Mauritius |

Revenue Model of Tag Markets

Tag Markets generates revenue through diversified brokerage-based streams including forex and CFD trading, spreads and commission models, liquidity partnerships, referral programs, and copy trading services. The platform operates multiple account types—such as Zero and Pro—allowing it to monetize through spreads alone or spreads plus commission. Liquidity aggregation from Tier-1 banks and non-bank LPs enables competitive pricing and supports over 35 forex pairs and 200+ CFDs. Additional channels include its Introducing Broker program, the Tag Copyx copy trading ecosystem with profit-sharing incentives, and the Amplify leveraged capital product, which increases trading volume efficiency under defined risk parameters. Revenue is further supported by institutional trading access, retail account offerings, and Islamic swap-free options that expand market reach.

- Core Trading Revenue:

Earned through spreads on forex & CFD instruments and commissions on specific account types.

- Liquidity Infrastructure:

Aggregates pricing from Tier-1 banks & non-bank LPs to maintain competitive spreads and execution quality. - Asset Coverage:

Access to 35+ forex pairs and 200+ CFDs (commodities, indices, equities, crypto). - Introducing Broker (IB) Program:

Generates revenue via partner commissions tied to trading volume, expanding distribution and client acquisition. - Copy Trading (Tag Copyx):

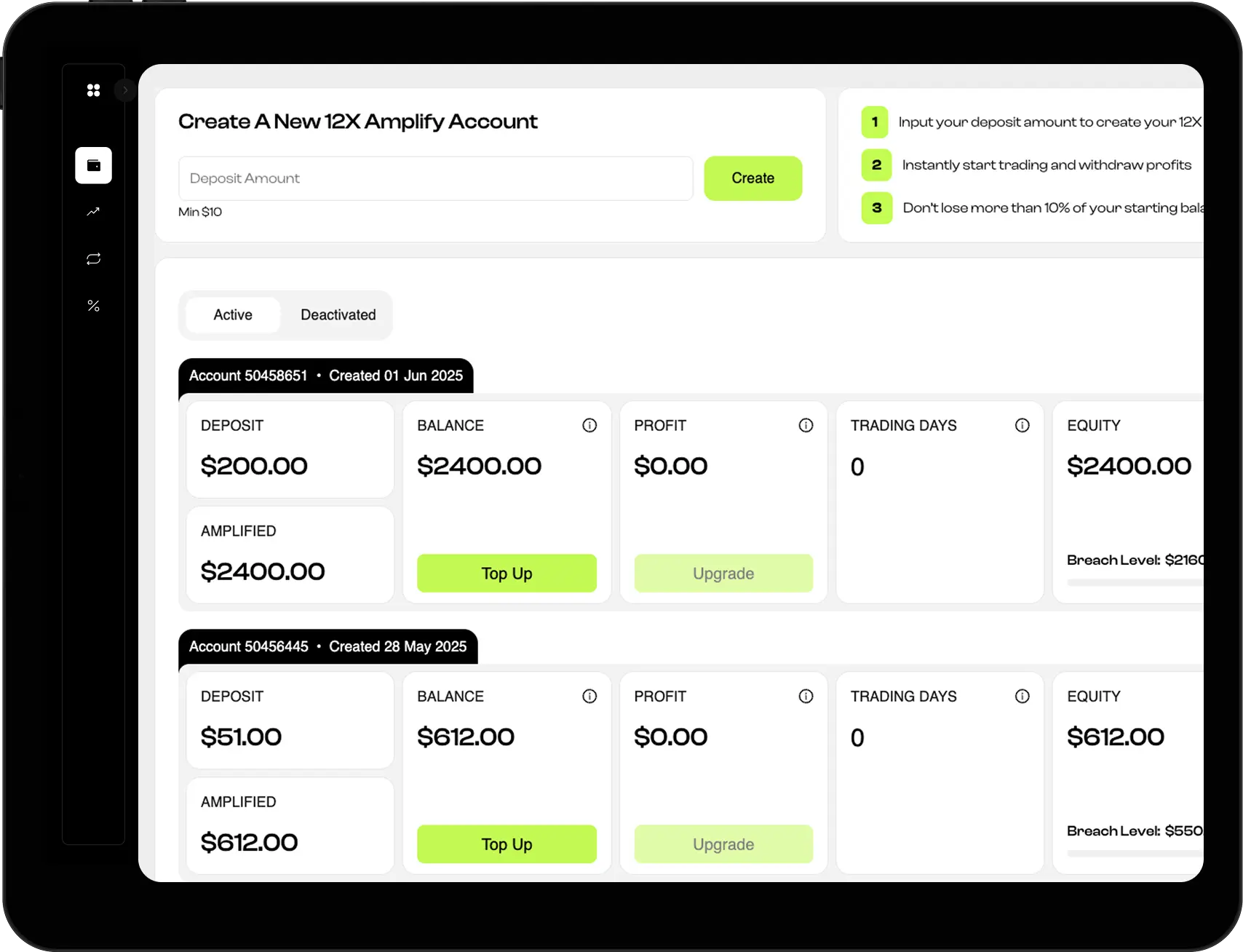

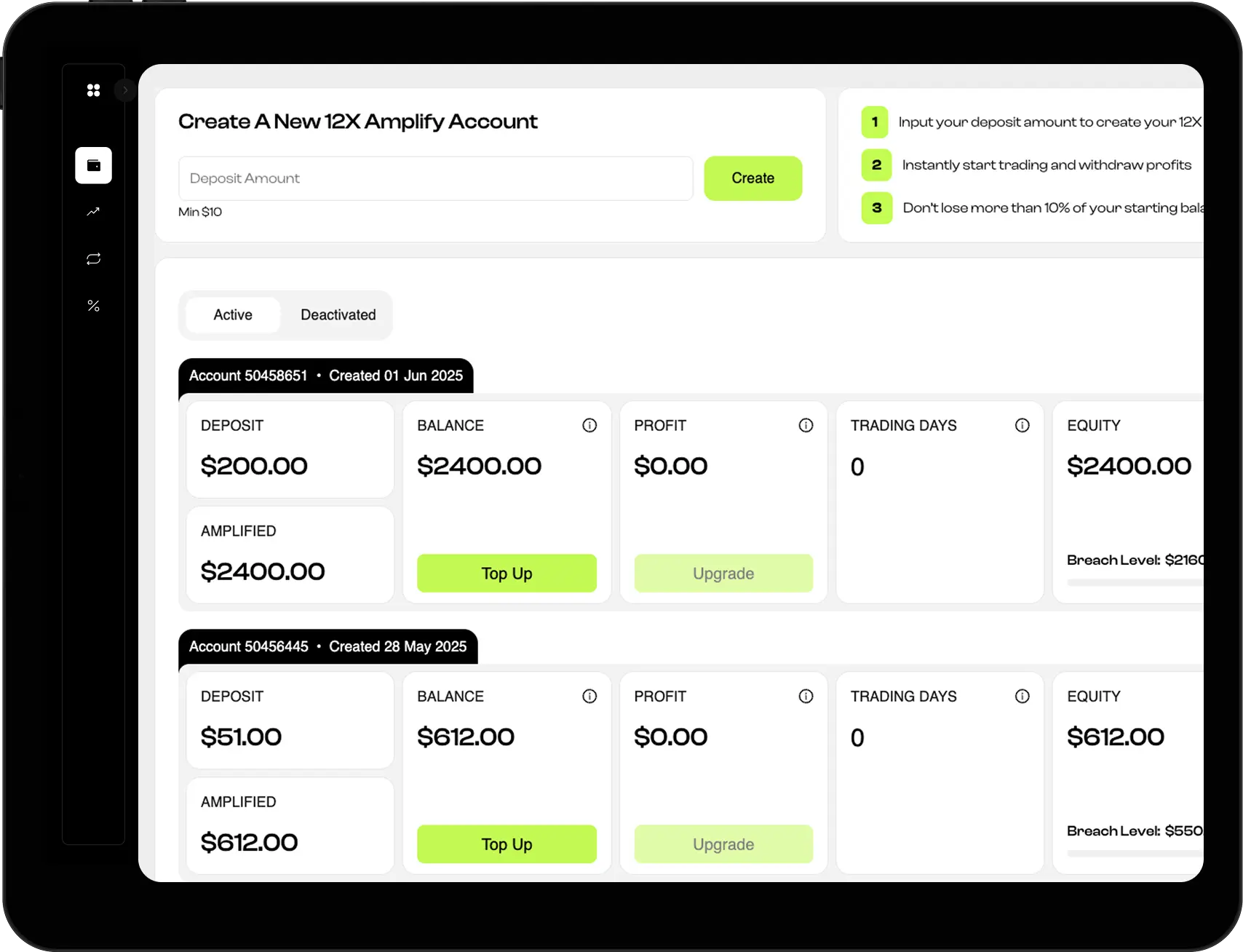

30% profit commission from strategy providers; ecosystem includes 1,000+ strategies and 22,000+ participants. - Amplify Account:

Leverages capital 12× with drawdown limits; monetizes via spreads & commissions on amplified trading volumes. - Client Segments:

Supports both institutional and retail traders. - Sharia Compliance:

Islamic swap-free accounts broaden market accessibility.

How to Log In to Tag Markets

Logging into Tag Markets is a quick and simple process designed for beginner and retail traders. Users can access their trading accounts directly through the official website using secure login credentials. The platform supports both web and mobile access, making it convenient for traders to explore features such as copy trading, market analysis, and multi-asset trading tools. For added security, optional two-factor authentication (2FA) can be enabled during login.

- Visit the Official Website

Open a browser and go to the official Tag Markets trading portal. - Click on the “Login” Button

Locate the login button on the top right corner of the homepage. - Enter Your Registered Email

Use the email address linked to your Tag Markets account. - Type Your Password Securely

Enter your password accurately; note that it is case-sensitive. - Click “Sign In” to Access Dashboard

Once submitted, you will be redirected to your main trading dashboard. - Enable 2FA (If Applicable)

Complete two-factor authentication if activated for enhanced security. - Start Trading via Web or Mobile

After login, access trading tools, copy trading features, and markets instantly.

Tag Markets Minimum Deposit & Withdrawal Policy

Tag Markets offers a beginner-friendly minimum deposit and withdrawal policy that enables traders to start with flexible capital requirements. The platform supports multiple funding and withdrawal options, making it convenient for users across different regions. Verification procedures and processing times may vary depending on regulatory compliance and payment method. This system ensures smooth fund management for retail traders while maintaining transparency and financial safety standards.

- Minimum Deposit Requirement

Tag Markets allows traders to begin with a low entry barrier, making it suitable for beginners. - Flexible Funding Options

Supports various payment channels including online transfers, e-wallets, and digital payment systems (depending on location). - Low-Capital Trader Friendly

Minimum deposit format helps users start trading with smaller capital, reducing financial risk. - Fast & Simple Withdrawal Process

Withdrawal requests can be submitted directly through the trading dashboard with a streamlined flow. - Verification May Be Required

For compliance and safety, KYC verification may be required depending on withdrawal amount and jurisdiction. - Processing Time Varies by Method

Withdrawal speed depends on banking systems, payment choice, and region. - Transparent Policy for Retail Traders

Clear rules ensure smooth fund movement, reducing confusion for new traders.

Products & Services by Tag Markets

Tag Markets provides a multi-asset brokerage infrastructure offering global trading across forex, CFDs, and cryptocurrencies through platforms including MetaTrader 5, cTrader, and DXTrade. Its execution architecture supports algorithmic and manual traders through FIX API connectivity, liquidity aggregation, and market execution models that allow both positive and negative slippage. The broker offers over 250 instruments across seven asset classes, alongside multiple account configurations such as Zero, Pro, Islamic, Amplify 12X, and Bonus accounts designed for different trading styles and capital requirements. Tag Copyx enables social and copy trading with performance metrics, real-time trade replication, and profit-sharing incentives between strategy providers and followers.

1. Multi-Platform Trading Infrastructure

- Supports MT5, cTrader, DXTrade

- MT5: algorithmic trading, strategy testing, EAs (MQL5), expanded order types

- cTrader: manual execution focus, DoM visibility, ladder trading, C# automation

- DXTrade: web/mobile cross-device workflow for multi-asset trading

- FIX API connectivity + market execution with slippage dynamics

2. Multi-Asset Market Access

- 250+ instruments across seven asset classes

- Forex: 35–40+ currency pairs, spreads from 1.0 pip, leverage up to 1:500

- CFDs: indices, stocks, commodities, metals, energies, agricultural products

- Crypto CFDs: synthetic exposure to BTC, ETH, etc., 24/7 trading, long/short capability

3. Account Structures & Funding Models

- Zero Accounts: spread-based, no commissions, low deposit ($10–$50)

- Pro Accounts: raw spreads (0.0 pips) + fixed commissions per lot

- Islamic Accounts: swap-free, Sharia compliant

- Amplify 12X: capital funding x12 with 10% drawdown rule & profit withdrawal conditions

- Bonus Accounts: up to 100% deposit bonus, $10k max, leverage 1:500

4. Copy Trading (Tag Copyx)

- 1,000+ strategies with historical metrics (returns, drawdown, frequency)

- Followers can diversify across strategies and adjust exposure (1x–10x multipliers)

- Real-time replication via MT5

- Providers earn 30% profit share + 5% commission rebates

- $10 minimum participation threshold

5. Risk Management & Execution Tools

- Stop loss / Take profit automation

- Trailing stop server-side execution

- Margin & Stop Out thresholds (typically 20–50%)

- Negative balance protection limits losses during normal market conditions

6. Client Support & Compliance

- Support: 24/5 via email, live chat, UK & India phone lines

- Compliance: KYC/AML verification, World Check screening, document-based onboarding

- Education: platform tutorials, webinars, risk & strategy guidance

Why Traders Choose Tag Markets

Choosing a forex and CFD broker directly impacts trading costs, execution quality, and platform security, and Tag Markets positions itself as an attractive option through low-barrier market access, diverse execution platforms, STP liquidity routing, copy trading, and capital efficiency products. With minimum deposits starting at $10 and instant crypto funding options, the platform reduces entry friction while supporting multiple trading styles through MT5, cTrader, and DXTrade. Its STP execution model and liquidity aggregation provide competitive pricing without dealing-desk conflict, while Tag Copyx enables transparent performance-based copy trading.

1. Low-Barrier Market Access

- Minimum deposits from $10

- Crypto funding via BTC, ETH, USDT, USDC up to $500,000/transaction

- Instant funding & 24/7 processing without banking delays

- Reduces evaluation risk for new traders

2. Platform & Execution Infrastructure

- Multi-platform: MT5, cTrader, DXTrade

- Supports algorithmic and manual trading

- FIX API connectivity + multi-provider liquidity

- STP execution model eliminates dealing-desk conflict

- Aggregated pricing improves spreads during volatility

3. Copy Trading (Tag Copyx)

- Helps new traders overcome knowledge/time barriers

- Transparent performance metrics: returns, drawdown, frequency

- Followers customize risk via 1x–10x multipliers

- Enables strategy diversification through multiple providers

4. Capital Efficiency via Amplify 12X

- 12× leverage on deposited capital

- Single risk rule: 10% drawdown limit

- No complex proprietary trading restrictions

- Profit withdrawals tied to volume requirements

- Functions similar to funded institutional-style programs

5. Regulation & Fund Security

- Licensed by FSC Mauritius

- Investment Dealer license GB21026474

- Segregated client funds + periodic audits

- KYC/AML compliant onboarding

- Transparent spreads, commissions & withdrawal timelines

6. Multi-Asset Diversification

- 250+ instruments across 7 asset classes

- Supports hedging & correlated market strategies

- Unified margin enables more efficient capital use

- Single account access simplifies portfolio management

Tag Markets vs Other Online Brokers

| # | Feature | Tag Markets | Traditional Forex Brokers | Discount Brokers | CFD Specialists |

|---|

| 1 | Minimum Deposit | $10 USD? | $500–1,000 typical | $0–100? | $100–500? |

| 2 | Platform Options | MT5, cTrader, DXTrade? | Primarily MT4/MT5 | Proprietary platforms? | MT4/MT5, proprietary? |

| 3 | Asset Classes | Forex, CFDs, Crypto, Indices, Commodities, Metals, Stocks | Primarily Forex? | Stocks, ETFs, limited Forex? | Forex, CFDs, limited crypto? |

| 4 | Maximum Leverage | Up to 1:500 | 1:30–1:500 (jurisdiction-dependent) | 1:50 typical? | 1:200–1:500? |

| 5 | Copy Trading | Yes (Tag Copyx)? | Limited availability? | Rare? | Growing adoption? |

| 6 | Funding Methods | Crypto, Cards, Wire, e-Wallets? | Wire, Cards primarily? | ACH, Wire, Cards? | Wire, Cards, limited crypto? |

| 7 | Withdrawal Speed | 1 working day typical? | 2–5 business days? | 1–3 business days? | 2–7 business days? |

| 8 | Amplify / Funded Accounts | 12X capital multiplier? | Not standard? | Not available? | Rare feature? |

| 9 | Regulatory Framework | FSC Mauritius? | FCA, ASIC, CFTC, CySEC | SEC, FINRA (US)? | Multiple tier-1 regulators? |

| 10 | EUR/USD Spread | From 1.0 pip? | 0.6–1.5 pips typical | 1.0–2.0 pips? | 0.0–1.0 pips? |

| 11 | Commission Structure | Account-dependent (Zero: $0, Pro: per-lot) | Variable by account type | Mostly zero? | Fixed per lot or spread-only? |

| 12 | 24/7 Market Access | 24/5 (Crypto 24/7)? | 24/5 forex hours? | Stock market hours only? | 24/5 with extended crypto? |

| 13 | Mobile Trading | Yes (all platforms)? | Standard feature | Strong mobile focus? | Standard availability? |

| 14 | Educational Resources | Platform tutorials, webinars | Comprehensive (major brokers)? | Basic to moderate? | Moderate to comprehensive? |

| 15 | Account Types | 5 specialized configurations? | 2–3 standard types | 1–2 types? | 3–4 types? |

How Tag Markets Solves Trading & Market Challenges

The forex and CFD trading industry faces structural challenges related to market access, execution reliability, platform usability, diversification complexity, and regulatory friction, and Tag Markets seeks to mitigate these through its product architecture and operational infrastructure. By offering leverage up to 1:500, minimum deposits starting at $10, and instant crypto funding, the platform reduces regulatory and capital barriers that limit market participation. Its STP execution model and multi-liquidity provider routing enhance execution quality while avoiding dealing-desk conflicts, with platform redundancy across MT5, cTrader, and DXTrade improving reliability.

1. Market Access & Capital Barriers

- FSC Mauritius regulation enables 1:500 leverage where domestic markets restrict access.

- $10 minimum deposit removes entry barriers vs. $500–$1,000 industry norms.

- Crypto funding mitigates wire fees ($25–$50) and reduces 3–5 day delays to instant transfers.

2. Execution Reliability & Slippage Mitigation

- Multi-liquidity provider aggregation increases fill probability during volatility.

- STP execution model removes dealing-desk conflict and aligns broker/trader interests.

- Redundancy via MT5, cTrader, DXTrade reduces single-platform failure risk.

3. Simplified Diversification & Multi-Asset Trading

- 250+ instruments across 7 asset classes consolidated in a unified account.

- Enables hedging & correlated exposure (equities, commodities, crypto, indices, FX).

- Unified reporting reduces tax and administrative complexity.

4. Withdrawal & Funding Efficiency

- Withdrawal policies specify 1-day processing under normal conditions.

- Same-method withdrawals support AML compliance and operational symmetry.

- Withdrawals fees waived for trading accounts; inactivity fees deter deposit cycling.

5. Platform Usability & Learning Curve Reduction

- Platform diversity accommodates beginner-to-advanced progression:

- DXTrade (web/mobile simplicity)

- MT5 (algorithmic & analytical tools)

- cTrader (order book visibility & C# automation)

- Copy trading reduces skill/time barriers and provides implicit learning through replication.

- Educational content bridges knowledge gaps that contribute to retail failure rates.

6. Transparency & Execution Standards

- Clear documentation of spreads, commissions, leverage, margin, and swaps.

- Execution policy defines queueing, rejection conditions, and slippage scenarios.

- Complaint handling includes Compliance review within five working days.

7. Risk Management Tooling

- Server-side SL/TP and trailing stop functionality ensures persistent protection.

- Real-time margin monitoring + Stop Out thresholds (20–50%) prevent margin exhaustion.

- Automated liquidation reduces negative balance risk in normal volatility conditions.

Conclusion

Tag Markets operates in a rapidly expanding $11.57B online brokerage market projected to reach $18.50B by 2034, positioning itself as an accessible multi-asset platform with low deposits, diverse funding, and unified trading across 250+ instruments. Its Amplify 12X capital model and Tag Copyx ecosystem differentiate it from over 3,400 global brokers by addressing trader capital constraints and knowledge gaps through performance-based funding and automated strategy replication. Regulated by the Mauritius FSC and using STP execution with multi-liquidity aggregation, Tag Markets prioritizes transparency, efficiency, and operational trust. By reducing pain points such as fragmented asset access, platform complexity, and withdrawal friction, the broker aligns with industry trends favoring accessibility, integration, and transparent execution standards.

Frequently Asked Questions

A multi-asset brokerage providing forex (35–40+ pairs) and 200+ CFD instruments on indices, commodities, stocks, crypto, metals, and energies with leverage up to 1:500 through MT5, cTrader, and DXTrade.

Accounts are managed through the client portal with separate logins for each platform. Mobile apps support full trading access on iOS and Android.

The minimum deposit is $10, making it one of the lowest in the industry.

Withdrawals normally process within one business day and are returned via the original funding method. Crypto withdrawals are typically instant. Fees apply only for non-trading withdrawals.

Feedback is mixed—positives include fast execution and crypto withdrawals; criticisms highlight occasional withdrawal delays and spread widening during high volatility.

Ratings vary across platforms, with mixed scores on Trustpilot and low ratings on WikiFX due to regulatory tier considerations.

Yes—regulated by the FSC Mauritius under license GB21026474 with requirements for segregated funds, KYC/AML compliance, and structured complaints procedures.

Over 250+ instruments across forex, indices, stocks, commodities, metals, energies, and crypto from a unified margin account.

Deposits are multiplied 12× for trading with a 10% drawdown limit and volume-based withdrawal rules. Only manual trading is allowed.

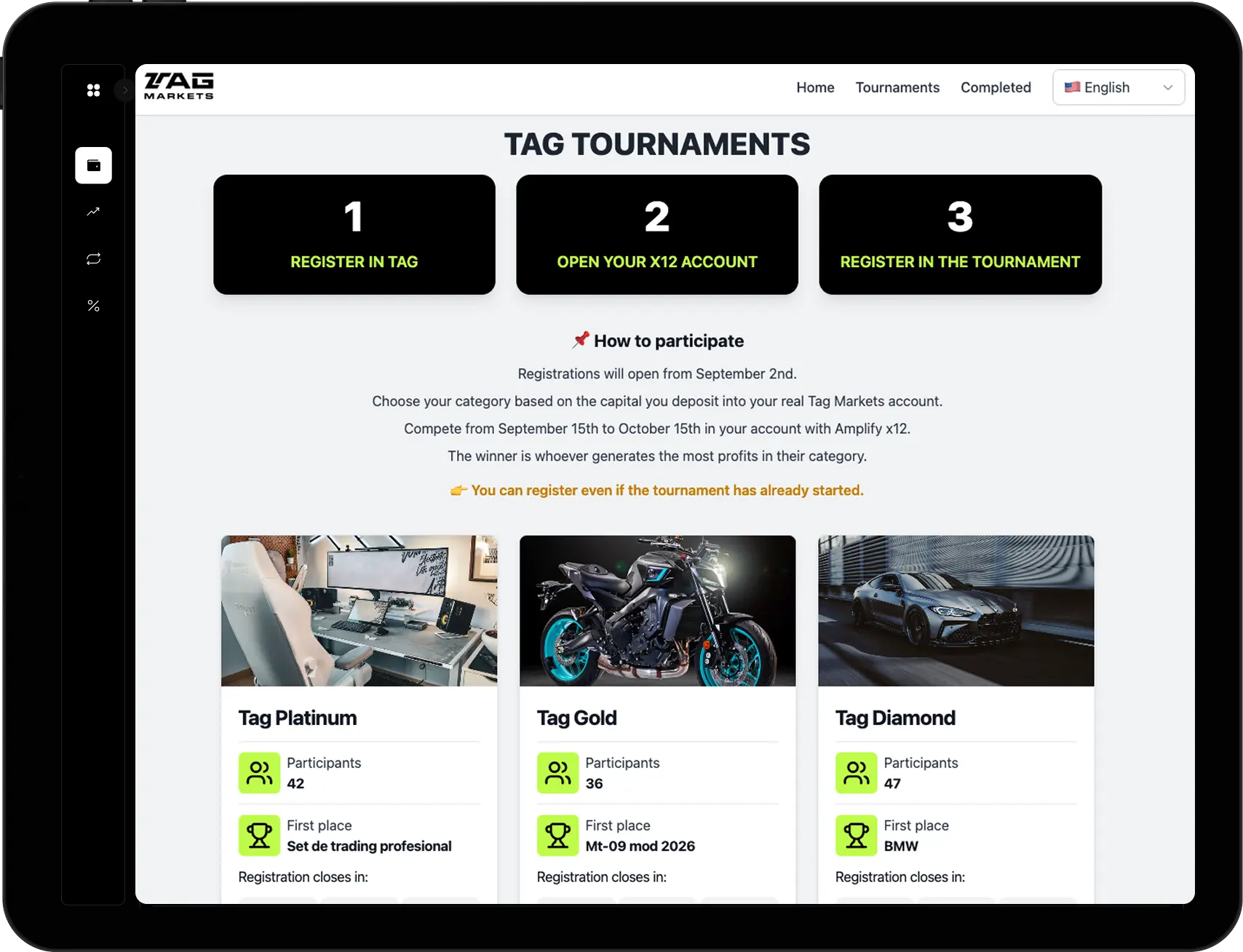

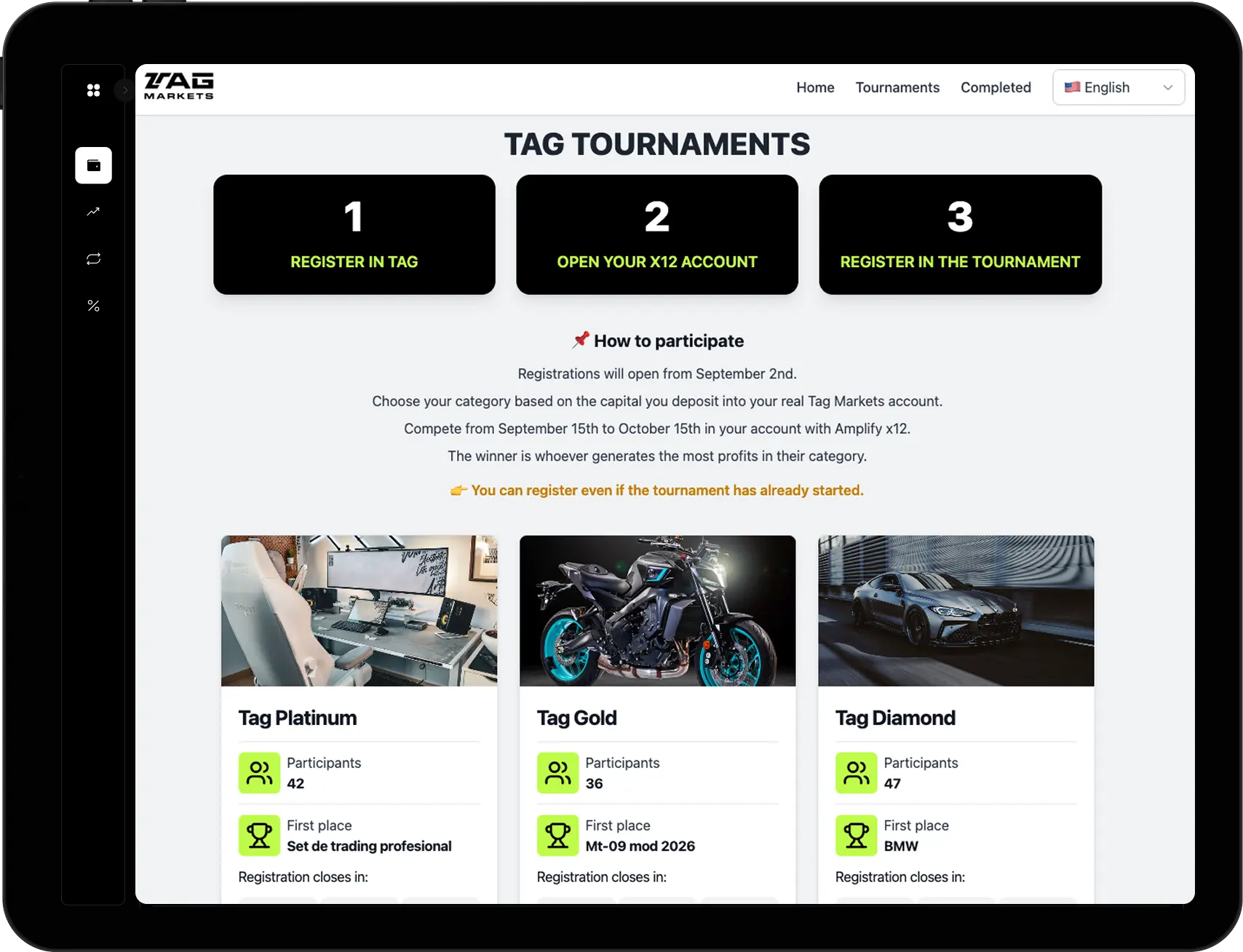

Focus areas include platform improvements, crypto expansion, mobile trading enhancements, geographic growth in LATAM/APAC/Africa, and social initiatives via Tag Heart.